Oil explorer Cobalt International Energy, Inc. (NYSE:CIE) recently announced plans to expand its Anchor prospect in Gulf of Mexico’s Green Canyon area. The chief operator of Anchor is Chevron Corporation (NYSE:CVX) , with a 55% stake. While Cobalt owns a 20% interest, Samsun Offshore Anchor, LLC and Venari Resources hold 12.5% stakes each.

Cobalt has inked a deal with the co-owners of the Anchor unit to include two of its leases – Green Canyon blocks 850 and 851 – to the south of the existing Anchor unit. The transfer of interests in the two leases is subject to customary regulatory approval. Following the approval, Cobalt will retain its 20% stake in the revised Anchor unit.

Cobalt owns a 100% working interest in two leases on the south flank of Anchor. The Anchor reservoir extends to these two blocks and the reservoir simulation test results reflect that additional wells on these two leases are likely to optimize the development plan and enhance oil discovery from the Anchor unit. The increased exploration potential will also boost Cobalt’s chances to divest the unit at an attractive price.

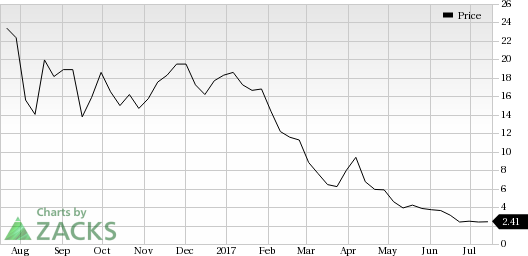

In March, the Houston-based company was warned by NYSE after its share price dipped below $1 over the last 30 days and thereby violated the listing rules. Since then, Cobalt has been contemplating on turnaround strategies including divestment of its non-core assets to fund significant projects, or merging with other companies for future growth and development opportunities along with selling off the entire company. The company finally regained NYSE compliance on Jul 5, following reverse stock split which boosted its share price.

Zacks Rank & Key Picks

Cobalt is an independent oil-focused exploration and production company with a robust world-class portfolio in the deepwater U.S. Gulf of Mexico and offshore West Africa. The company's prospects are all oil focused. Cobalt, which belongs to the Zacks categorized Oil and Gas - United States - Exploration and Production industry, presently carries a Zacks Rank #4 (Sell).

Cobalt International Energy, Inc. Price

Some better-ranked players in the same space are Cheniere Energy, Inc. (NYSE:LNG) and Antero Resources Corporation (NYSE:AR) . While Cheniere Energy sports a Zacks Rank #1 (Strong Buy), Antero Resources carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Cheniere Energy delivered a positive earnings surprise of 14% in the trailing four quarters.

Antero Resources reported positive earnings surprise in each of the last four quarters, the average being 665.71%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

Chevron Corporation (CVX): Free Stock Analysis Report

Cobalt International Energy, Inc. (CIE): Free Stock Analysis Report

Antero Resources Corporation (AR): Free Stock Analysis Report

Cheniere Energy, Inc. (LNG): Free Stock Analysis Report

Original post

Zacks Investment Research