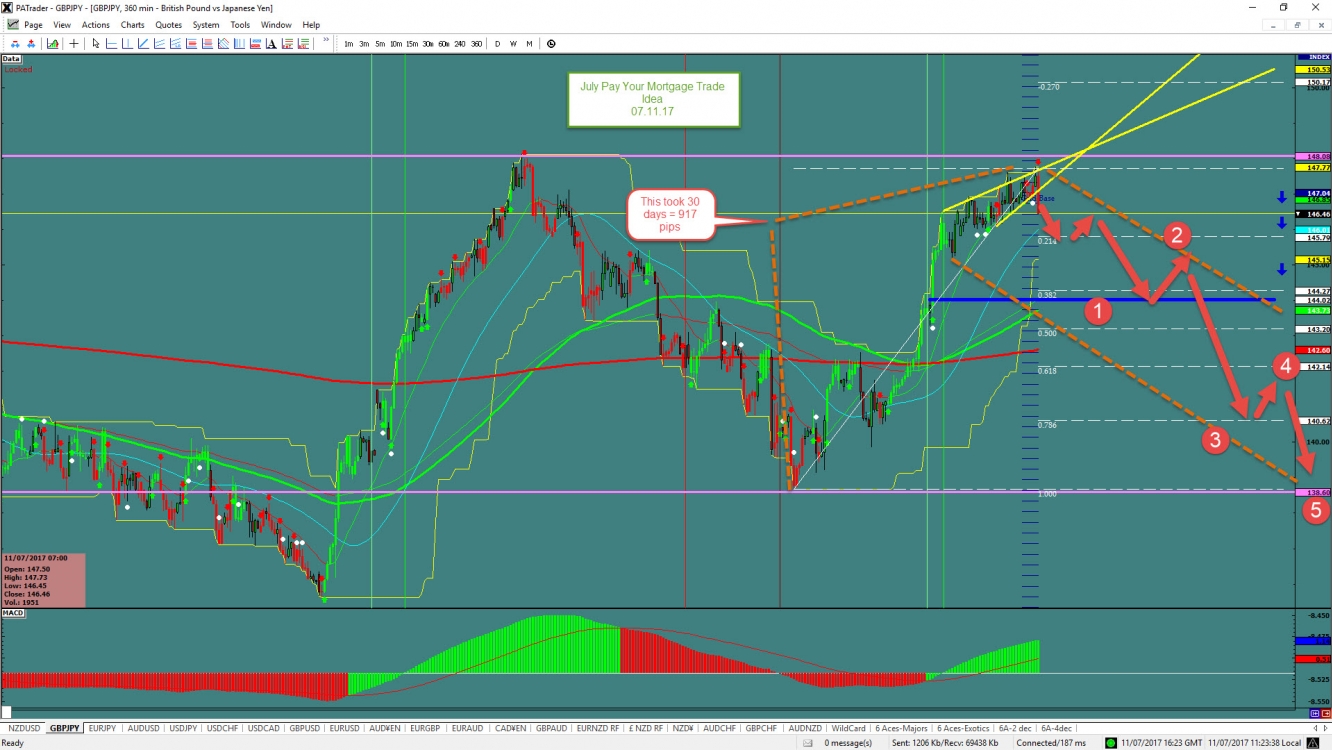

This month's ProAct Traders “Pay Your Mortgage Trade” idea is found in the GBP/JPY pair.

07/11/17

GBP/JPY a little late due to USA holiday.

We see that we have just reacted at the top of this very large range. We have divergence on the pair and a rising wedge all of which are bearish for the pair. We are looking for an initial big move to the square up at 144.02. Watch for a significant bounce there before the resumption to the downside. Although currently in a range this could set up to trend in 5 waves so watch for those counter trend moves to set up those corrective waves. These offer increased opportunity to add positions. The overall target from here is 917 Pips away at the range bottom (138.60).

How to trade it? You will need to wait for your set-up to show up, for London & New York traders, that will mean waiting for the reaction now in the current area. Take your first entry and use the respective risk reward ratio to start trading this currency pair. We have preplaced entry orders (sell stops) on the break of each Fib and barrier to the downside and any rally should be considered an area to add to the position. DO NOT TRY AND CROWD THIS PAIR WITH TIGHT STOPS. Remember the “pullback is your friend” in route so use those to add to the position.

Be careful at the 0.786 Fibo at 140.62 if you see that waves are developing but shorter then shown and that may be the real target.

The pair typically has pullbacks in the 150 pips range so every pullback could add an additional 150 pips to the trade with another position. Currently the ATR (14 Day-Average True Range) of the currency is 127 Pips per day, so this might take about 3 weeks with pullbacks.