Arthur J. Gallagher & Co. (NYSE:AJG) recently acquired GPL Assurance Inc. to add capabilities to its compelling portfolio. Terms of the deal remained undisclosed.

Canada-based GPL Assurance was founded in 1968. The company is a retail insurance broker providing commercial property/casualty services to large corporations, middle-market and small business clients. Its niche expertise lies in developing tailored risk management and insurance programs for the construction, knowledge-economy and commercial/SME sectors.

The buyout is expected to help the acquirer consolidate its footprint in Canada and boost growth capacity. Post acquisition, GPL Assurance will continue to operate from its current location under the leadership of the acquirer’s executives.

Arthur J. Gallagher has put the steam behind its acquisition activity in retail employee benefits as well as wholesale brokerage areas, thus targeting smaller tuck-in mergers in 2017. The broker’s merger and acquisition pipeline remains strong with $250 million of revenues. The company’s impressive growth is driven by organic sales, acquisition and mergers.

Buyouts not only widen the company’s geographical footprints but also enhance its portfolio of services. Furthermore, such deals consolidate its position in retail and wholesale insurance brokerage services and risk management industries. Arthur J. Gallagher has closed 21 buyouts in the first half of 2017 with estimated annualized revenues of $92.8 million. The latest takeover marks the first one in the current quarter.

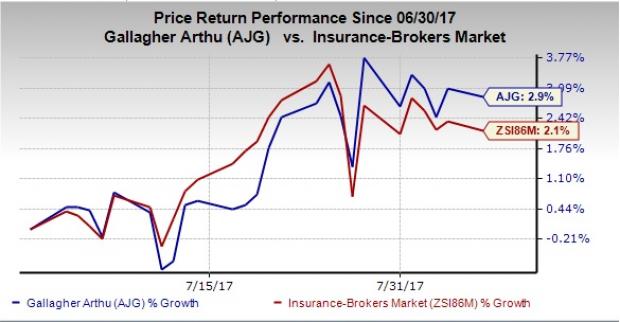

Shares of Arthur J. Gallagher have inched up 2.90% quarter to date, outperforming the industry’s 2.19% increase. The company’s focus on international expansion, ramping up growth profile and a strong capital position should drive the shares higher.

Arthur J. Gallagher carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks in the insurance industry are First American Financial Corporation (NYSE:FAF) , State Markel Corporation (NYSE:MKL) and Mercury General Corporation (NYSE:MCY) , all flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

First American Financial provides financial services. The company delivered positive surprises in the last four quarters with an average beat of 12.64%.

Markel markets and underwrites specialty insurance products in the United States and internationally. The company delivered positive surprises in two of the last four quarters with an average beat of 21.06%.

Mercury General engages in writing personal automobile insurance in the United States. The company delivered positive surprises in three of the last four quarters with an average beat of 1.06%.

Looking for Stocks with Skyrocketing Upside? Zacks has just released a Special Report on the booming investment opportunities of legal marijuana. Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Arthur J. Gallagher & Co. (AJG): Free Stock Analysis Report

First American Corporation (The) (FAF): Free Stock Analysis Report

Markel Corporation (MKL): Free Stock Analysis Report

Mercury General Corporation (MCY): Free Stock Analysis Report

Original post