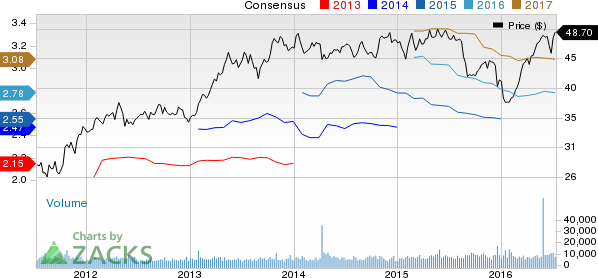

On Jul 8, 2016, shares of Arthur J Gallagher & Co (NYSE:AJG) hit a 52-week high of $48.76, driven by its compelling inorganic growth story. About 1.1 million shares exchanged hands in the last trading session and the stock finally closed at $48.70, up 1.46%. Year to date, the stock has returned 18.9%, which compares favorably with 4.2% returns by the S&P.

Arthur J. Gallagher & Co. indulges in acquisitions to augment its product and service offerings as well as to strengthen its position in retail and wholesale insurance brokerage services and risk management industries. Moreover, acquisitions have been helping the company to expand its international presence.

Recently, Arthur J. Gallagher acquired an 85% stake in Brim AB. The acquisition widens the broker’s Scandinavian presence. Last month, Arthur J. Gallagher acquired The Buchholz Planning Corporation to enhance its employee benefits brokerage and consulting services in the North Central region. Also, it acquired KRW Insurance Agency, Inc. to enhance its brokerage services in the Midwestern region of the United States. The company also bought Ashmore & Associates Insurance Agency, Inc. to enhance its brokerage services in the South Central region.

Arthur J. Gallagher & Co. remains focused on international expansion through both acquisitions and organic measures. The company’s international operations, primarily in Australia, Bermuda, Canada, the Caribbean, Singapore, New Zealand and the U.K., generated about 30% of its revenues.

With respect to the earnings trend, the Zacks Rank #3 (Hold) broker delivered positive surprises in the last three quarters. The company is scheduled to release second-quarter results on Jul 28. The Zacks Consensus Estimate for the same is currently pegged at 96 cents, which translates into year-over-year growth of 2.4%. However our proven model cannot conclusively state whether the company’s earnings will beat estimate. This is because though the company’s favorable Zacks Rank #3 (Hold) increases the predictive power of an earnings beat, an Earnings ESP of 0.00% makes prediction difficult.

Stocks to Consider

Some better-ranked insurance brokers are Hannover Rück SE (OTC:HVRRY) , Brown & Brown Inc. (NYSE:BRO) and Aon plc (NYSE:AON) . Each of these stocks carries a Zacks Rank #2 (Buy).

AON PLC (AON): Free Stock Analysis Report

BROWN & BROWN (BRO): Free Stock Analysis Report

GALLAGHER ARTHU (AJG): Free Stock Analysis Report

HANNOVER RUECKV (HVRRY): Free Stock Analysis Report

Original post

Zacks Investment Research