The Italian title of today’s Gold News Monitor means “goodbye gold, dollar is strong.” Is that really true? Let’s analyze the implications of the recent Italian turmoil for the gold market.

Italian Yields Up

Mamma mia, it is disastro! Let’s look at Italian yields. As we reported on Tuesday, the political drama in Italy deepened when President Sergio Mattarella blocked the populist parties from taking power by rejecting their candidate for economy minister and by nominating Carlo Cottarelli as a prime minister until the snap elections.

As one can see in the chart below, the Italian turmoil made domestic bond yields surge. They jumped above 3 percent, a level not seen since 2014. The news about Mattarella’s move alone triggered a 48 basis-point rise in Italian 10-year government bond yields.

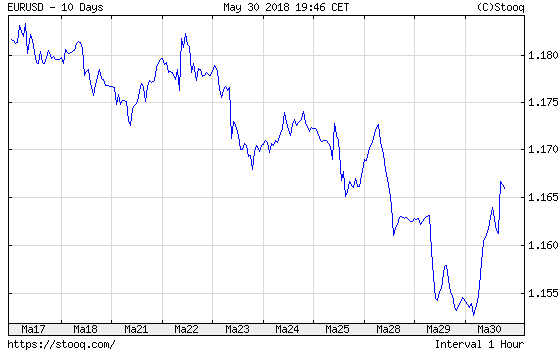

The sudden rally in yields is orrible for Italy, which is heavily indebted. The country carries a €2.3 trillion-dollar debt and rising rates could only exacerbate its debt problem. The bankruptcy of Italy, which is the eurozone’s third-largest economy – or its withdrawal from the eurozone as many populists demand – threatens the viability of the currency bloc. This, of course, has put pressure on euro. As the next chart shows, the EUR/USD exchange rate has dived in recent days.

Stronger dollar is not good news for gold, as it is an alternative safe haven against financial turmoil. However, as one can see in the chart below, gold was generally unchanged on Tuesday. Why?

U.S. Rates Down

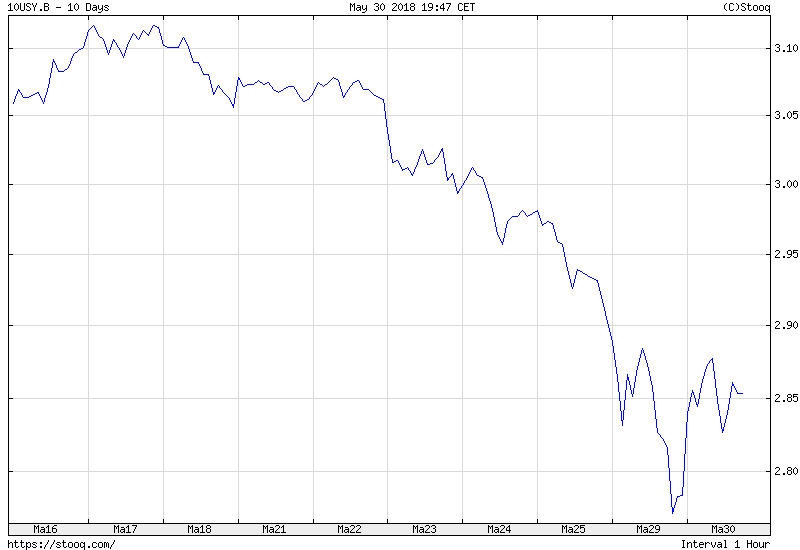

The reason is that U.S. bond yields fell. As the next chart shows, the 10-year Treasury yield plunged below 2.80 on Tuesday, marking its largest single-day decline since the post-Brexit turmoil in 2016. Concerns over Italy led investors to park their money into safe American treasuries, pushing yields down.

So we had two opposing forces on the gold market: strengthening dollar and falling yields. Hence, gold was basically stuck between these conflicting drivers. However, the stable gold prices when investors seek safe haven assets look rather bearish. After Brexit vote, the price of the yellow metal surged!

Implications For Gold

Italy is again under the spotlight. It has been struggling to establish government since elections in March. The drama has worsened on Tuesday, as the fresh elections turned out to be on the table. Investors worry that populists will strengthen their hand – and that the popular vote could postpone the ECB’s tightening of monetary policy. In the near future, it means a downward pressure on euro and thus on gold.

However, the medium term outlook is not so gloomy. Investors often exaggerate geopolitical threats. Remember Greece’s debt crisis? Syriza party was populist as hell, but ultimately it had to do what the EU demanded because it needed money. The same will work here: the populists will talk a lot about exiting the eurozone, but they will make concessions after all.

Surely, Italy presents much more severe threat that Greece, but you shouldn’t underestimate the power of the establishment. There was even a referendum in Greece – and nothing happened. Remember Brexit? The UK is still in the EU. Do not underestimate the tyranny of status quo. We have to be cautious, agreed, but it’s simply too early to trump the collapse of Italy and the eurozone. When you take another look at the charts above, you will see some signs of stabilization actually. The sudden moves are often temporary (again: remember Brexit?). Stay tuned!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.