Home automation company Arlo Technologies (NYSE:ARLO) is slated to report third-quarter earnings after tonight's close. ARLO stock has a dismal history of earnings reactions -- having closed down double-digit percentage points following three of the firm's last four reports -- but one options trader today is betting on a major swing higher for the shares after this evening's event.

With about an hour left in today's trading, nearly 7,100 ARLO calls are on the tape -- 45 times what's typically seen, and 12 times the number of puts exchanged. The November 4 call is most active, due to a 5,000-contract block that was likely bought to open earlier for an initial cash outlay of $100,000 (number of contracts * $0.20 premium paid * 100 shares per contract).

In this scenario, the call buyer will profit with each step above breakeven at $4.20 (strike plus premium paid) ARLO shares take through front-month expiration at the close next Friday, Nov. 15. Losses, meanwhile, are limited to the initial premium paid, should the security stay below $4 through expiration.

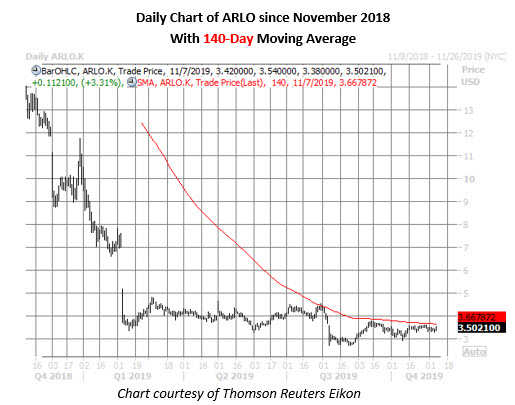

At last check, Arlo Technologies stock is up 3.3% to trade at $3.50, so a move above $4.20 would require at least another 20% surge in the shares. The equity has struggled over the long term, down 74% year-over-year. More recently, ARLO has been stuck churning below the $3.70-$4.00 neighborhood, home to its pre-bear gap lows from early August, as well as its 140-day moving average.

As such, it's possible a short seller could be initiating an options hedge to guard against any post-earnings upside risk. Shorts control a healthy 8.3% of ARLO's float, or 10 times the average daily pace of trading. For tomorrow's trading, the options market is pricing in a 34.1% post-earnings move, regardless of direction, much bigger than the 20.9% next-day move the equity has averaged over the past year.