EIA approval to trigger debt financing

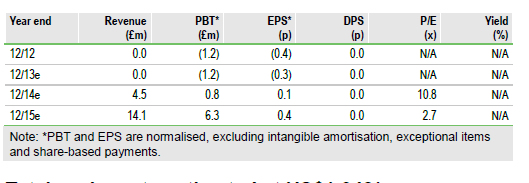

Ariana Resources, (ARNR) announced on 30 December 2013 that it had received a positive decision on the Environmental Impact Assessment for its 50%-owned Kiziltepe gold-silver mine in Western Turkey. This is a key de-risking event that should have positive implications for sourcing the remaining c US$25m in debt finance from Turkish institutions. Proccea, Ariana’s 50% JV partner, is currently managing this process and we await the formal announcement of the completion of this financing in Q114. Our 10% discounted dividend flow (DDF) valuation, using our revised gold price forecasts (see page 2), is 2.27p. Our unrisked valuation is 3.45p, which we believe better reflects Ariana’s strengthening geological understanding of the wider area under its control.

Total cash costs estimated at US$1,043/oz

Ariana still has to finalise contractor costs for its future operations at Kiziltepe. However, based on its June 2013 DFS, we estimate a total operating cash cost (cash costs plus depreciation) of US$1,043/oz, allowing for a moderately resilient operation at Kiziltepe under current gold price conditions.

Eldorado JV drilling could add 0.74p to valuation

For illustrative purposes only we have undertaken an order of magnitude assessment of the resources that could potentially be delineated by the latest 2013 drilling at the Salinbas-Ardala properties in North-East Turkey. Based on our key assumption that ounces will become indicated in category with further drilling (Ariana is free carried at present and will not incur this cost), we estimate that the 2013 round of drilling could add 0.74p to its valuation (see page 7 onwards).

Valuation: Increased to reflect resource growth

We have adjusted our previous 3.19p valuation for our revised gold and silver price forecasts (see page 12) and use mining costs contained in the June 2013 DFS (see page 11 for a full description of our current and previous assumptions). On this basis, our valuation is now 2.27p per share. This valuation is for Ariana’s eventual 50% share of the Red Rabbit project and uses a discount rate of 10% to reflect general equity risk. Our model assumes 100% debt funding for Red Rabbit. Including blue-sky exploration potential, this company could be worth an additional 1.18p. Furthermore, our valuation remains a robust 1.57p at current gold and silver prices of US$1,265/oz and US$20/oz respectively. Positive catalysts include information about funding and the start of production at Kiziltepe.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Ariana Resources: Increased To Reflect Resource Growth

Published 02/03/2014, 06:19 AM

Ariana Resources: Increased To Reflect Resource Growth

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.