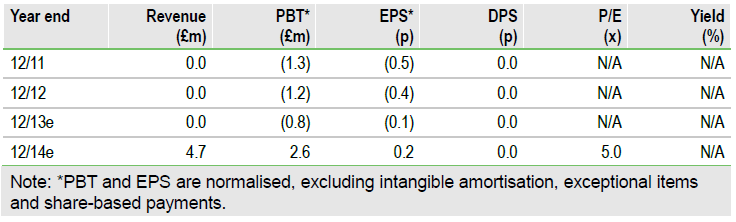

Ariana (AAU.L) has announced the outcome of its final Definitive Feasibility Study (DFS) for the Kiziltepe sector of its JV Red Rabbit project. The DFS states adjustments to operating costs and initial capital requirements. While these have, in general, moderately increased, the actual cost of mining waste and ore has dropped markedly, by c 28%, from US$25.98/t (in its 29 October interim FS) to US$18.69/t. Taking account of the DFS cost parameters we revise our previous 3.30p base case valuation to 3.19p per share (at long-term prices of US$1,676/oz Au & US$28.15/oz Ag). Our unrisked valuation is now 5.51p, which we consider better reflects Ariana’s ongoing exploration successes close to Red Rabbit that could extend its current eight-year mine life. Both valuations use a 10% discount rate.

Funded through to mine development

Ariana has conditionally agreed a £1.25m equity subscription/swap agreement with Lanstead Partners (announced 17 June 2013). Through this, Ariana has secured enough funding to take it through to the development stage of Red Rabbit, anticipated for early-2014 pending successful financing. The latter is expected by Q413.

EIA process underway and completion due in Q313

Ariana’s current target is to have obtained environmental impact assessment (EIA) approval during September 2013. Following this, Ariana expects to submit further forestry applications and to apply for other permits during Q413. We have therefore modelled first production to occur at Red Rabbit in H214 (vs Q114 previously), which allows for an estimated six- to eight-month construction period.

Valuation: Revised for DFS, base case now 3.19p/s

We have adjusted our previous 3.30p valuation for capex and mining costs contained within the recent DFS. We have not changed the mining schedule from that of our previous valuation (a full description of our previous assumptions can be found on page three of this note). On this basis, our valuation is now 3.19p per share at gold prices of US$1,510/oz (2014) rising to US$1,676/oz long-term. The silver price used is US$24.75/oz (2014) rising to US$28.15/oz long-term. Both valuations are for Ariana’s eventual 50% share of the Red Rabbit project and use a discount rate of 10% to reflect general equity risk. Our model assumes 100% debt funding for Red Rabbit. Furthermore, our valuation remains a robust 1.80p at current gold and silver prices of US$1,250/oz and US$19/oz respectively.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Ariana Resources Funded Through To Mine Development

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.