Nobel Laureate Paul Krugman believes the economic argument over extending unemployment is a political one.

Still, don’t expect prominent Republicans to change their views, except maybe to come up with additional reasons to punish the unemployed. For example, Senator Rand Paul recently cited research suggesting that the long-term unemployed have a hard time re-entering the work force as a reason to, you guessed it, cut off long-term unemployment benefits. You see, those benefits are actually a “disservice” to the unemployed.

The good news, such as it is, is that the White House and Senate Democrats are trying to make an issue of expiring unemployment benefits. The bad news is that they don’t sound willing to make extending benefits a precondition for a budget deal, which means that they aren’t really willing to make a stand.

So the odds, I’m sorry to say, are that the long-term unemployed will be cut off, thanks to a perfect marriage of callousness — a complete lack of empathy for the unfortunate — with bad economics. But then, hasn’t that been the story of just about everything lately?

The above is not an economic argument for extending unemployment – but emotional diatribe. I can understand that there is disagreement on unemployment benefits. Everyone’s view is distorted by the baggage they carry. People try to mold information into their preconceptions.

There have been few studies on the long term effects of unemployment in the USA. Most studies (like the one Professor Krugman referenced) reference other studies – and when you start running down each of the referenced studies, most are nothing more than taking a few data points and extrapolating a conclusion. The overriding concern is the validity of any study prior to the economic reset which occurred in 2007 (aka the Great Recession) – which likely created a very different set of dynamics than any past study periods (except for the Great Depression).

I do not have any issue with the concept of unemployment benefits – nor would I be fundamentally against extending benefits. I do admit to having several caution flags:

- unemployment benefits should not impede the reset to the new normal;

- unemployment benefits cannot approach the benefits of having a real job.

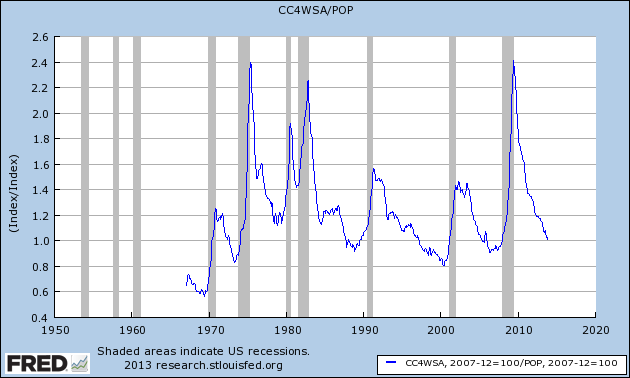

To quantify the situation, unemployment benefits (indexed to population growth) have returned to post recession levels, and are currently at the levels seen in times of economic expansion.

Figure 1 – Relative Number of People Receiving Unemployment Benefits, Indexed for Population Growth

The states (who are responsible for unemployment insurance execution) set the benefits whilst getting government support. From the Department of Labor:

The Federal-State Unemployment Insurance Program provides unemployment benefits to eligible workers who are unemployed through no fault of their own (as determined under State law), and meet other eligibility requirements of State law.

- Unemployment insurance payments (benefits) are intended to provide temporary financial assistance to unemployed workers who meet the requirements of State law.

- Each State administers a separate unemployment insurance program within guidelines established by Federal law.

- Eligibility for unemployment insurance, benefit amounts and the length of time benefits are available are determined by the State law under which unemployment insurance claims are established.

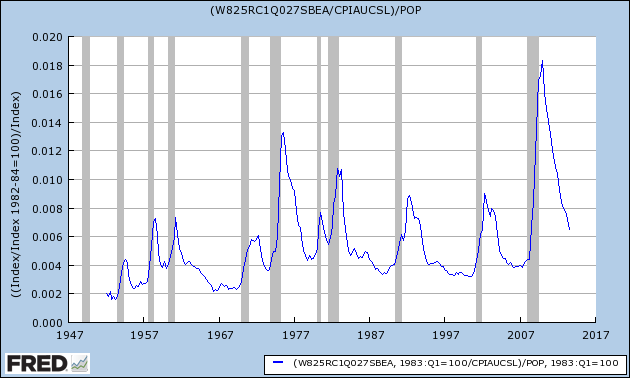

The states get support from the federal government for unemployment benefits paid to the unemployed as long as they meet the federal guidelines. The amount of real unemployment benefit payments into the economy remain high for non-recessionary periods. Graph below is indexed and inflation adjusted.

Figure 2 – Inflation and Population Indexed Total Unemployment Benefits Paid

In other words,

- the number of people receiving unemployment benefits are in a normal range for times of economic expansion

- but the amount of benefits being paid are higher than the normal range – implying the real compensation in this current period is higher than previous periods.

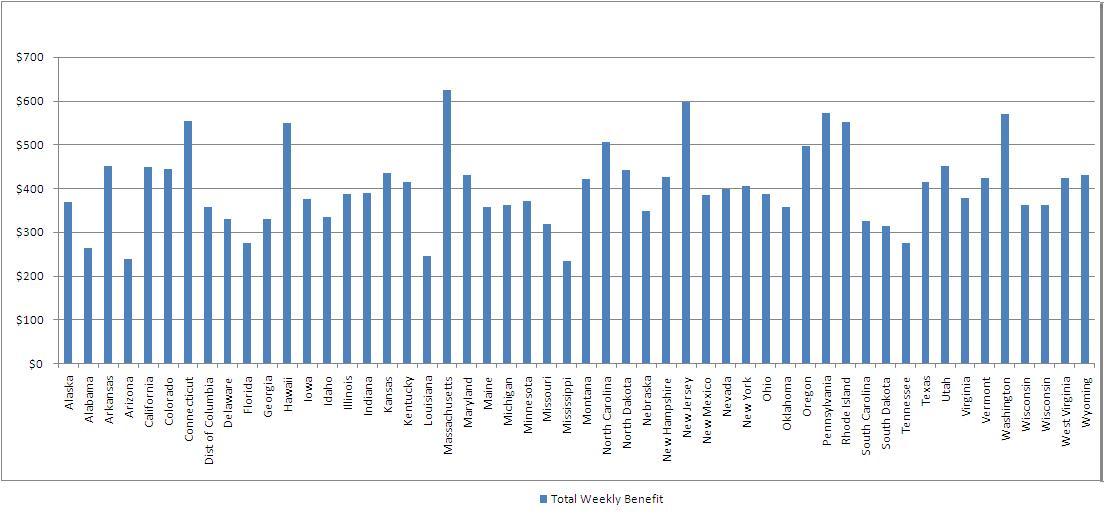

With hat tip to fileunemployment.org – here is the maximum unemployment benefits by state:

Figure 2 – Maximum Weekly Unemployment Benefits Paid by State

How much would someone trying to find a job make if they were paid minimum wage?

- Part time employment per the Obamacare criteria would only compensate a little over $200 per week;

- and full time employment at minimum wage averages more than $300 per week.

Are too high of unemployment benefits (or too low minimum wage) creating an incentive NOT to go back to work?

The issue at this juncture is whether extending the unemployment benefits are a good use of a social safety net to assist those who are in need – or just an unneeded crutch in times of economic expansion which could now become an incentive not to find a job. Unfortunately there is truth in both opposing opinions. And no data conclusive analysis that I have found.

Other Economic News this Week:

The Econintersect economic forecast for December 2013 again improved. What this forecast cannot see is the real effect of austerity and Obamacare – but it does see that business is betting the effects on the economy will be minimal.

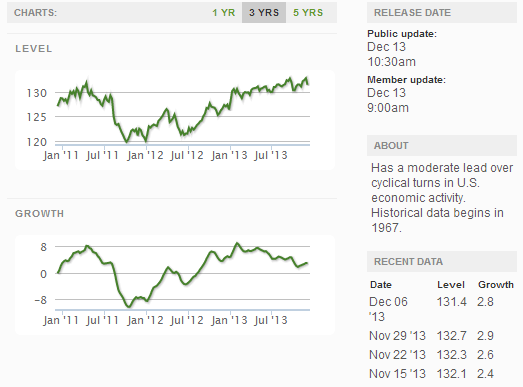

The ECRI WLI growth index value has been weakly in positive territory for over four months – but in a noticeable improvement trend. The index is indicating the economy six month from today will be slightly better than it is today.

Current ECRI WLI Growth Index

Initial unemployment claims went from 298,000 (reported last week) to 368,000 this week. Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate. The real gauge – the 4 week moving average – degraded from 322,250 (reported last week) to 328.750. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks releases), the 4-week average remains the reliable gauge.

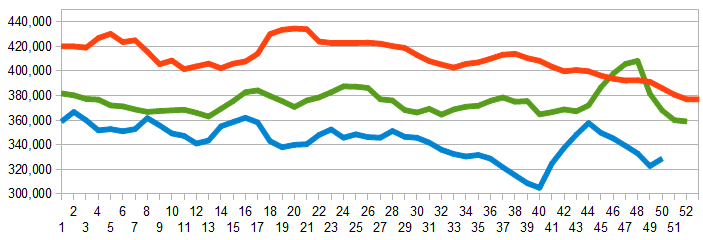

Weekly Initial Unemployment Claims – 4 Week Average – Seasonally Adjusted – 2011 (red line), 2012 (green line), 2013 (blue line)

Bankruptcies this Week: none

Weekly Economic Release Scorecard:

Click here to view the scorecard table below with active hyperlinks