In the face of inflation running at 25-30% - one of the highest rates in the world - Argentina unexpectedly decided to cut interest rates yesterday. It is difficult to say how the government justifies this madness, but here we are. Combined with the nation's recent default and no settlement on the horizon, the rate decision sent the nation's currency to record lows.

WSJ: - The decision to cut rates will likely be seen as a sign that Economy Minister Axel Kicillof's plans to stimulate the economy are prevailing over central bank Governor Juan Carlos Fabrega's effort to curb inflation, analysts said. ...

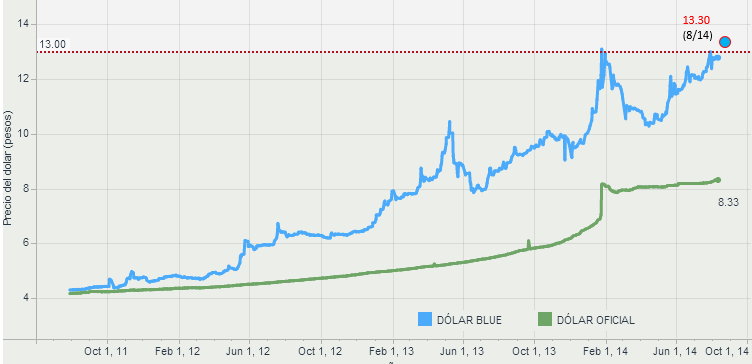

Argentina's peso weakened to 13.15 to the dollar on the black market Wednesday, breaking the previous record of 13.10 in January when the government devalued the peso 20%, according to newspaper El Cronista, which tracks black-market exchange rates. The peso was stable at 8.2730 on the regulated exchange market.

... The dollar has been especially coveted for the last three years, given rampant government spending that has fueled one of the highest rates of inflation in the world.

Currency controls were imposed almost three years ago to prevent foreigners and locals from depleting the central bank's reserves by changing their pesos into dollars.

The black market peso continued to slide this afternoon, with quotes hitting 13.3 pesos per one dollar. The so-called "blue dollar" is the unofficial market for US dollars in Argentina (there is also the "blue euro" market).

At this rate the blue dollar is at a 60%+ premium to the official exchange rate (dollars cost 60% more in the black market).

Unless we see some sort of settlement on the defaulted debt and the resumption of coupon payments to all the bondholders (see post), Argentina will unravel rapidly. Another official currency devaluation becomes increasingly likely, pushing inflation to new highs and making Argentina look increasingly like Zimbabwe. With no ability to access international debt markets, foreign reserves will begin to run out and shortages of imported goods will become commonplace. Violent unrest is sure to follow.