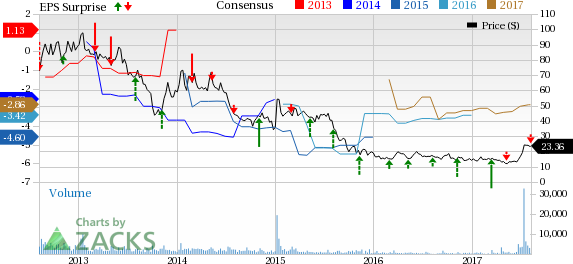

Arena Pharmaceuticals, Inc. (NASDAQ:ARNA) reported a loss of 77 cents per share in the second quarter of 2017, narrower than the year-ago loss of $1.12 per share. However, the loss was wider than the Zacks Consensus Estimate loss of 68 cents.

In Jun 2017, the company completed a reverse stock split of 10:1. All per share data have been adjusted to incorporate the split.

Arena’s shares were down 3.4% in after-market trading. However, the stock has significantly outperformed the industry so far this year. Its shares have gained 64.5% while the industry registered an increase of 9.7%.

Total revenue in the quarter was $6.5 million, down 31.7% from the year-ago quarter. However, revenues beat the Zacks Consensus Estimate of $5.62 million. Revenues included $2.06 million in net product sales of Belviq, $1.8 million in manufacturing support payments from Japanese pharma company Eisai and $1.9 million in the form of upfront payments from collaborations with Boehringer Ingelheim and Axovant Sciences Ltd.

Belviq is the only approved product in Arena’s portfolio. It was launched in Jun 2013 and is approved for chronic weight management in adult patients.

Quarter in Detail

During the second quarter of 2017, Belviq sales declined to $2.06 million from $4.3 million a year ago.

Belviq, the first obesity drug to be approved by the FDA in over a decade, is yet to impress with its performance. An extended-release version was launched in Oct 2016. However, sales have been lackluster so far.

Research & development (R&D) expenses declined 3.4% year over year to $17.9 million. General & administrative (G&A) expenses were $7.2 million, down 14.5% year over year.

Subsequent to quarter end in July, the company received net proceeds of $162 million from the sale of common stock under equity financing during the quarter.

Pipeline Update

Arena’s pipeline consists of several early- to mid-stage candidates targeting different therapeutic areas. These include ralinepag (pulmonary arterial hypertension), etrasimod (a number of autoimmune diseases) and APD371 (pain and fibrotic diseases).

The company reported positive results from a phase II study on ralinepeg in July and is preparing to initiate a phase III study after discussions with the FDA. Etrasimod is currently being evaluated in multiple phase II studies. Data from ulcerative colitis study is expected by Mar 2018. Meanwhile, the company is enrolling patients in inflammatory bowel disease and pyoderma gangrenosum studies. Another phase II study on biliary cholangitis is expected to begin in 2017.

The company is also enrolling patients in phase II trial on APD371 for the treatment of pain linked with Crohn's disease with data expected by Mar 2018.

Zacks Rank & Key Picks

Arena Pharma carries a Zacks Rank #2 (Buy).

Some stocks worth considering in the pharma sector include Summit Therapeutics PLC (NASDAQ:SMMT) , Aduro Biotech, Inc. (NASDAQ:ADRO) and Alnylam Pharmaceuticals, Inc. (NASDAQ:ALNY) . All the three stocks carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Summit’s loss estimates narrowed from $2.36 to 32 cents for 2017 over the last 30 days. The company delivered positive earnings surprise in each of the four trailing quarters with an average beat of 25.55%. Its share price is up 69% so far this year.

Alnylam’s loss estimates narrowed from $5.16 to $5.08 for 2017 over the last 30 days. The company came up with a positive earnings surprise in two of the four trailing quarters with an average beat of 3.69%. The stock is up 121.5% so far this year.

Aduro Biotech’s loss per share estimates narrowed from $1.46 to $1.36 for 2017 over the last 30 days. The company delivered positive surprises in two of the four trailing quarters with an average beat of 2.53%. The stock is up 7.4% so far this year.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Arena Pharmaceuticals, Inc. (ARNA): Free Stock Analysis Report

Alnylam Pharmaceuticals, Inc. (ALNY): Free Stock Analysis Report

Aduro Biotech, Inc. (ADRO): Free Stock Analysis Report

Summit Therapeutics PLC (SMMT): Free Stock Analysis Report

Original post

Zacks Investment Research