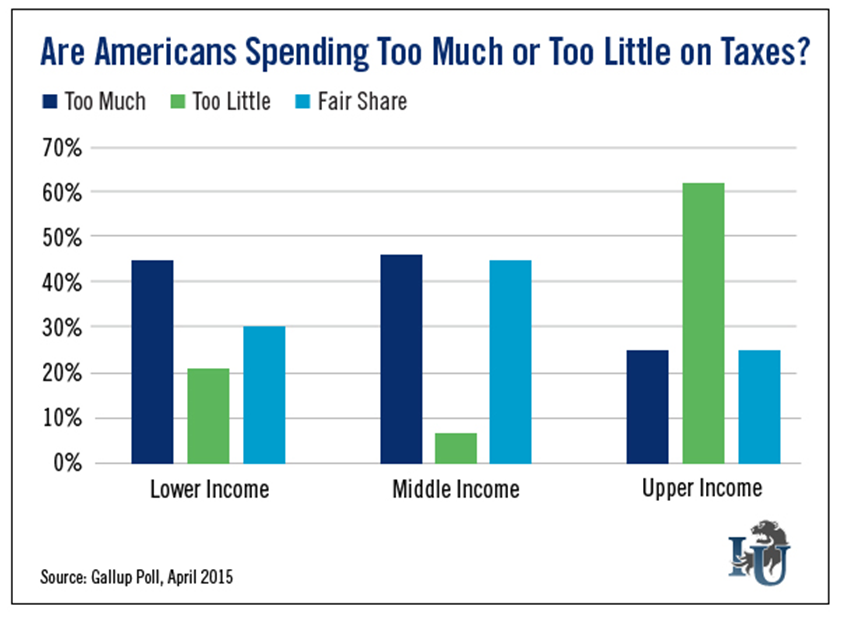

This week’s chart is based on a Gallup Poll taken just before tax day. The poll asked Americans if they think different income groups (lower, middle and upper) pay “too little,” “too much” or their “fair share” in federal taxes.

In 1992, the first year this survey was conducted, 77% of people said upper-income Americans pay too little in taxes. Since then, that number has dropped to 62%.

Regarding the other two classes: 21% of people said they feel lower-income Americans aren’t paying enough while 6% responded that middle-income Americans pay too little in taxes.

Roughly 45% of people felt both middle-income and lower-income Americans spend too much in taxes.

No matter how much you handed Uncle Sam this year, there are ways to ensure you spend less next year. In his article “Your Most Important Tax Savings This Year,” The Oxford Club’s Chief Investment Strategist Alexander Green lays out five specific steps to help you maximize what you keep come tax season:

- Outside your retirement accounts, shift all or most of your Treasury and corporate bonds to municipal bonds. They will compound tax-free.

- Do your short-term trading in your IRA or other qualified retirement accounts. That way, instead of paying taxes of up to 39.6% on realized gains, your money will grow tax-deferred.

- Outside your retirement account, hold your stocks for 12 months or more to qualify for more favorable long-term capital gains tax treatment.

- Hold your tax-efficient assets - like individual stocks, ETFs and index funds - in your non-retirement accounts. Hold your tax-inefficient investments - like bonds, real estate investment trusts (REITs) and high dividend paying stocks - in your retirement account. This minimizes the annual tax bite from the IRS.

- At the end of each year, take capital losses to offset realized capital gains. (You can buy the same securities back after 30 days.) And when possible, take an additional $3,000 in losses against earned income. Any unused losses can be carried forward for use in future years.

To avoid paying more than your “fair share,” it’s important to recognize and take advantage of the incentives built into the tax code. As Alex says, “It's not how much you make... It's how much you keep.”