The chaos and manipulation continue.

Not only are investors forced to answer the question of the year (or is it the decade?) -- when will Yellen raise rates? -- but we’re forced to navigate a churning sea of manipulation.

With so much manipulation, the “hormones” of our economy are out of whack. Our body no longer knows what’s normal and what’s not.

Our economy doesn’t know how to react to each new stimulus.

With such an unnatural imbalance we get things like job growth... but no increase in wages. We get companies hoarding cash. And you get what we had last quarter... an economy surging backward, while stocks hit record highs.

Last Thursday, the Club’s Emerging Trends Strategist Matthew Carr and I had a chance to get an insider’s point of view on the situation. The vice president of research at the Boston branch of the Federal Reserve gave us his figures... and his take on the math.

The economic picture he painted wasn’t pretty.

It wasn’t necessarily because the numbers were ugly. No, the numbers aren’t all that bad. It’s just that they point us toward the idea of a new normal.

It’s clear the benchmarks and goals of a pre-QE economy no longer make sense.

For example, the Fed aims for what’s described as the “equilibrium” rate. It’s the rate - typically defined as the fed fund rate minus inflation - that leads to full employment, stable prices and well-paced economic growth.

It’s the “Goldilocks” number.

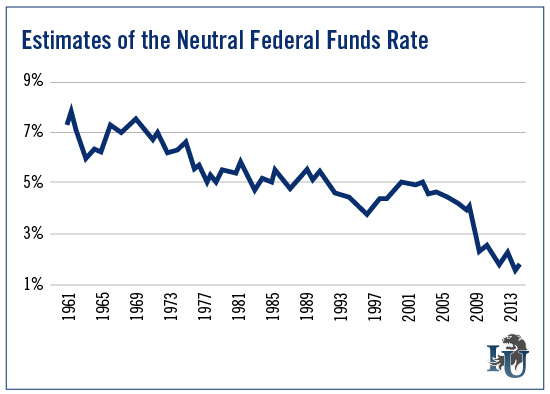

Historically, the Fed has aimed for a neutral rate target somewhere in the range of 3.5% to 5.5%. But as the chart below shows, the historic data (as estimated by the Fed) shows us the long-term trend is pointed in a direction that will keep us well below those goals.

That was certainly the contention of the expert we talked with last week. It was clear that his research was pointing toward a new benchmark... a new normal.

For investors, that’s a big idea worth pondering.

All of this manipulation -- whether it’s done directly by the Fed or its lawmaking counterparts in Washington -- has had dramatic effects on the nation’s economy.

A perfect example comes this week from one of America’s finest bellwethers, General Electric (NYSE: NYSE:GE). It made one more giant step out of its once lucrative banking business. It sold its lending arm to Canada’s pension system for some $12 billion.

The move is a game changer for several key reasons.

First, it highlights a growing -- and greatly under-reported -- problem in the American economy. Traditional streams of corporate lending are drying up.

While it’s great news for business development companies (BDCs) and their investors, it’s a not-so-great indication of the headwinds stirred by increased regulations and sustained ultra-low interest rates.

General Electric CEO Jeffrey Immelt has stated many times that his move to get out of the capital game comes as Washington threatens to deem the company a “systematically important financial institution.”

In other words, he’s getting out because the business will face much more expensive regulation.

Again, we point to the chart above. With interest rates entering a realm of a new and distorted normal, the banking business is nowhere near as profitable as it once was. All of that economic manipulation has taken its toll.

And let’s not overlook who Immelt sold the lending group to... a pension fund.

As we’ve said before, pension funds across the globe face incredible pressure in a no-rate world. This move to buy a private-equity lending firm proves that Canada’s pension fund is forced to move further out on the risk spectrum in order to meet its future obligations.

A traditional income strategy no longer works.

That’s big. It has the potential to stir all sorts of trouble.

But our goal here is not to scare or even to warn. As our name implies, we’re here to educate in a way you won’t get elsewhere.

After all, the trend has sparked some incredible opportunities (especially within acronym-heavy realm of BDCs and REITS). I met with several CEOs and CFOs over the last month who are taking full advantage of the situation.

But it is absolutely critical that investors know what’s happening. The markets are filled with manipulation and unnatural levels of regulation. In some sectors, it’s stirred chaos.