Are you prepared for the new rules of the economy? Can your portfolio overcome a major jolt to the world’s financial system?

As we wrap up our special series on financial predictions for 2016, it’s time to put our theories to practice.

It’s time to prepare for what lies ahead.

Last week, I wrote you and said the typically ho-hum realm of interest rates would be the biggest financial story of 2016. I’m sure scores of unenthused readers immediately moved on to their next email.

Too bad for them. I’m certain they are going to regret not paying attention to what’s happening.

I’m more convinced than ever that we’ve found ourselves in a bit of a trap.

And now, it’s clear that others have noticed the jarring pain around our collective leg.

I spent time last week reading through the text of a speech James Bullard, the president of the Federal Reserve Bank of St. Louis, recently gave at the Cato Institute.

If you know Bullard’s policy, you know he’s a hawk with sharp talons. He’s been behind Yellen, pushing her for higher rates for many months.

But it may have been too little, too late. Even he ponders if we might be stuck.

In a speech simply titled “Permazero,” Bullard admits we may have just seen the system change forever.

“Should we find ourselves in a persistent state of low nominal interest rates and low inflation,” he said, “some of our fundamental assumptions about how U.S. monetary policy works may have to be altered."

"During the past six years I have warned along with many others that the committee's [zero interest rate policy] has put the U.S. economy at considerable risk of future inflation," Bullard said. "After seven years, one might want to consider other models."

It’s possible, he continued, that an equilibrium has been set that will be tough to break.

That’s not good.

Bullard is stating the case for the idea of a new normal. Like us, he ponders whether the Fed’s interest rates are no longer a reaction to inflation but are, in reality, the driving force.

In other words, is the current lack of inflation due to the Fed’s zero interest rate policy... or is the policy due to the lack of inflation?

Historically, the Fed follows the economy, like a cart behind a horse. The Fed pulls the reins or cracks the whip to keep the beast under control. But lately it’s clear Yellen has her clenched hand on the bridle and her heels dug into the dirt, pulling the stubborn economy where she wants it to go.

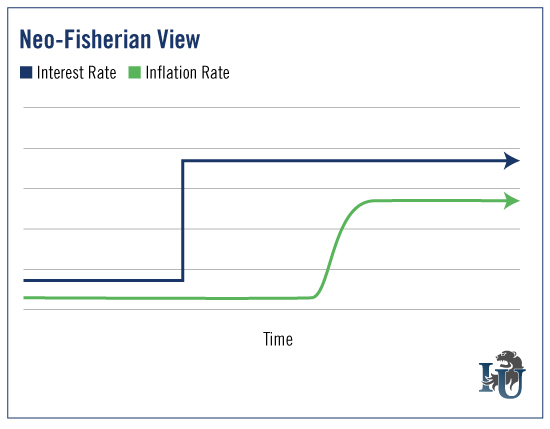

The latter scenario hints at a controversial theory known as Neo-Fisherian economics - a revival of Irving Fisher’s century-old theories on interest rates.

In the Neo-Fisherian view, interest rates dictate the inflation rate.

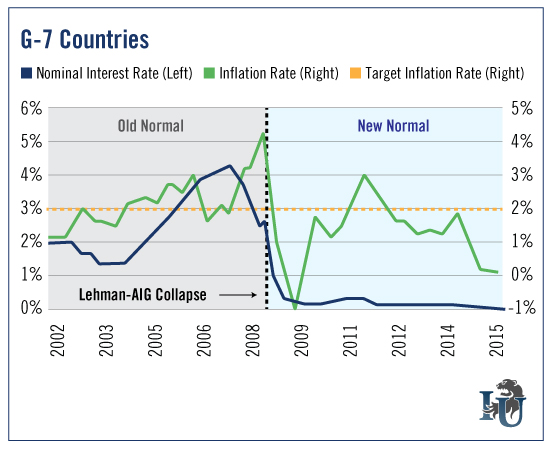

Looking at real-life results across the globe’s major economies, it’s not difficult to see the merit of the idea. Since the fall of Lehman and American International Group Inc (N:AIG) in 2008, something has changed... falling central bank benchmark rates have pulled inflation lower.

Traditional theories contend the low rates should have sent inflation climbing quickly. Clearly, that didn’t happen.

Put bluntly... if the pattern holds, textbook printers are going to be busy. The Econ 101 syllabus will change.

The problem this theory presents is that it takes great power away from Yellen and her monetary maestros. It stands to take away their most powerful weapon... rate increases. If a hike in benchmark rates actually pulls inflation higher, it does the exact opposite of what current theory dictates.

In other words, it switches the reins with the whip.

That’s scary.

It’s an idea Bullard hints at in a couple of wordy, yet powerful sentences.

“... the limits on operating monetary policy through ordinary short‐term nominal interest rate adjustment in this situation would surely continue to fire a search for alternative ways to conduct monetary stabilization policy,” he says. “The favored approach during the past five years within the G‐7 economies has been quantitative easing, and there would surely be pressure to use this or related tools.”

In other words, if the neo-Fisherian theory holds up, the Fed would no longer rely on interest rates to control the economy. Instead, it would lean on the printing press... a practice that rarely ends with smiling citizens.

Don’t get me wrong... it’s not all that bad for the average investor. If it mirrors the last seven years, it’s great news.

As long as you realize what’s happening and adjust accordingly, you’ll do well. But be unaware of the change - and rely on traditional economic ideas - and you’ll soon wonder why your money isn’t growing quite like you’d hoped.

In a “permazero” economy, traditional investing techniques will fail.

You’ll need to use a much more sophisticated bond strategy, you’ll need safe dividend stocks and you’ll need to own shares of companies that have business models that are immune to persistent low rates. Big banks and insurers that rely on interest rate spreads won’t do well if the idea of interest rates dies.

It’s a fascinating development. The weapons the Fed once used to control the economy have lost their edge.

New tactics are needed. New rules are in place. Make sure your portfolio is up to date.