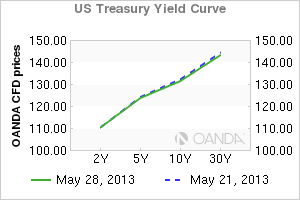

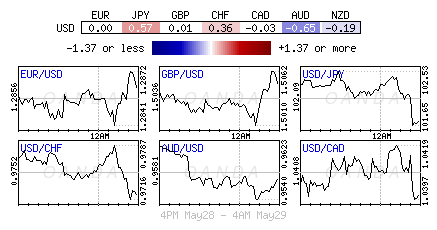

The forex market has returned to rate watching as a primary source for currency direction. It’s either a central bank rate announcement (Canada, Brazil and Thailand) or the shape of a particular domestic yield curve that has interest rates greatly influencing the demand or supply of a particular currency. The greenback’s strength has been one of this week’s main themes. It’s not so much a move to high yields in US Treasuries (BoJ look out) that is stoking the mighty dollar to scale new heights. According to fixed income traders it's all about the “notable break in the shape of the yield curve” that is changing the forward price of money that is affecting investors' decision practices.

Yesterday’s US 2′s/10′s spread (+189bps) widening +12bp raises the distinct possibility that a certain type of bond folk is back on the scene and possibly front running the Fed. If that is the case, then these spreads are proof that ‘helicopter’ Ben’s ultra-easy policy days may be coming to an end.

The notable jump higher in US front-end yields indicates that the fixed income trader has begun thinking about the Fed tightening and not just tapering. A strong payroll print next week should support the existing strong dollar policy.

US 10s are currently within earshot of their 14-month peak (+2.19%) and technically knocking on the door to move even higher. In just under a month the US benchmark has moved in a semi-orderly fashion from +1.61% to +2.19%. It would be normally fashionable, given a move of similar magnitude, that a gap fill would create some resistance for yields in the short term. However, so far that has not been the case. Excluding Japan, yields in emerging Asia (Hong Kong and Singapore) are higher across the board (+5-8bps) this morning, jumping in sympathy with the US and Korean yields.

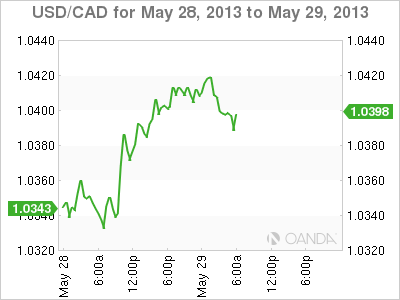

With the FI traders pricing in the Fed to begin tapering its QE program it’s not a major surprise that safe haven currencies are bearing most of this market's weight – CAD, CHF and AUD in particular. The perception that global risk is again on the rise is argument enough that some of these safe haven currencies remain overvalued. Despite the loonie having been relatively low in the current G10 currency ranking, the volumes traded have been on the rise over the past few weeks.

The CAD twin sister from down-under, the AUD, remains weak on strong volume particularly against the 17-member single currency. Earlier this morning the AUD happened to record a 19-month low (0.9545) against its favored ‘greenback.’

The world’s longest Central Bank Governor goodbye gets to draw its final breath today with outgoing Governor Carney presiding over his last Bank of Canada meet this morning before heading “across the pond” to take the helm at the BoE. The market does not expect today’s BoC statement to deviate considerably from the most recent decision and especially so ahead of the Canadian economy getting to release it’s first-quarter GDP results this coming Friday.

Canada’s overnight rate is expected to remain on hold at +1% with no significant change in the “guidance language” – the hawkish bias is to remain in place. However, if the language is at all softened, and combined with the market's current weaker economic outlook, then investors should expect the loonie to come under renewed pressure and test again this week’s lows anywhere north of 1.0420.

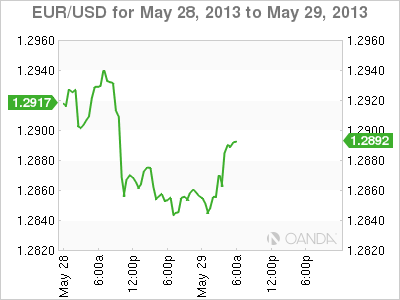

The 17-member single currency has not been without its detractors again today. German unemployment rose more than four-times as much as the market had been expecting this month (+21k to +2.96- million), as the sovereign debt crisis and harsher winter took a charge on Europe’s economic ‘backbone’.

Not helping the single currency’s cause was the OECD’s updated economic outlook stating that developed economies' growth rates would be weaker this year than last (US and Japanese expansion being offset by the Euro-zone’s), to which the ECB should respond with new stimulus. Currently, further downside risk remains in the cards for the EUR as hourlies threaten to “rollover from over bought levels.”

The technicians note that below the 21-DMA (1.2968), the EUR remains in a bear channel. Market stop-losses are strategically accumulating above this level as the investors focus on their medium term target level of 1.2760.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Are Yields Going To Break The Euro’s Back?

Published 05/29/2013, 07:16 AM

Updated 07/09/2023, 06:31 AM

Are Yields Going To Break The Euro’s Back?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.