In the article, the author notes,

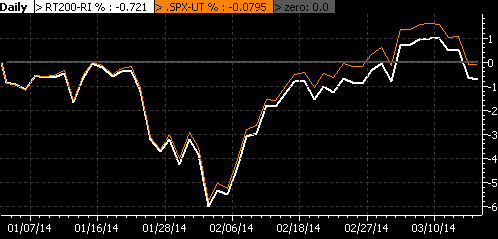

"The broader index may be making new all-time highs, but less and less of its components are. This means the market is being driven higher by fewer and fewer companies and solely by those companies with the biggest market caps that have the larger effects on the indices (emphasis added)."

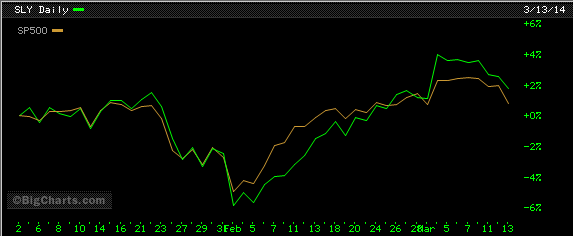

The next chart shows the S&P 600 Small Cap ETF compared to the S&P 500 Index. In this case as well, small caps are outperforming large cap stocks.

Further, the market strength has really been evident in the small cap stock space. Much is being written about the extended valuations in small cap stocks:

- A Major Small Cap Warning? by Ryan Detrick

- Are Small Cap Valuations Getting Extended? by HORAN Capital Advisors

Also, looking at a broader index like the NYSE Composite Index, the percentage of stocks trading above their 200 day moving average has been increasing this year. The NYSE Composite consists of 1,867 companies (1,518 of which are U.S. companies.) In actuality, maybe we are seeing a broader more global participation in this market advance.

From our firm's perspective, consolidation of market gains generated over the last year and a half would be constructive for another move higher for the market. The market has consistently stair-stepped its way higher since late 2012.