The so-called recovery is built on sand, and as stock markets climb and climb, and more traders and investors turn bullish, we come ever-closer to a new 2008-style collapse.

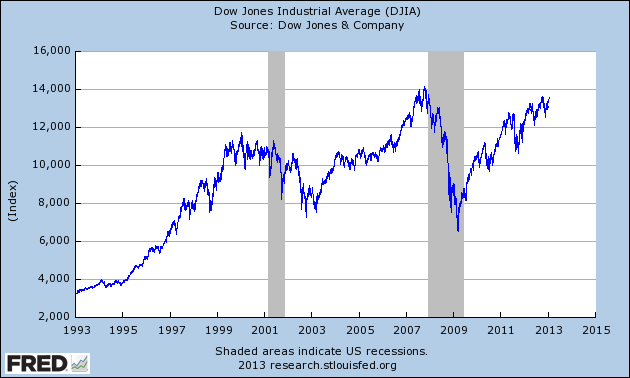

Markets have already gone far, far higher than many expected on a drift of reinflationary central bank liquidity. Yesterday the DJIA hit a new post-2007 high:

The same day, it was revealed that the big Wall Street banks are gambling again with billions and billions of dollars of clients’ funds. Goldman Sachs are back to pre-crisis-style profits. Again and again — from the LIBOR scandal, to MF Global, to the London Whale, to Kweku Adoboli — the financial sector has illustrated that it has learned very little from 2008, and is still practising many of the same hyper-fragile ponzi finance practices that led to the subprime bubble and the 2008 collapse.

Soaring markets, and soaring speculation. Big finance using loopholes to speculate bigger and harder. Mainstream financial journalists becoming more and more complacent about the “recovery”.

We’ve been here before. Isn’t repeating the same behaviour and hoping for different results the very definition of insanity?

I don’t know exactly how the next crash will occur — although there are many potential ignition spots including a severe trade or energy shock, or a Chinese real estate and subprime meltdown, or a natural disaster, or a new Western financial crisis. I don’t know when the next crash will occur, or how high the markets will climb before it does (DJIA 36,000 maybe? That would be hilarious).

But I know that if markets and regulators continue to repeat the mistakes that led to 2008, we will be back in a similar or worse hole soon.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Are We Headed for a 2008-Style Collapse?

Published 01/20/2013, 12:12 AM

Updated 07/09/2023, 06:31 AM

Are We Headed for a 2008-Style Collapse?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.