If the Information Technology and Financials sectors were priced at their median valuation since 1995, and with all other things being constant, the S&P 500 would trade at 1,950 up 19.3 percent from today's price.

Information Technology and Financials are valued at historically low valuations

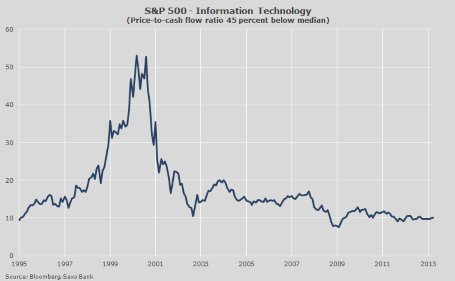

Despite the S&P 500 being up 14.5 percent year to date the two largest sectors, technology and financials, are still trading significantly below their historical valuations. Measured on price-to-cash flow, the information technology component in the S&P 500 index is trading 45 percent below its median valuation of 14.73 since 1995 (see chart below).

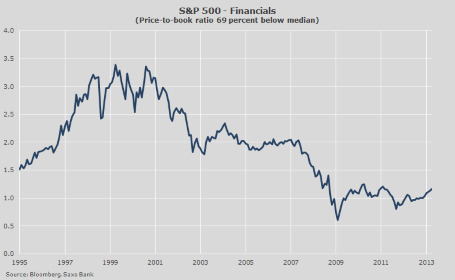

Measured on price-to-book, financials (banks, real estate, insurance and diversified financials) are trading 69 percent below their median valuation of 1.96 since 1995 (see chart below).

Could the S&P 500 index trade at 2,000 in 2015?

The Information Technology and Financials sectors have a combined weight of 34.1 percent in the S&P 500. A multiple expansion in those two sectors alone would contribute tremendously to the overall valuation and price level in the S&P 500.

The current price-earnings ratio is 16.0 based on a weighted harmonic mean (the preferred method for calculating fundamental ratios on indices). If Information Technology and Financials saw their valuations expand to their median, translating into a 45 percent and 69 percent rise in their prices respectively, the price-earnings ratio would rise to around 19.3 which would be relatively pricey, of course depending on interest rate and inflation expectations. The calculation is based on keeping all other sectors' prices constant. The multiple expansion in these two sectors alone would take the S&P 500 to around 1,950 or about 19 percent higher than the current price.

These calculations do not take into account an improving economy and rising nominal prices and earnings. However, they give you a pretty good idea of the potential impact on the S&P 500 price level. If the mean-reversion in those two sectors' valuations is an ongoing process for the next couple of years and we factor in the rising economic activity in nominal prices, then a price level of 2,000 in the S&P 500 in 2015 does not sound outrageous. Of course, this would depend on a couple of things, like no major disruptions from the euro area and the region turning back into growth. Secondly, it requires that emerging markets continue to expand with no major hiccups from China.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Are Technology And Financial Stocks The Rocket Fuel For S&P 500?

Published 05/14/2013, 08:35 AM

Updated 03/19/2019, 04:00 AM

Are Technology And Financial Stocks The Rocket Fuel For S&P 500?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.