President Trump shocked the markets and its constituents with his “Liberation Day” tariffs. His intent of promoting his America First initiative, reviving the nation's manufacturing industry and lowering trade deficits, was overshadowed by the worst two-day stock market decline in history as the markets shed $6.6 trillion.

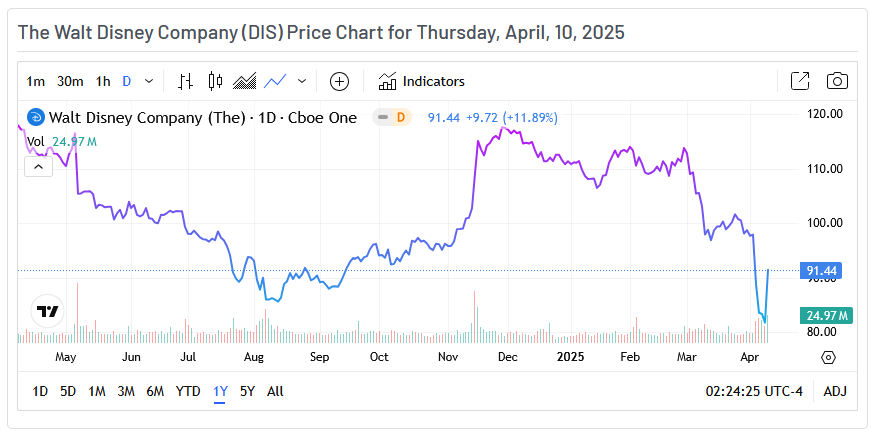

During those two days, The Walt Disney (NYSE:DIS) stock shed over 14%.

And now, a sudden and sweeping move imposing an additional 50% hike on Chinese imports (now totaling 104%) has thrown financial markets into disarray and sparked fears of a full-blown trade war.

As of the market open on April 9, Disney stock is down over 22% month-to-date and down over 26% year-to-date as investors scramble to reassess the company’s exposure to global supply chains, international markets, and consumer sentiment.

Investors are now asking themselves a painful question: Are these sharp losses just market turbulence—or do they pose a serious threat to the iconic brand's comeback story and the consumer discretionary sector in general?

Direct Hits: The Disney Segments Feeling the Immediate Squeeze

Disney sits at the crossroads of global trade and consumer spending, making it acutely sensitive to import tariffs—especially those targeting manufactured goods from China, where much of the company’s licensed merchandise and production inputs originate.

While the direct implications are clearest in its consumer products, electronics, and cruise line segments, the shockwaves extend well beyond.

The Consumer Products and Merchandise division—responsible for monetizing Disney’s intellectual property through toys, apparel, and collectibles—is especially exposed. Disney’s licensed toys, many of which are produced in China by partners like Hasbro (NASDAQ:HAS) and Mattel (NASDAQ:MAT), are now burdened with a 104% tariff, more than doubling costs virtually overnight.

Apparel and in-park merchandise face lower, though still material, tariffs that tighten margins and may lead to price hikes that suppress demand, particularly among budget-conscious families.

Disney’s Media and Entertainment Distribution operations are also indirectly impacted. While not always discussed in the tariff spotlight, consumer electronics—including streaming devices and accessories used by platforms like Disney+—are now significantly more expensive to produce or procure. These rising input costs create downstream pressures on pricing models and subscriber acquisition costs.

Perhaps most alarmingly, Disney’s ambitious Cruise Line expansion has hit choppy waters. The company is in the midst of building seven new ships, two of which are expected to launch in 2025. The newly enacted tariffs on imported steel and aluminum—materials not easily substituted with domestic alternatives—mean that capital expenditures on the fleet could surge, forcing difficult decisions about scale and timelines.

Ripple Effects: Indirect Tariff Fallout Across Disney’s Empire

Beyond the obvious pain points, the tariffs are subtly but significantly reshaping Disney’s broader ecosystem.

In the Consumer Products and Licensing business, while the tariff burden technically falls on third-party manufacturers, the effects will reverberate through renegotiated licensing deals and potentially muted consumer demand. When wholesale prices rise, retailers pass those increases on, and Disney’s licensing revenue could take a hit.

In the Parks, Experiences, and Products segment, discretionary spending pressure could depress in-park purchases, especially for imported goods like European wine or Asian seafood served in themed restaurants. Price-sensitive guests may scale back on merchandise and meals, dampening the high-margin upsell opportunities that theme parks rely on.

Meanwhile, Advertising and Linear Networks—including properties like ABC and ESPN—could face a downturn in advertiser demand. As companies across sectors adjust to rising input costs, marketing budgets may be among the first things cut. This could slow the rebound in ad sales that Disney had been counting on post-strike.

On the content side, Studio and TV production budgets are under pressure as costs rise for imported equipment, sets, and materials. While not headline-grabbing, even modest delays or overruns across Marvel, Lucasfilm, or Disney Animation projects could have cascading effects on release calendars and revenue forecasts.

Finally, Disney’s international resorts, particularly in Shanghai, Tokyo, and Paris, may face brand and geopolitical fallout. Anti-U.S. sentiment in response to escalating tariffs could lead to boycotts or reputational damage, undermining years of carefully cultivated goodwill in key global markets.

Rising Input Costs Will Lead to Higher CapEx

As tariffs take hold, Disney is facing mounting capital expenditures across its operational and developmental footprint. The expansion of its theme parks and cruise line fleet is particularly vulnerable to price increases on imported materials like steel, aluminum, animatronics, glass, and mechanical equipment—many of which are unavailable domestically at the same scale or quality.

Theoretically, Disney can shift its supply chain to domestic providers to avoid tariffs, but when it comes to steel, costs can rise either way as domestic steel producers raise their prices because they can—which is what happened in 2018.

Disney CEO Bob Iger has publicly acknowledged the strain on the company’s Cruise Line segment, stating that the rising costs may force Disney to scale back capital-intensive projects. Iger also noted that relocalizing international manufacturing is neither fast nor practical, especially given Disney’s reliance on highly specialized overseas suppliers.

How Tariffs Are Reshaping Consumer Spending

Disney must also contend with the broader macroeconomic effects of tariff-driven inflation. As the cost of goods rises across the board, disposable income shrinks, leading consumers to tighten their belts—particularly on non-essential, discretionary purchases.

This trend poses a threat across nearly every Disney segment. Families may cancel theme park vacations or cut back on streaming services like Disney+ or Hulu. Gift and impulse buying may decline, and the sales of branded merchandise, apparel, and toys may fall along with it.

In essence, even if Disney manages to navigate supply chain and production cost challenges, its revenue is still at the mercy of consumer sentiment and spending capacity—both of which are highly sensitive to inflationary pressures.

Should Investors Be Worried?

The short answer is probably. Even though the market’s reaction may seem extreme, it is not entirely unfounded.

Tariffs have created a dual threat for Disney: rising operational costs and weakening consumer demand.

While the company’s long-term brand strength and global diversification provide some resilience, the near-term challenges of inflation, reduced spending, and supply chain rigidity should not be overlooked.

Investors should pay attention to Disney’s strategic responses. Leadership transparency will be a key indicator of how well Disney will weather this turbulent tariff environment.