Flare-ups in the euro-zone refuse to disappear entirely. On the heels of a disastrous Italian election and a full-fledged banking crisis in Cyprus, a Portuguese court has ruled that some of the austerity requirements for bailout dollars are discriminatory. Prime Minister Coelho hopes to find a workaround, but alas, securing bailout money in the near future may be a bit more challenging than the leader cares to admit.

Since the S&P 500 recovered lost ground on Monday (4/8/13), pundits were quick to say that the market no longer responds to the eurozone’s tribulations. “This is the third bad European story this year, and the first two instances told us that the market doesn’t care,” Dan Greenhaus said. Mr. Greenhaus, chief global strategist at BTIG, offered his thoughts to the Wall Street Journal.

With all due respect to Mr. Greenhaus, it’s the fourth bad story. Last month, Greece refused to lay off 25,000 public employees, forcing euro zone financial officials to leave the country. Indeed, there is an increasing lack of support for austerity reform in Italy, Greece, Cyprus and Portugal, making it more difficult for financial leaders to green light bailout bucks going forward.

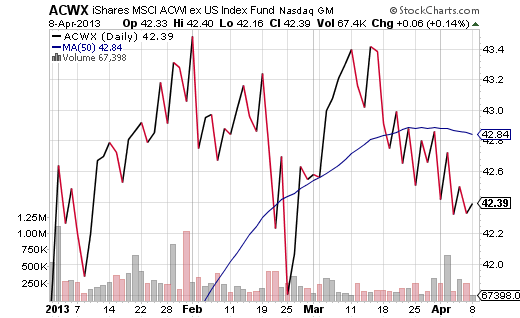

The number of stories notwithstanding, is Mr. Greenhaus accurate that the market does not care? I suppose we’d have to get more clarity on what the “market” is. Year-to-date, the S&P 500 may be 9.5% higher, but iShares All-World excl U.S. (ACWX) may be close to buckling under the weight of global growth uncertainties.

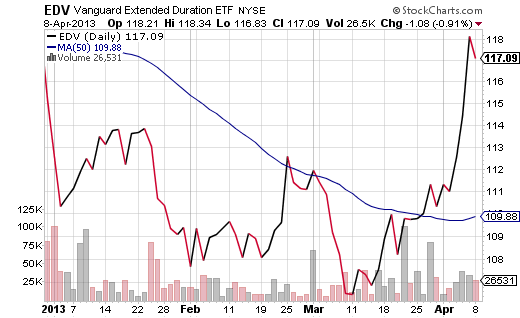

Similarly, the bond market has not dismissed the eurozone debt crisis. Vanguard Extended Duration (EDV) has moved back up near its 2013 highs and interest rates are plummeting again. Isn’t a flight back into treasury bonds a sign that nerves may be fraying?

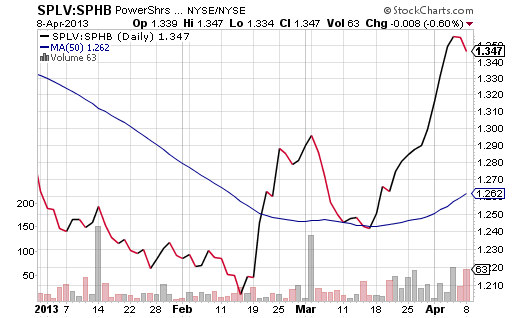

Even if a strategist contends that investors are more willing than ever to look beyond Europe, stocks tied to the domestic and/or global economic cycle (i.e., cyclicals) have been wavering. The strength of non-cyclicals is clearly visible in the PowerShares S&P 500 Low Beta Volatility (SPLV):PowerShares S&P 500 High Beta (SPHB) price ratio. Investors are bidding up healthcare, staples and utilities, while shunning materials, tech and energy.

It is certainly possible that the U.S. markets will not see a 10% correction in 2013. There’s enough evidence to suggest that, while relatively uncommon, markets can go on for years without significant sell-offs. On the flip side, 5% pullbacks have happened in the first 5 months of every single year since 1996. Fed money printing alone is unlikely to override deteriorating economic data — both domestic and abroad — let alone the possibility of region-wide financial instability in Europe.

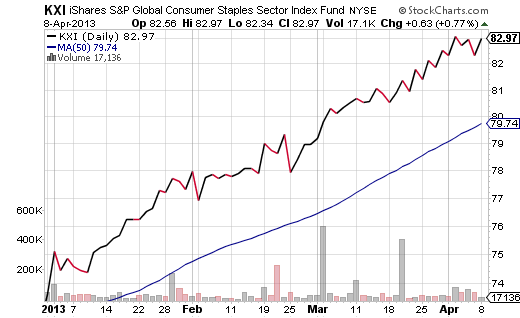

Should you buy the dip when it comes? I will. Nevertheless, I am likely to stick with non-cyclical stand-outs like SPDR Global Consumer Staples (KXI) and WisdomTree Equity Income (DHS) when one or more of them pulls back to a 50-day.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Are Stock ETFs Tired Of The Eurozone Crisis?

Published 04/09/2013, 01:45 AM

Are Stock ETFs Tired Of The Eurozone Crisis?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.