At Walmart (NYSE:WMT), the patrons seem to have better cars and smartphones than I own - and yet do not believe these patrons are as financially secure as I am. Is the spending pattern changing putting consumption well above saving and investing?

Follow up:

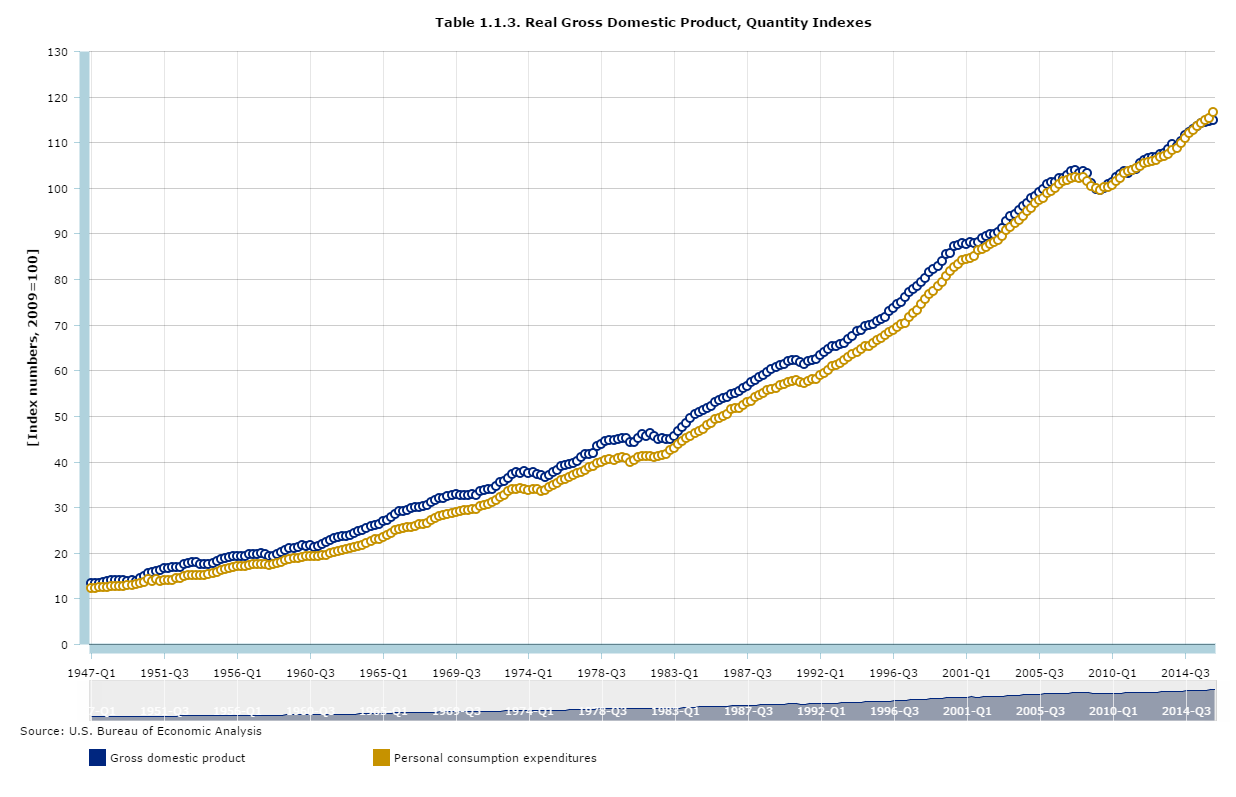

Looking at GDP, consumers remain at the trough consuming. And the USA just entered a period where personal consumption is growing faster than GDP.

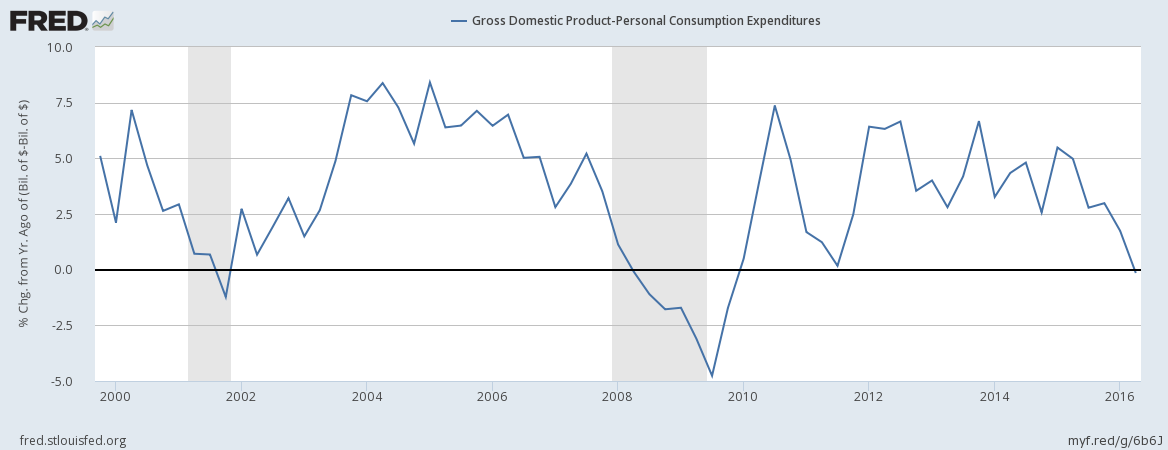

There seems to be little change in the growth of consumer spending relative to GDP through the ages. However, GDP would be zero if not for consumers. The graph below removes consumer spending from GDP.

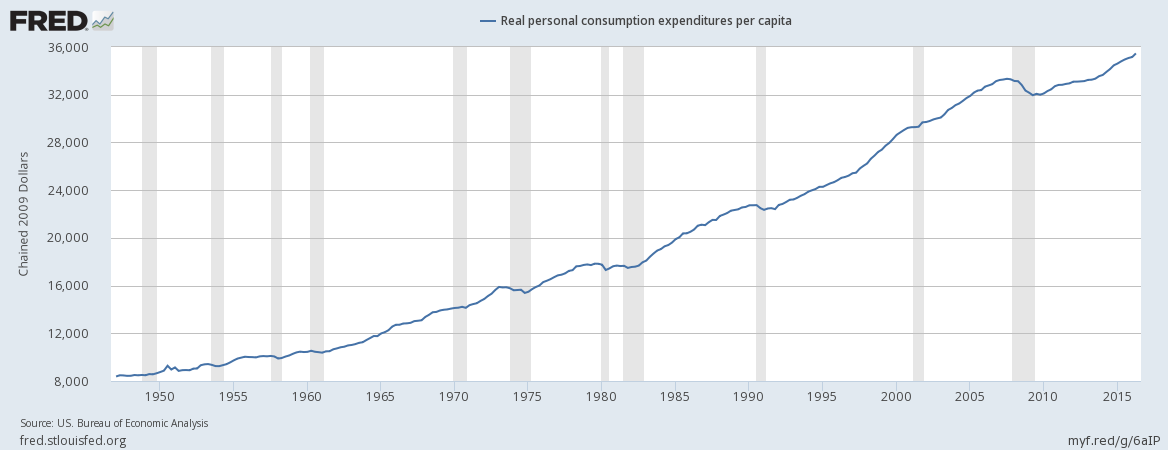

And spending per capita seems to be growing at the historical pace (albeit the reset caused by the Great Recession).

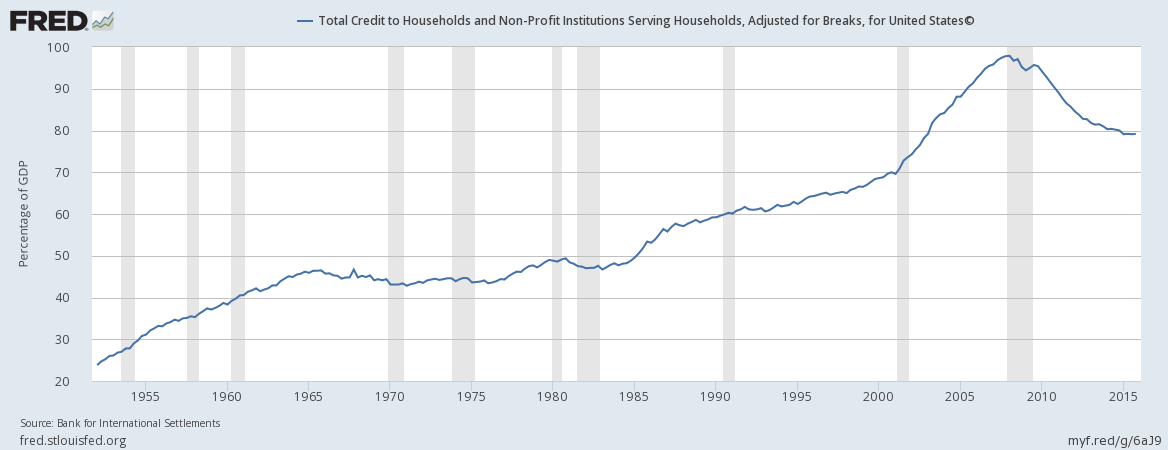

As GDP and consumer spending are growing at the same rate - we can assume based on the following graph that consumers are carrying debt equal to 2003 levels. The graph implies that GDP is not being fueled by borrowing to the same degree it was beginning in 2000 (and ending at the beginning of the Great Recession) - hence to spend the same amount of money, less was saved or invested.

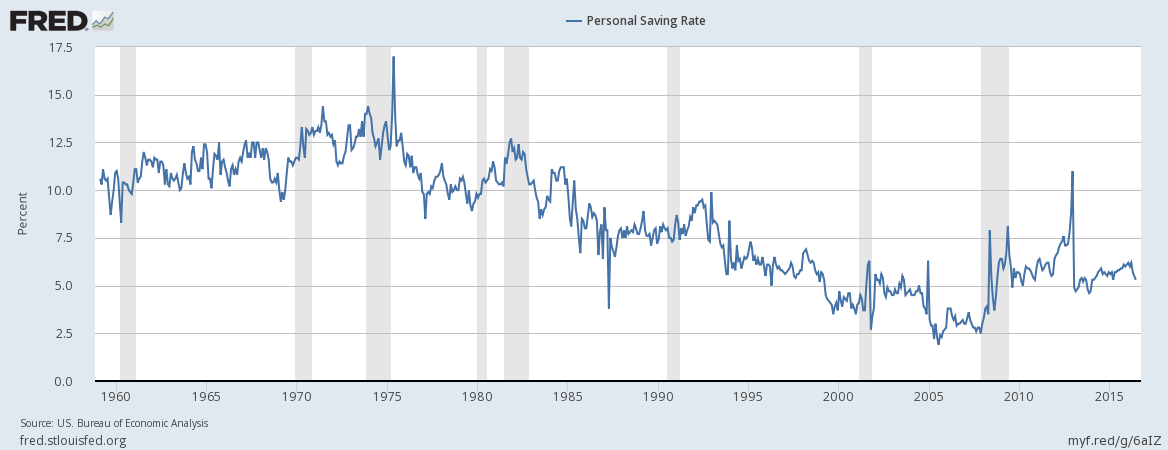

The savings rate has been in a long-term decline from more than 12% in the early 1970s to around 2.5% before the Great Financial Crisis of 2008. Since then it has recovered to better than 5%, but is still below the level of the early 1990s.

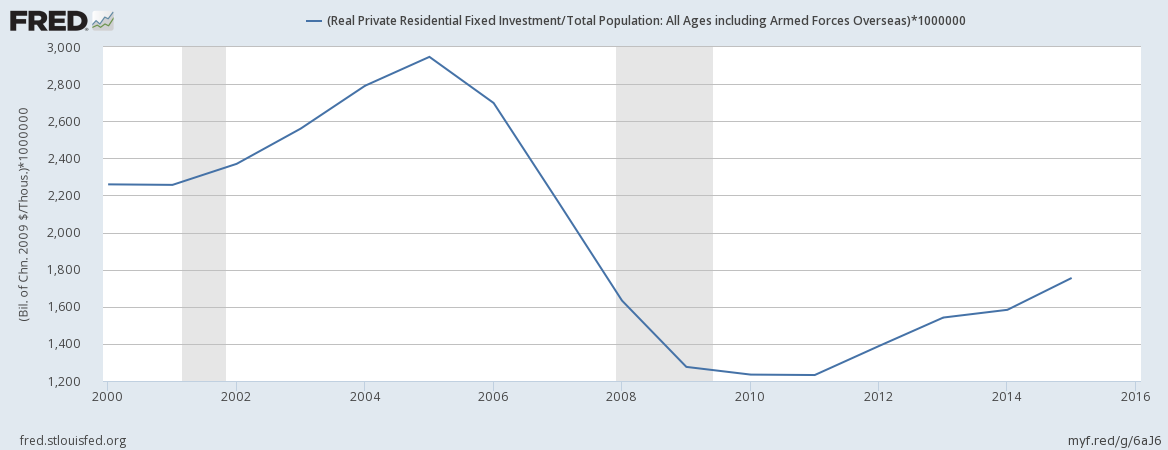

And the annual residential investment per capita is improving but has not returned to pre-Great Recession levels.

Neither savings or investment is included in consumer spending (but investment IS included in GDP in fixed investments, whilst savings is not included in GDP).

Consumers can only borrow so much and spend so much. GDP prior to the Great Recession was fueled to a large degree by borrowing, and before that by the Baby Boomers going through their spending peaks. Those days are gone.

So to answer the question is spending habits changing - it is hard to say. But it is obvious that consumers are spending more of their paychecks than for much of the post World War II era at the detriment of saving and investing. Further, it is difficult for consumers to drive additional investing without taking this money from consumption. In other words - it is unlikely that consumers can drive GDP higher.

Other Economic News this Week:

The Econintersect Economic Index for August 2016 is no longer in contraction but its level correlating to snail's pace economic growth. The index remains near the lowest value since the end of the Great Recession.

Bankruptcies this Week: International Shipholding, Privately-held Global Geophysical Services

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: