Scary selling yesterday. See how little the downswing has achieved technically. Check out the other characteristics, and you‘ll probably reach the same conclusion I did. It‘s still about tech getting its act together while much of the rest of the market is doing quite fine.

The credit market confirmed, as is obvious from the HYG:SHY ratio chart I‘m showing you. True, long-term Treasuries are under pressure. But as I wrote on Monda, not even considerably higher rates would break the bulls‘ back. The dollar isn‘t getting far, and tomorrow‘s nonfarm payrolls are expected to be rather bad. Bottom line, this correction appears in its latter stages, waiting for more liquidity.

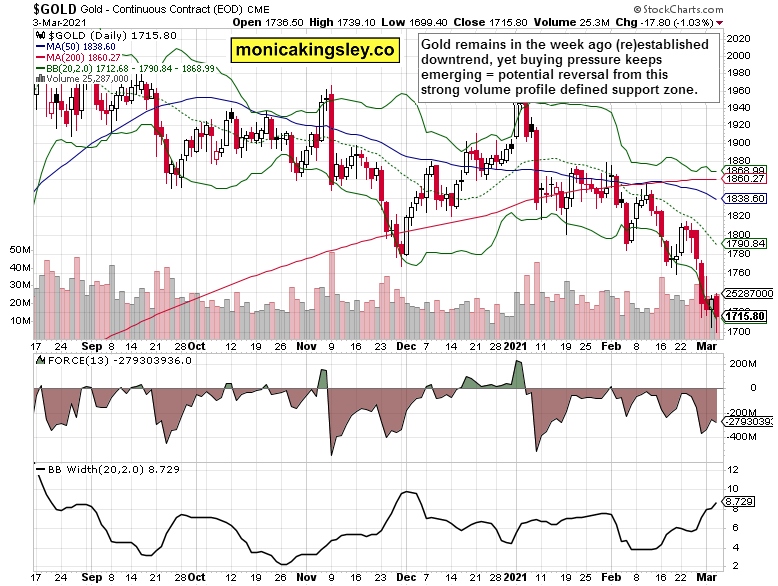

That was stocks, what about gold?

There is no shortage of gloomy charts there, accompanied by various calls for a local bottom. The most bullish predictions talk about a possible bottom being made here, with the $1,700 to $1,690 zone. The doomsayers' scary click-baitish targets of $1,500 or $1,350 are in the minority, and about as helpful as calls for $100 silver before the year's end.

As I always say, let's be realistic, honest and act with real integrity. People deserve better than to be played due to fear or greed.

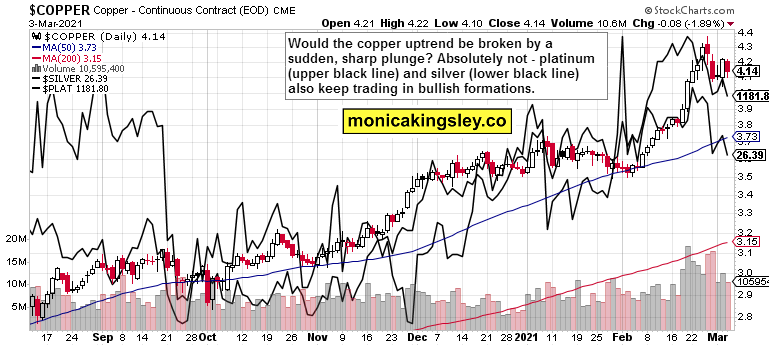

Silver remains in a solid uptrend, and so does platinum. Regardless of today's premarket downswing, taking copper down more than 4%, commodities are happily running higher in the face of call of "no inflation here, move along." How far is the Fed announcing yield curve control, or at least a twist program? Markets crave more intervention, and those calling for rate hikes to materialize soon, are landing with egg on their faces. Mark my words, the Fed is going to stay accommodative longer than generally anticipated. Have we learned nothing from the Yellen Fed?

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

Gold And Silver

Gold still has a good chance to rebound higher, even though it missed yesterday's opportunity that would have resulted in a nice hammer candlestick. Never mind. We have to live with what we have – and the support is still unbroken. I am not ruling out an upswing in the least. Yes, regardless of the deeply negative Force index, which really wasted each prior opportunity to turn positive this winter. The metals would do well to get used to living with higher nominal rates really, when the real rates are little changed.

Silver keeps doing much better, which is a little surprising given the economic recovery, leading indicators not weakening, manufacturing activity doing fine. It's a versatile metal, both industrial and monetary after all. Compare how little its Force index has declined vs. gold. This is rather a bullish chart, unlike gold, which is still searching for direction (i.e. without an established uptrend).

Copper

Let's compare the red metal (perched high, digesting steep February gains) to platinum and silver. I'm featuring copper as the key determinant for precious metals, also given the positive March seasonality. The above chart fittingly illustrates the bull market's strength.

Summary

Gold remains stuck in its support zone, unable to rally, not breaking down. Meanwhile, copper is retreating today. The technical odds favor a rebound off this support. Once that happens, it would be though to call for the new gold bull upleg to resume. Much more would need to happen, such as the miners doing really well, and so on. But we‘ll get there.