Prior to the collapse of real estate , tradable securities as well as dozens of global financial heavyweights in 2008, investors bet heavily on emerging market growth. Indeed, exporting powerhouses — Brazil, Russia, China — had benefited from an increasing worldwide demand for natural resources. Additionally, economists had ballyhooed the purchasing power of hundreds of millions of newly minted middle class consumers.

With the meltdown in 2008 and the subsequent 2011 debt crisis in the euro-zone, prices on a wide variety of commodities declined considerably. Waning interest in the emerging market growth theme hit commodity producers even harder. And assets under management for ETFs tied to emerging countries dwindled.

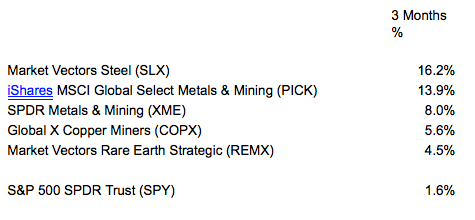

Some folks, however, are beginning to see an end to the carnage. Whereas funds like SPDR Metals and Mining (XME) have been in a long bearish descent since mid-2011, a bottom may have formed at the end of June in 2013.

From a technical standpoint, the picture is far from certain. In the second half of 2012, XME proved capable of breaking through long-term resistance on its 200-day moving average, only to succumb to increased selling in the first half of 2013. So why should metal producing companies be awarded a break this time around? Fool me once, shame on me. Fool me twice, shame on who?

One reason for newfangled optimism is the modest improvement in both Chinese and pan-European demand. The regions rank #1 and #2 in base metal consumption worldwide. Specifically, demand in Europe for aluminum rose 1.3% in the third quarter, and estimates suggest it will rise another 1% in the final quarter of 2013. Similarly, copper demand rose 1% in Q3 and estimates for Q4 are in the 2% range. While nobody has suggested that the rate of growth is torrid, both aluminum and copper came off a previous year where the respective rates had been negative.

To the extent that forward guidance is accurate, metal producing corporations in Europe express cautious optimism on “turning a corner.” What’s more, analysts share the sentiment; most see a number of European countries needing to restock their supply of aluminum. Others are equally bullish on copper. And why not? Research firm Markit recently pegged the euro-zone growing its manufacturing segment at the fastest pace in 27 months.

Are Commodity Producers Presenting An Opportunity?

Perhaps the one investment that is more intriguing than the others in the metal mining space is iShares Global Metals and Mining Producers (PICK). This exchange-traded vehicle tracks an index that excludes the precious metals space that is dominated by gold and silver. With a concentration on companies that engage in the extraction and production of copper, aluminum and steel, investors may benefit from a pick-up in generalized economic growth, rather than include a space that is more useful as a hedge against fiat currency devaluation.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Are Metal-Miner ETFs Producing Again?

Published 10/14/2013, 12:54 PM

Updated 03/09/2019, 08:30 AM

Are Metal-Miner ETFs Producing Again?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.