Weeks ago precious metals began a correction amid overbought conditions (in the miners) and very bullish sentiment in the metals. The recent Fed minutes helped accelerate the weakness but it lost steam in recent days. A real stinker of a jobs report completely reversed the thought that the Fed would hike rates in the summer and it sent precious metals surging. As a result, the gold stocks and junior gold stocks especially could be back on the path to making new highs before autumn.

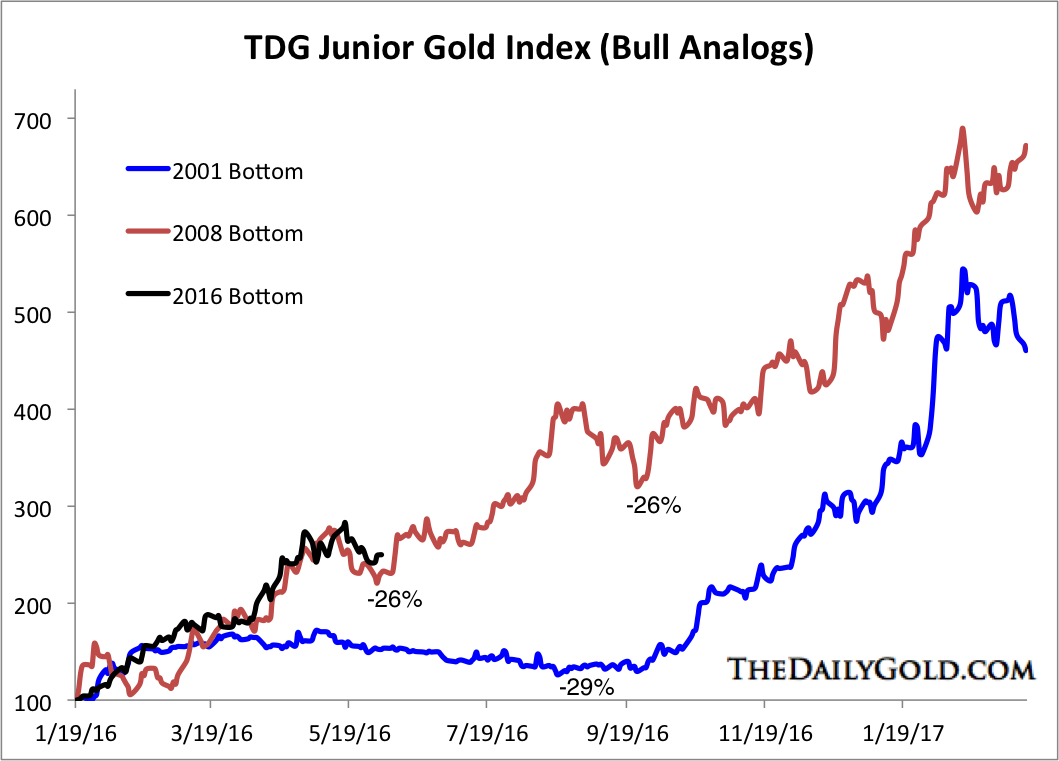

Below we show our junior gold index bull analog chart. It is a custom index of 18 stocks with a median market cap of roughly $300 Million. We plot the rebounds from 2001, 2008 and January 2016 on the same scale. From high to low the index had corrected 18%, which compares to the 26% at this point in the 2008-2009 rebound. In 2001 the juniors corrected 29% over five months. Given the reaction to the jobs news, the probabilities say the juniors are more likely to follow the red path (2009) or something close to it then the blue path (2001).

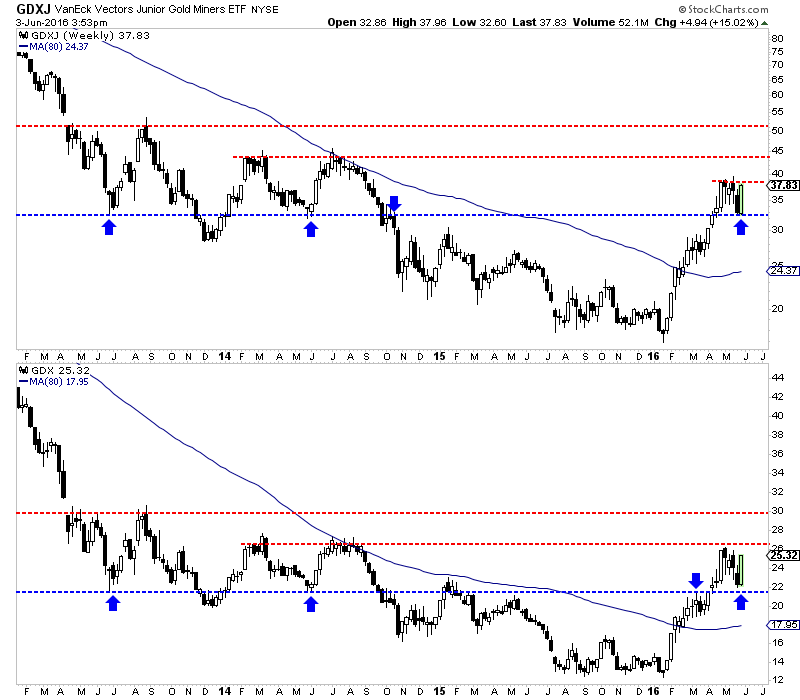

Below are the weekly candle charts for VanEck Vectors Junior Gold Miners (NYSE:GDXJ) and VanEck Vectors Gold Miners (NYSE:GDX) which have now engulfed the bearish candle from the previous week.

Note how the miners were able to hold support which includes the 50-day moving averages (not shown). If GDXJ can make a weekly close above $38 then that brings upside targets of $44 and $50 into play. Meanwhile, if GDX can make a weekly close above $26 then it has upside potential to $30 and even $32, the 38% retracement.

This was an amazing move in the gold stocks that caught many off guard, including me! The data argued and argues for a bigger and longer correction.

My junior index corrected only 18% while the corrections in 2001 and 2009 were 29% and 26%. No one can predict if the correction is over or if gold stocks (and juniors especially) will continue to follow their 2008-2009 path.

However, we do know a few things. It is a bull market and prices should move higher in the months and quarters ahead. Finally, we know that a bullish consolidation in the weeks ahead followed by a breakout would be inline with recent history (2008-2009).