Big Lots, Inc. (NYSE:BIG) is scheduled to release third-quarter fiscal 2017 results on Dec 1, before the opening bell. Last quarter, the company’s bottom-line beat the Zacks Consensus Estimate by 8.1%. Notably, earnings have surpassed the consensus mark by an average of 81.1% in the trailing four quarters. Let’s see how things are shaping up prior to this announcement.

What to Expect?

The question facing investors is whether this broad-line closeout retailer would be able to post positive earnings surprise in the quarter to be reported. The current Zacks Consensus Estimate for the quarter under review is 4 cents, flat year over year. Notably, the Zacks Consensus Estimate has been stable in the past 30 days. Moreover, analysts polled by Zacks expect revenues of $1,116 million in the third quarter, up nearly 1% from the year-ago quarter.

Factors at Play

Big Lots’ strategic endeavors, furniture financing programs and soft home bode well for the quarter to be reported. Furniture, which has been the leading performer in the last few quarters, increased in mid-single digits in the second quarter. The company is very optimistic about the performance of furniture in fiscal 2017. Moreover, management has been expanding assortments in this category by including lawn and garden items, such as patio furniture, gazebos and gas grills.

However, sluggishness in food and consumables, electronics/accessories and hard home remain a deterrent. The company is lowering SKUs across Hard Home and Electronics due to soft sales. Further, a challenging retail landscape, aggressive promotional strategies and waning store traffic also remain primary headwinds.

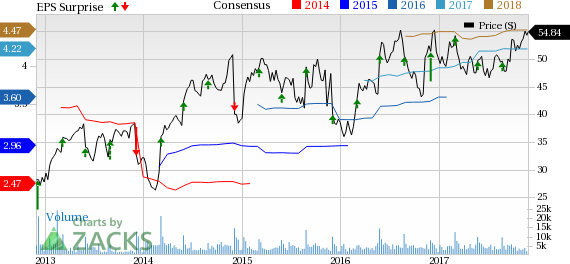

Big Lots, Inc. Price, Consensus and EPS Surprise

What Does the Zacks Model Say?

Our proven model shows that Big Lots is likely to beat earnings estimates this quarter. This is because a stock needs to have both a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Big Lots has an Earnings ESP of -7.69%. Although, the company’s Zacks Rank #3 increases the predictive power of ESP, we need to have a positive ESP to be confident about an earnings surprise.

Stocks with Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Zumiez Inc. (NASDAQ:ZUMZ) has an Earnings ESP of +0.69% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

American Eagle Outfitters, Inc. (NYSE:AEO) has an Earnings ESP of +1.04% and a Zacks Rank #2.

G-III Apparel Group, Ltd. (NASDAQ:GIII) has an Earnings ESP of +1.44% and a Zacks Rank #3.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO): Free Stock Analysis Report

Big Lots, Inc. (BIG): Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII): Free Stock Analysis Report

Original post