Gold is bottoming, showing incredible resilience over the past 7 months. After suffering an epic plunge in last year’s second quarter, gold has held its ground ever since. This is despite still facing the same howling headwinds that forced that extraordinary selloff. Gold has found strong support and carved a massive double bottom. Thus 2013’s gold super-storm has passed, and a mighty new upleg is dawning.

Obviously last year was exceedingly miserable for gold. This metal plunged 27.9%, its worst calendar-year performance in 32 years! When something hasn’t been witnessed for a third of a century, there is no doubt it is rare and extreme. But the whole year masks the real story, the second quarter. The gold price plummeted an astounding 22.8% in 2013’s Q2. That was its worst calendar quarter in 93 years!

Almost 4/5ths of last year’s entire gold losses happened during Q2. If the pair of epic gold selloffs that erupted in April and June hadn’t occurred, last year would’ve looked radically different. And don’t be fooled by the certainty of hindsight, market events so rare and extreme that they only happen on the order of once a century simply can’t be predicted. These once-in-a-lifetime super-storms just have to be weathered.

After gold’s second-quarter free-fall, analysts swarmed out of the woodwork to forecast far-lower gold prices. They bought into the extreme fear spawned by that epic selloff, fully expecting gold’s downside momentum to continue. Dire predictions of sub-$1000 gold in the subsequent months abounded, even among veteran gold analysts. Their commentary back in June and July was overwhelmingly bearish.

But momentum-based technical analysis always fails at extremes. Just when everyone is convinced that a price has moved so far in one direction that its kinetic energy will carry it on indefinitely, prevailing sentiment is too lopsided to be sustainable. In gold’s case, the epic fear last summer meant everyone susceptible to being scared into selling gold low had already pulled the trigger. So gold started to bottom.

That critical process looks to have finished in December, when gold’s brutal late-June lows essentially held despite a universal expectation they would crumble. Gold has carved a massive double bottom, suggesting a major new upleg is just getting underway. Buttressing this is the radical change in gold action in the second half of 2013. Gold has truly shown extraordinary resilience in those 6 months.

The same fierce headwinds that obliterated the yellow metal in last year’s second quarter persisted and even intensified in some cases in the second half. The vexing levitation in the US stock markets that was sucking capital out of alternative investments including gold accelerated. And the long-dreaded QE3 taper went from threat to reality. Yet gold held its ground, showing extraordinary relative strength.

Unfortunately with investors still so blinded by the excessive gold bearishness, most have missed the bottoming signs. But they are readily evident when you consider gold’s performance in the past 7 months in light of those major headwinds. This week we’ll look at gold versus the stock markets, the mass exodus from the flagship GLD gold ETF, and the extreme selling by American futures speculators.

Ultimately gold’s horrendous year was splash damage from 2013’s extraordinary stock-market levitation. Ben Bernanke’s Federal Reserve fell all over itself trying to convince stock traders that it wouldn’t let the stock markets correct without ramping up its money-printing operations. This so-called Fed Put emboldened traders to ignore all kinds of warning signs of toppy overvalued markets and keep buying stocks.

So the stock markets rose and rose and rose, with the benchmark S&P 500 stock index (SPX) closing at new cyclical-bull or nominal record highs on 69 of 2013’s 252 trading days! It was a crazy run devoid of normal corrections, fostering extreme greed. With the SPX melting up so relentlessly, stock investors aggressively dumped their gold in the form of GLD-ETF shares to shift that capital into general stocks.

These vexing gold-to-stock-market capital flows quickly became self-reinforcing. The higher the SPX traveled the more investors wanted to buy in to chase the gains, and the lower gold fell the more wanted to sell to end the pain. This dynamic was deeply manifested in 2013’s first half. In a 5.1-month span between gold’s January peak and June low, it plunged 29.1% partially driven by the huge 8.2% SPX rally.

Though gold suffered a couple massive fast selloffs, the necessary sentimental foundation to trigger them was formed by the relentless SPX levitation day after day. In April gold plummeted in a panic-like selloff after critical multi-year support was breached. But this metal would’ve never even neared that support without the early-year selling sparked by that SPX melt-up. And gold again plummeted in June.

That was immediately after Ben Bernanke laid out the Fed’s best-case plan for starting to slow its pace of monetizing bonds in its third quantitative-easing campaign. Gold futures traders in particular fanned each other’s fears of the QE3 taper into a fever-pitch hysteria. But if gold hadn’t first suffered the steady drip-drip-drip of levitating stock markets sucking capital out of it, that plunge couldn’t have happened.

Extreme selloffs only cascade from lows when the necessary hyper-bearish psychological backdrop is already in place. And the relentless SPX levitation provided it. On countless trading days in 2013, gold would start selling off as soon as the SPX started rallying. The real-time inverse relationship between these alternative and conventional investments couldn’t have been more striking. The SPX killed gold.

Gold peak fear was hit in late June, when the great majority of analysts were making fools of themselves by succumbing to groupthink. They were attempting to rationalize extreme prices driven by epic fear as fundamentally righteous, leading them to make silly apocalyptic gold-price predictions. Man they were so wrong! Gold only fell slightly below its late-June low almost 6 months later, mocking the ravenous bears.

In fact, gold’s June low didn’t even marginally fail until right after the Fed actually launched QE3 tapering in mid-December. All year long gold futures traders and even investors had feared gold would immediately plunge to deep new lows after QE3 tapering began. After all, if the mere threat of a QE3 taper contributed heavily to Q2’s once-in-a-century plummet, wouldn’t the actual event drive that dagger home?

In the 5.8 months between gold’s June low driven by Bernanke’s QE3-taper-timeline forecast, and gold’s December low driven by the actual QE3 tapering, gold merely fell 0.8%. This was despite the stock-market levitation actually accelerating in 2013’s second half, with the SPX up 10.6% over that span! This was a remarkable show of gold resilience. The same selling catalysts failed to batter gold to new lows.

The SPX-levitation headwinds continued to howl, and gold’s sharp 18.2% rebound rally in July and August was indeed garroted when the SPX again started to surge. Yet the intensifying SPX levitation and resulting stock-market euphoria failed to push gold materially under its late-June bottom. The character of gold’s price action was very different in 2013’s second half than in its first, despite the same headwinds.

While the SPX-melt-up-driven euphoria sucked investor interest from gold, the flagship GLD gold ETF was the actual fundamental mechanism through which the SPX levitation crushed gold. GLD acts as a conduit for stock-market capital to flow into and out of physical gold bullion. When stock traders sell GLD shares faster than gold itself is being sold, this ETF’s custodians are forced to sell real physical bullion.

GLD is a tracking ETF, its mission is to mirror the gold price. When it is sold faster than gold, its share price starts decoupling from gold to the downside. In order to stave that off, the excess supply of GLD shares has to be equalized into the gold market. So GLD’s custodians sell some of its gigantic hoard of gold bullion held in trust for its shareholders, and use the proceeds to buy back the excess GLD shares.

Thus heavy differential selling of GLD shares leads to heavy liquidations of GLD’s gold bullion. That flood of marginal new gold supply hitting the global markets last year was what fundamentally drove gold’s plunge. This next chart looks at the gold price superimposed on GLD’s physical bullion holdings. Once again despite GLD-selling headwinds persisting, gold showed remarkable resilience in 2013’s second half.

Over that same 5.1-month peak-to-trough span for gold in 2013’s first half, GLD faced such extreme differential selling pressure that it had to liquidate 27.4% of its holdings! This was a gargantuan 366.4 metric tons of gold, so much supply that it overwhelmed robust global physical-gold demand growth. This was an epic GLD draw, so far into record territory that it defies belief. It was truly a rare and extreme anomaly.

This record mass exodus by American stock traders from GLD hammered gold down 29.1% over that short span. And unfortunately this flood of gold liquidations from stock capital being pulled out of GLD continued to be huge in 2013’s second half. Over that 5.8-month span between gold’s June and December lows, GLD’s holdings fell by another 16.6%! Another 160.8 tonnes of gold were dumped on the market.

Prior to 2013, that second-half GLD liquidation alone would have been a dominating all-time record! Yet gold merely lost 0.8% over that span. It remained flat on balance despite the screaming headwinds of extreme GLD differential selling persisting. Again this was an incredible show of relative strength, and a vast change in the character of gold’s price action. Despite the bearishness, it was in the process of bottoming.

A strong support zone was forming between $1200 and $1250. This was only possible fundamentally because the heavy GLD liquidations were largely being absorbed by worldwide physical buying. But many investors missed this bullish development, because they had foolishly worked so hard to convince themselves that gold was doomed to fall indefinitely. They rationalized extreme fear as normal, which is silly.

2013’s crazy stock-market melt-up driven by the perceived Fed Put most directly affected gold through its impact on GLD-share selling. But the resulting downside pressure on gold convinced American futures speculators to also dump this metal aggressively, intensifying its plummeting spiral lower. They pared their long-side contracts while multiplying their short-side ones, crushing benchmark futures gold prices.

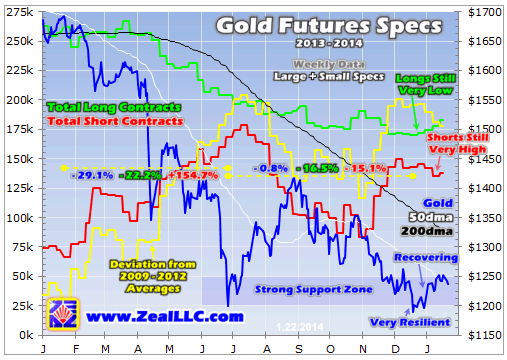

The aggregate gold-futures positions held by speculators in the US markets are reported once a week in the CFTC’s famous Commitments of Traders reports. This last chart shows speculators’ total longs and total shorts, as well as the total deviation in these positions from their 2009-to-2012 average levels in normal market conditions. I’ve explained this chart in great depth in past essays if you need a refresher.

In the hyper-leveraged zero-sum game of futures trading, the price impact of selling an existing long contract or adding a new short contract is identical. Both add gold supply in the futures market, which drives the gold price lower. And both American speculators’ long-side liquidations and short-side additions were extraordinary last year. Nothing remotely close had happened before in gold’s entire secular bull.

In that January-to-June span where gold plummeted 29.1%, speculators’ long-side gold futures fell by 22.2% while their short-side contracts skyrocketed 154.7% higher! That might not mean much to investors who don’t traffic in this wild realm, so let’s convert it into familiar gold terms. Added together, the total deviation of spec longs and shorts from prior-years’ averages shot from 27.2k to 187.9k contracts.

That difference of 160.7k contracts of gold-futures selling from paring longs and multiplying shorts is the equivalent of 500.0 tonnes of gold! That actually dwarfs GLD’s massive 366.4-tonne supply added to the market over that same 5.1-month span. Add the blizzard of GLD and futures selling together, and it is no wonder gold plummeted 29.1%. There’s no way 866.4 tonnes of new gold can be absorbed in just 5 months.

And provocatively American futures speculators’ extreme bearish bets on gold didn’t abate between gold’s June and December lows. Longs continued falling another 16.5%, unleashing more gold selling. And though shorts retreated 15.1%, the net of this short-covering buying and long liquidations was still an 8.1k contract increase in gold-futures deviations from their 2009-to-2012 averages in normal times.

That represents another 25.2t of gold supply hitting the futures markets, admittedly trivial compared to the first half of 2013. But gold still held strong, merely edging 0.8% lower over that span when futures speculators were totally convinced it would soon plunge under $1000. Again gold was very resilient in the second half of last year, defying the same stiff headwinds that massacred it during the first half.

And there was nowhere the QE3-tapering hysteria on gold was more acute than among futures speculators. Despite futures traders’ long track record of always betting wrong at price extremes, being too bullish as gold tops and too bearish as it bottoms, these guys were utterly sure gold would crater once the actual QE3 taper arrived. They had seen gold plummet in June on the rumor, so the fact would kill it.

Yet the day after the actual QE3-taper announcement hit in mid-December, by surprise no less, gold merely edged 0.8% under its brutal late-June low. Like so many things in life, the simple fear of the taper was far worse than the actual event. The futures speculators have started to realize how wrong they were in believing the bearish hype, and have been adding longs and covering shorts in recent weeks.

But their bearish bets against gold were so extreme last year that their new gold buying has a long way left to go. Merely to mean revert their total gold-futures longs and shorts to their prior-four-year averages, they have to buy 177.9k contracts from here. This equates to 553.2 tonnes of gold, a vast amount that will fuel gold’s new upleg for many months to come! They have to unwind their bearish bets, which is very bullish.

The fact that gold’s behavior was so different in last year’s second half despite the same first-half headwinds persisting is very important for investors and speculators to understand today for a couple reasons. Since gold just hit fresh new lows in mid-December after the Fed birthed its long-feared QE3 taper, most traders naturally assume gold’s strength is new. That taints their perception of 2014’s gold action.

If this gold strength is really just a few weeks old, it is far easier for traders to dismiss as a flash-in-the-pan short-covering rally that will soon run out of steam. Or the eye of the gold super-storm, which is still widely forecast to resume this year. But if gold has instead been stealthily building momentum for the better part of 7 months now, actually bottoming in the face of fierce headwinds, that’s a whole new ball game.

A massive double bottom 6 months in the making in the most hostile gold environment imaginable is an incredibly bullish omen. While gold was hated and loathed and expected to keep plummeting, it found a strong support zone. While the US stock markets continued to levitate, stock-market capital continued to rush out of GLD, and futures speculators’ gold positions remained extreme, gold held strong and made a stand.

If the same howling headwinds that crushed it to its worst calendar quarter in nearly a century in 2013’s Q2 failed to make a dent in gold in the following two quarters, a major reversal is underway. Gold is carving a major secular bottom, and we are seeing the very earliest vanguard of a major new upleg being born. Gold is overdue for a massive mean reversion higher after 2013’s extreme selling, and it is starting.

Gold entered 2013 near $1675, and that’s where it would have to return to merely nullify last year’s once-in-a-lifetime selling anomaly. That is another 35% higher from this week’s levels before gold even starts reflecting the extreme money-supply growth in the Fed’s quantitative-easing campaigns! And given the ballooning of the Fed’s balance sheet, gold is highly likely to head a heck of a lot higher than that.

But even just returning to late-2012 levels offers incredible opportunities for traders. As usual, gold and silver stocks will greatly leverage the underlying gains in gold. On the last day of 2012, the flagship HUI gold-stock index was 108% higher than this week’s levels. And most of the elite smaller high-potential gold and silver miners we prefer to own were at least quadruple today’s dismal levels just over a year ago!

The gains in great precious-metals stocks as gold recovers are going to be enormous. They are already starting to move in the past couple weeks. If you want to ride this mean reversion, at Zeal we continue to do extensive research to whittle down the universe of miners and explorers to our fundamental favorites. The winners are each profiled in fascinating reports. Buy yours today before this dirt-cheap sector explodes higher!

In the financial markets, the more you know the more successful you’ll be. We share our ongoing research and decades of hard-earned experience, wisdom, and knowledge in our popular weekly and monthly newsletters. They explore current market action from a unique and valuable contrarian perspective, and recommend specific stock trades as appropriate. How can you afford not to get smarter at just $10 an issue? Subscribe today and learn about tomorrow’s trends early when you can still buy cheap!

The bottom line is gold is bottoming. This process started back in late June at peak fear, and cemented in late December after the dreaded QE3 taper actually arrived. Despite the same savage gold headwinds persisting in 2013’s second half that killed gold in the first half, it held strong. It defied the legions of bears to form a strong support zone, from which a major new upleg is now being born before our very eyes.

Gold’s incredibly resilient behavior over the past 7 months or so in an exceedingly-hostile environment proves its global fundamentals remain bullish. That created the strong foundation from which this young new year’s gold rally launched. Far from a short-lived bounce, such a massive double bottom heralds a mighty new upleg. Last year’s anomalous selloff demanded a mean reversion, and it has begun.