The market’s “fear” index is flipping out.

Trading volumes in front-month VIX futures hit a record high last week, in terms of the number of contracts traded.

Anomaly? Hardly!

It turns out that this surge in weekly trading volume caps off the VIX’s largest monthly trading volume, too.

In other words, fears have been building for weeks.

So what’s got investors so freaked out? And is it justified? Let’s take a closer look…

Call it a Contagion

After rallying nearly 30% last year, U.S. stocks got off to a downright nasty start to 2014, dropping 3.6% in January alone.

Yet there was nothing overwhelmingly negative to spark such a precipitous selloff – at least in the United States. All of the trouble has been brewing overseas, particularly in emerging markets.

As the Financial Times’ John Authers puts it, we’ve experienced “ugly political eruptions” in Argentina, Ukraine and Turkey.

On the financial front, the world’s fastest-growing and largest emerging market, China, isn’t growing that fast anymore. (The latest GDP growth figures checked in at a 14-year low of 7.7%.) At the same time, the country is pulling out all the stops to avoid a $15-trillion shadow banking crisis.

Add it all up, and as much as pundits tried to tell us years ago that emerging markets were “decoupled” from developed markets, it’s just not true.

Like I wrote before, “Globalization – an undeniable, decades’ old, economic force – created one quantum entanglement.” So what happens in emerging markets doesn’t stay in emerging markets.

And now we’re witnessing the negative consequences of this reality.

With that in mind, here are three frightening statistics that underscore the potential severity of a slowdown in emerging markets.

Frightening Emerging Markets Stat #1: Say “Hello” to the New Majority

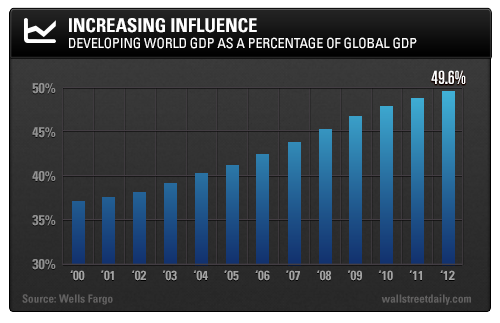

Years ago, we could easily dismiss a downturn in emerging markets. Why? Because developing countries accounted for a minority of global GDP.

Fast-forward to today, though, and we can’t be so cavalier.

According to Wells Fargo’s Global Economist, Jay Bryson, developing countries accounted for 49.6% of global GDP at the end of 2012.

Although 2013 data isn’t available yet, it’s safe to assume that the trend has continued, pushing developing countries’ contribution squarely above 50%.

Simply put, what happens in emerging markets significantly impacts the world.

Frightening Emerging Markets Stat #2: A Bigger and Bigger Customer

When most people think of emerging markets, they think of cheap manufactured goods. Get rid of that stereotype!

Developing economies are increasingly consumption driven. And guess what? Developed economies are the ones supplying their needs.

Statistically speaking, 35% of exports from developed economies now go to developing economies. That’s up from just 20% in 2000.

If developing country “customers” cut back, developed countries can’t help but be impacted.

Frightening Emerging Markets Stat #3: Addicted to Debt

The U.S. government isn’t the only one that can rack up trillion-dollar liabilities.

Alan Ruskin of Deutsche Bank points out that developing country liabilities now rest at $8 trillion – up nine-fold from 1997.

To help put that in perspective, consider that global portfolio liabilities stood at about $5.7 trillion in 1997. So we’re talking about the potential for a far-reaching financial crisis, should emerging economies start defaulting on their liabilities.

Bottom line: Unlike any other time in history, the economic importance of developing countries has reached a critical level, whereby the developed world must pay attention. So investors’ fears over an emerging markets contagion are completely justified.

By no means am I suggesting that you should join in the panic. Right now, I just want to make sure you’re aware of the legitimate threat.