Further interest rate cuts might be on the way for the kiwi dollar after New Zealand Finance Minister Bill English made comments suggesting that rates might have further to fall. Despite the highly dovish comments from the NZ Finance Minister, the NZD remained robust in early trading.

However, given the RBNZ’s recent comments regarding a rate hike, it seems unlikely December will see a cut from the central bank. In fact, the RBNZ’s Governor Wheeler made a statement in the middle of October outlining the case for leaving the Official Cash Rate (OCR) unchanged. Although the venerable central banker did concede that the OCR may need to decrease in the short term if conditions worsen.

In addition, a bevy of economists are urging the central bank to take a conservative approach to any further cuts given the need to retain sufficient capacity to cut if global conditions decline. There appears to be a view that there is a diminishing return in attempting to stoke inflation solely through the manipulation of rates. This is particularly salient given the effect of rolling rounds of currency depreciations that are currently occurring throughout Asia. Subsequently, the higher kiwi dollar complicates both the trade balance and export competitiveness.

It is highly likely that the RBNZ will seek to delay any rate cut in December despite the dovish rhetoric from the NZ Finance Minister. Thankfully, economic policy drives rate setting, not political ambitions.

NZD: Subsequent Outlook - Bearish

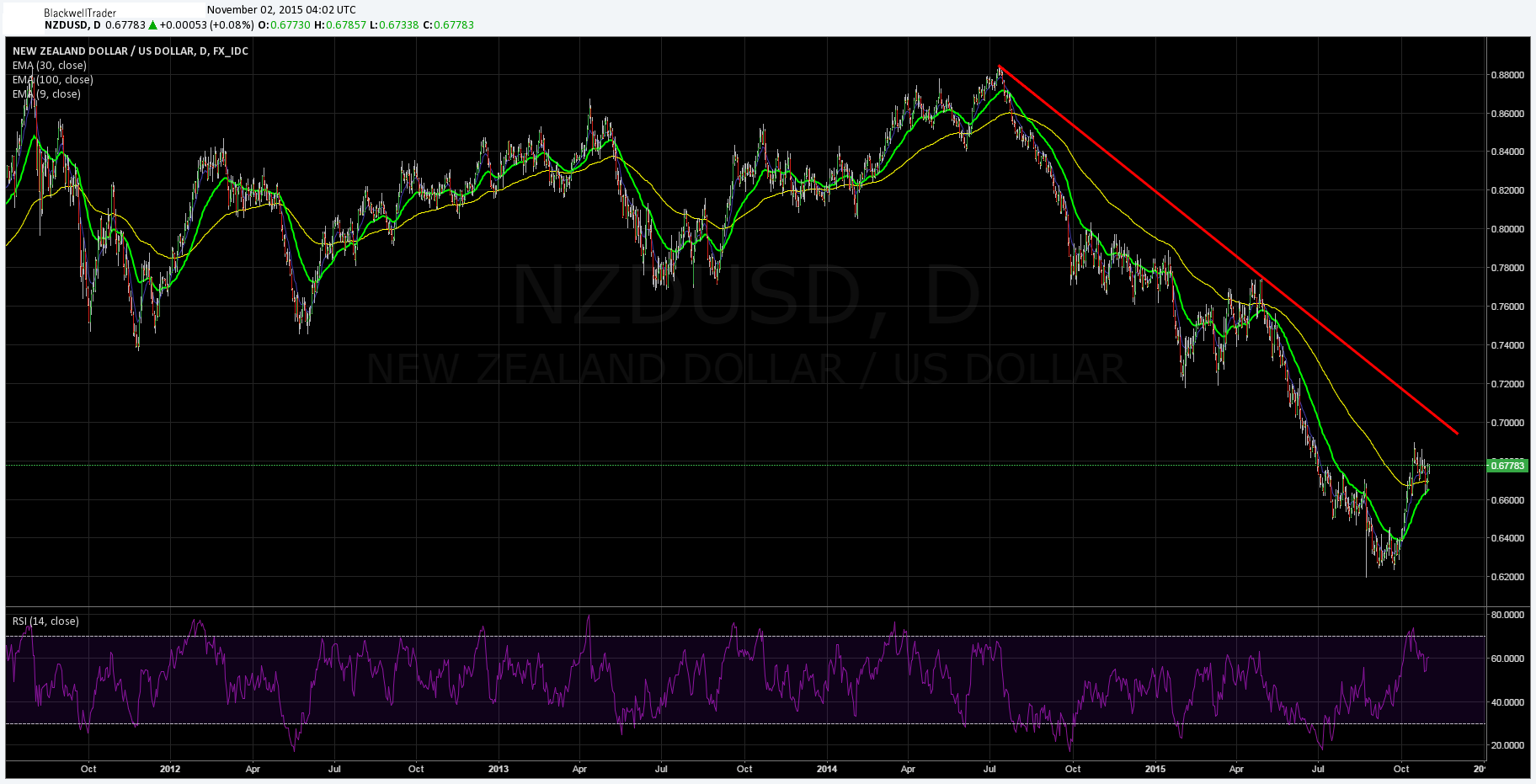

The NZD had a largely volatile week last week as New Zealand’s trade balance deteriorated to -1.22B along with exports dipping significantly. The pair subsequently experienced a sharp decline of around 80 pips before the RBNZ helped to fuel a rally when they elected to hold interest rates steady at 2.75%. The NZD subsequently managed to close the week only fractionally lower, around the 0.6773 mark.

The week ahead will largely be focused upon the NZ Global Dairy Trade (GDT) and unemployment figures. The dairy trade result will be closely monitored by the market given the recent deterioration in New Zealand exports. Also, recent comments from the NZ Finance Minister indicate a definite dovish bias and are likely to impact the pair in the short term. On the news front, keep a close watch upon the US NFPs as they are likely to cause some sharp volatility within the markets.

From a technical perspective, the NZD is being squeezed between the long run bearish trend line and the 100-Day moving average. That consolidating wedge is likely breakout in the coming week with a bias to the downside. Subsequently, monitor the pair closely for a break below the 100-Day MA. Support is found at 0.6631, 0.6497, and 0.6408. Resistance is found at 0.6895, 0.7013, and 0.7229.