Love is in the air this Valentines week and many income investors are smitten with the returns of their high yield investments. The steady march higher in assets like junk bonds, preferred stocks, emerging market debt, and even leveraged closed-end funds has remunerated shareholders for their faith.

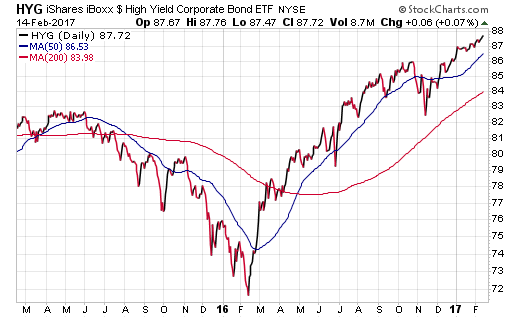

The poster child of this strength may well be the iShares iBoxx $ High Yield Corporate Bond (NYSE:HYG). This well-known fund, which invests in a passive index of high yield U.S. corporate debt, has gained more than 22% over the last year. That jump includes both price gains and income distribution over a 52-week period. It also bests every corner of the U.S. fixed-income sector map by a wide margin.

This low volatility environment has been good to shareholders of credit-sensitive bonds that have participated in the rally. However, I am always careful to remind investors that the strength of this trend comes at a meaningful cost as well. The inverse relationship between bond prices and yields precipitates the compression of future dividends. In the case of HYG, it is only sporting a 30-day SEC yield of 5.22% now and that statistic could soon start with a 4 handle.

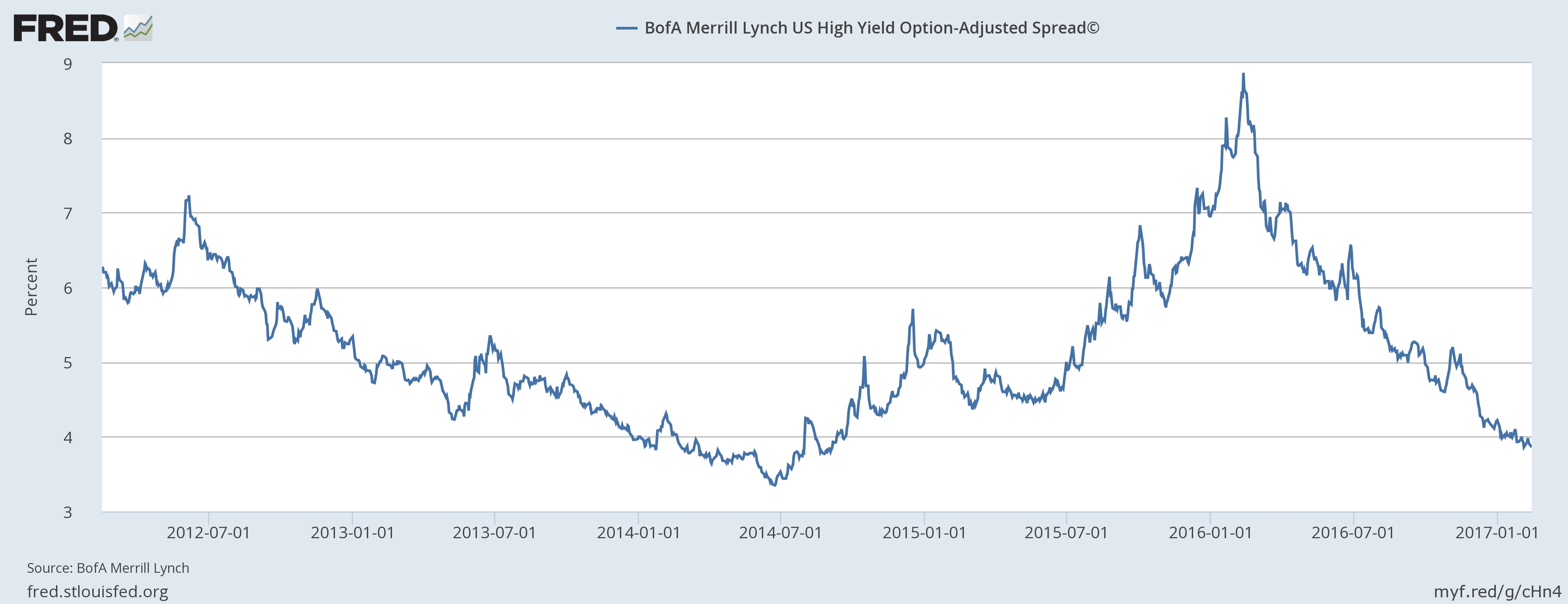

Owners of high yield debt are now getting paid far less for the uncertainty of holding risky credit than they have since 2014. One look at a 5-year chart of the BofA Merrill Lynch US High Yield Option-Adjusted Spread Index should be a sobering experience.

This chart effectively measures the difference between a high yield bond index and a similar spot on the Treasury curve. It’s now trading at a spread of 386 basis points, which is down near levels not seen since 2014. That prior low in high yield bond spreads ultimately led to a period of volatility and above-average risk for shareholders

This same compression in yields is happening across other areas of the credit spectrum as well. The iShares US Preferred Stock (NYSE:PFF) yields just 5.5% at today’s prices. The iShares JPMorgan (NYSE:JPM) USD Emerging Markets Bond (NYSE:EMB) yields 4.92%. Even a lower duration junk bond fund such as the PIMCO 0-5 Year High Yield Corporate Bond (NYSE:HYS) is yielding just 4.13%. We have seen these funds trade with an additional 200 basis points or more in yield during the trough of a correction.

I also noted the overall complacent stance of the high yield closed-end fund (CEF) market in a recent video presentation. Many of the top leveraged funds in this space are trading with some of the widest premiums or tightest discounts in years. It’s downright frothy at the index level.

It’s worth noting that CEFs are often a great sentiment indicator for credit conditions because their share price floats in relation to net asset value. This provides them with the capability to draw in late-cycle buyers or attract emotionally driven sellers on both sides of the market. If price is an indicator, there certainly is no fear to be had at the moment.

There is no telling how long the rally in credit will last and I’m certainly not going to call a top in absolute terms. Any long-term market participant that has ridden through these credit cycles in the past knows trends can extend much farther than anyone thought possible. However, there is growing reason to be cautious with new money committed at these levels. I would much rather be a buyer on a meaningful pullback than fantasizing that the current trend will extend indefinitely into the future.

For those who continue to hold high yield investments, it’s a great time to evaluate your exposure and consider what changes may be appropriate in light of your risk tolerance. Making incremental changes when markets are calm is far easier than after volatility rears its ugly head. That’s when emotions take over your typically level-headed strategy. Simply moderately reducing large position sizes and adding to cash will allow you to have some dry powder on hand for the next opportunity that comes along.

Bond investors tend to believe they can always be bailed out through the accumulation of income if they simply hold an investment long enough. Nevertheless, just like in the stock market, there are appropriate times to be an enthusiastic buyer and appropriate times to be more careful and thoughtful.