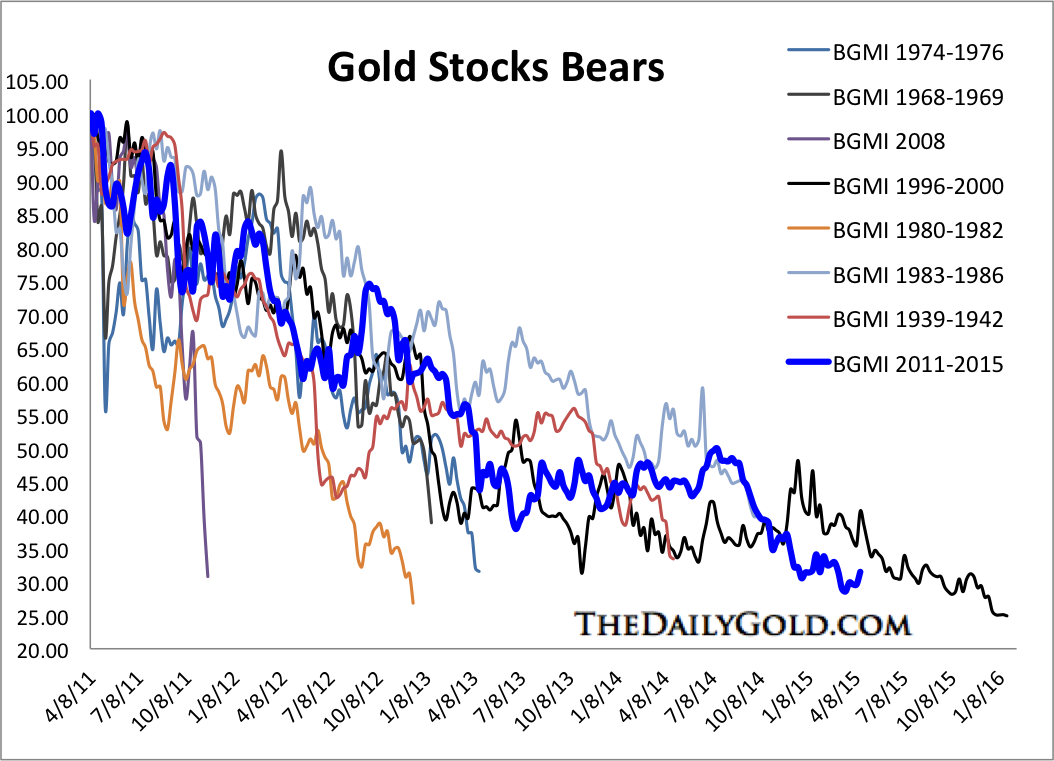

Everyone knows that this has been a devastating bear market for the gold-mining sector. If you have followed our work you know that it is the second-worst cyclical bear market in at least 80 years. Obviously, gold-mining stocks have been crushed. Then they became cheaper, then cheaper and then really cheap. Yet we may not realize just how cheap this sector has become both in nominal and relative terms.

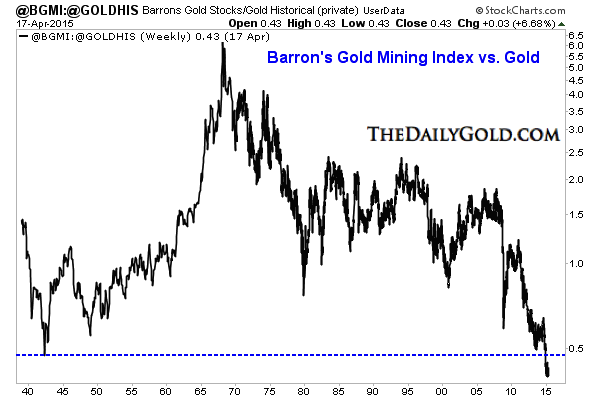

Below we plot the Barron’s Gold Mining Index (BGMI) against gold. The BGMI dates back to 1938. The ratio recently touched its lowest level in at least 77 years! There might not be anyone alive today who has seen gold stocks this cheap relative to Gold.

The next chart plots the price to cash flow valuation for senior gold miners. Twice in the past two years it touched a low of about 5. According to data from BMO, this is even lower than during the secular bottom of 2000 when senior miners traded at 6x-7x cash flow.

Gold stocks are also historically cheap relative to book value. A year or so ago I posted a chart from Datastream, a product of Thomson Reuters that showed gold stocks trading at their lowest book value since at least 1980. You can view that here. Here's another chart that shows the price-to-book ratio for the 10 largest miners. It is unsourced but shows price-to-book value at the lowest levels since at least 1993.

These spectacularly low valuations have resulted from arguably the second-worst bear market ever. The updated bear analog chart is below.

Could gold-mining stocks get even cheaper in the weeks or months ahead? It's certainly possible, but only in the scenario where gold trades to new lows. Even then, there's no guarantee that the various gold-miner indices will make new lows.

While we lack data that precedes 1980, my guess is that the gold-mining stocks relative to cash flow and book value are trading at valuations not seen since 1960 (a secular bottom) or even earlier. In the year 2000, the gold stocks were at the end of their worst cyclical bear market in history (and worst secular bear) and were trading at a 24-year low. Valuations recently surpassed (to the downside) where they were at that epic low.

In any event, the gold-mining sector is primed for what should be a spectacular recovery. A big rise in margins/earnings and valuations is the one two punch that causes markets to rally substantially following a major bottom. Margins are starting to recover as evidenced by Newmont Mining's (NYSE:NEM) earnings report. Miners have worked to cut costs and are now getting a boost from lower energy prices and weak local currencies.

All that remains is for metals prices to turnaround.