Investing in the ETF GLD is pretty much an investment in the metal itself. If gold rises in price, you make money; if it falls, you lose money.

However, an investment in a gold mining ETF is much more complicated.

GDX, the featured ETF for gold miners, is a basket of stocks that are involved in the exploration and development of gold mines, and the production of gold from those mines.

Therefore, gold mining companies and the ETF are far more subject to move according to overall market conditions.

Gold prices could rise, and one can still lose money in gold miners.

This is TradingView’s chart of gold miners (XAU) versus Gold.

Valuations in gold mining stocks remain cheap compared to the precious metal which is currently nearing new all-time highs.

We do see the potential that the ratio has bottomed out though and could favor the miners going forward.

This is what we are watching for with the silver-to-gold ratio.

Silver is also underperforming and that too is flashing a cheap ratio.

In the past, we have seen miners lead gold prices.

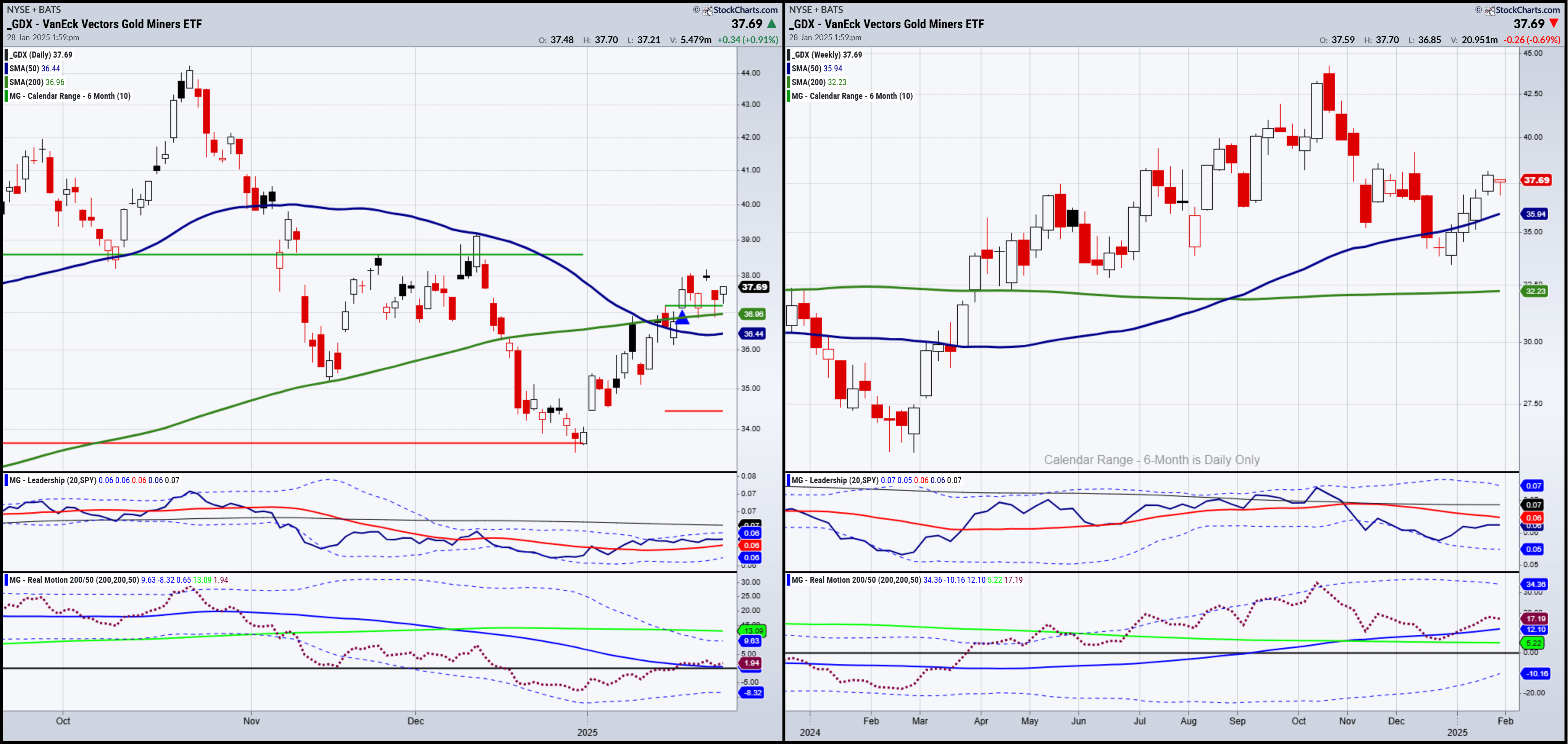

For now, though, looking at the chart of gold miners on a Daily and weekly timeframes, a few conclusions can be drawn.

Why am I even focusing on gold miners right now?

Gold miners primarily track inflation by monitoring the "all-in sustaining cost (AISC)" which calculates the total cost of producing an ounce of gold.

AISC considers operating expenses, capital expenditures, and exploration costs

A rising AISC indicates a significant impact from inflation on their operations.

The daily chart of GDX shows an Accumulation Phase.

The 50 DMA is under the 200-DMA but the slope on the 50-DMA is sloping up.

GDX has cleared the 6-month calendar range high.

GDX is outperforming the benchmark while the momentum remains in a bearish divergence.

The weekly chart is in a Bullish Phase.

GDX over a longer timeframe, underperforms the benchmark.

Momentum though is much better.

This trade has potential. Along with the ratio between miners and gold possibly at support, GDX is good to keep on your radar.

ETF Summary

(Pivotal means short-term bullish above that level and bearish below)

- S&P 500 (SPY) 600 now the support as this makes a great comeback

- Russell 2000 (IWM) 225-227 is key as an area to hold up

- Dow (DIA) 452 now the resistance to clear

- Nasdaq (QQQ) Back over the 50-DMA and must confirm Wed-also FOMC

- Regional banks (KRE) Over 64 this looks better

- Semiconductors (SMH) 237 cleared which puts her back in the Family’s good graces

- Transportation (IYT) 71.40 important to hold

- Biotechnology (IBB) 137 support 140 next place to clear

- Retail (XRT) Over 81, the risk is under 78 and we could see a move towards 84-85

- iShares iBoxx Hi Yd Cor Bond ETF (HYG) 79.40 the calendar range support