Summary

• For several months now, various analysts have expressed fears regarding the residential real estate sector in Canada based on ratios of house prices to income or rent. In our opinion, these analyses do not paint a correct picture of the situation in that interest rate levels were not taken into account.

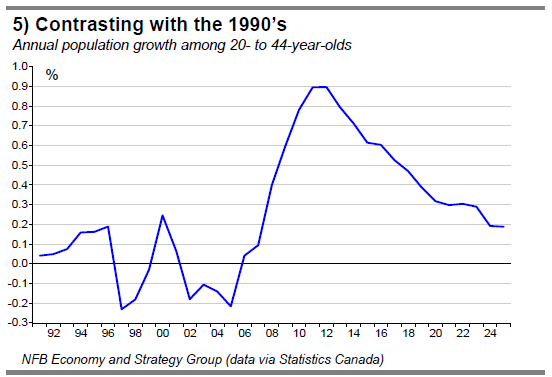

• The recent advance in house prices in Canada is due to recordlow interest rates at a time when the labour market has registered one of the best performances among the advanced countries since 2007. What’s more, Canada’s demographic profile is playing in favour of the housing sector given that the cohort of first-time homebuyers is presently growing at one of the fastest rates among the advanced countries.

• Based on our calculations, in order to purchase an averagepriced property today in Canada, the average household must spend 28.7% of its disposable income, a level shy of the average since 1997 (28.9%) and well below the 35.1% mark reached in 2007. As for the three largest Canadian cities, the monthly mortgage payment relative to income is also well below what it was at in 2008.

• In sum, the growth of house prices in Canada in recent years seems to reflect the country’s economic fundamentals. Consequently, provided that Canadian economic expansion is not undermined by a global credit crisis, an imminent house price correction is rather unlikely.

• However, given that real estate has fared quite well as an asset class over the past few years, any price acceleration in future could be the sign of undesirable speculative activity. Over the past decade, Canadian households have benefited from a substantial wealth effect from real estate but conditions are less conducive to gains over the next ten years given that interest rates are expected to rise and demographics should take a less favourable turn as far as housing is concerned.

Residential real estate raising fears Residential real estate in Canada has performed amazingly well in the difficult global economic context that has persisted since 2008. Indeed, house prices have declined drastically in various advanced countries and activity in the construction sector remains at anemic levels

in many cases. In Canada, the drop in activity in the construction sector and in the home resale market lasted but a few months before bouncing back essentially to prerecession levels. House prices, for their part, presently stand 13.1% above their pre-recession peak, an extraordinary performance among the advanced countries. In such a context, numerous analysts have expressed reservations regarding the sustainability of these price increases. Back in March 2011, The Wall Street Journal asserted in an article titled “Housing Booms North of the Border” that some economists considered the market ripe for a correction. Then, last November, in an article titled “House of Horrors”, The Economist took it a step further by saying that houses in Canada were overpriced by more than 25%. More recently, in an international comparison, Demographia reported that Montreal, Toronto and Vancouver were cities where housing was severely unaffordable. In this issue of the Weekly Economic Letter, we will take stock of the situation regarding house prices in Canada.

Extraordinary performance

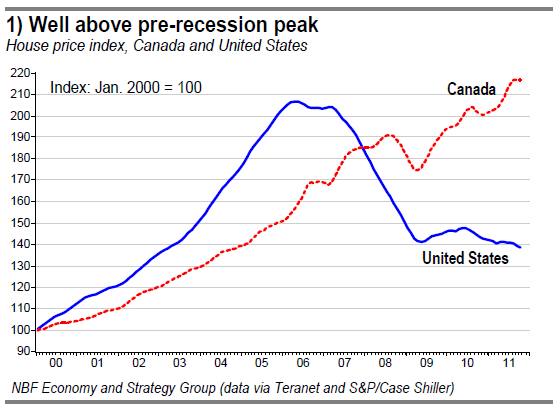

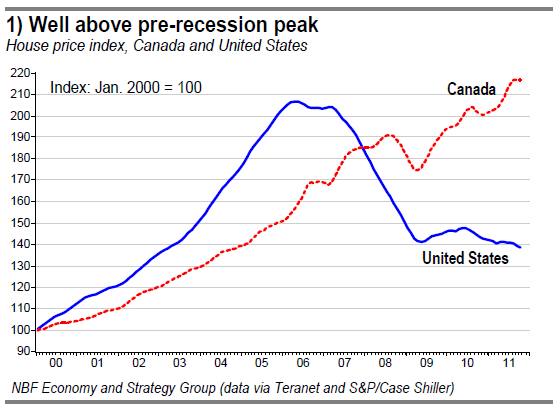

As mentioned, the resilience of house prices in Canada during the latest recession has surprised many people. All in all, the drop in house prices that began in September 2008 proved modest at 8.7% (Chart 1). What’s more, it took no more than 14 months for house prices to regain the lost ground. As prices have continued to rise, they presently stand 13.1% above their pre-recession level. Such a performance is all the more spectacular in that it contrasts with that in the United States, where house prices remain 33.5% below where they were at before the crisis.

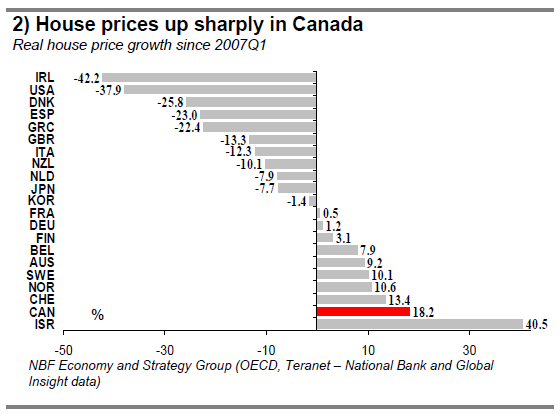

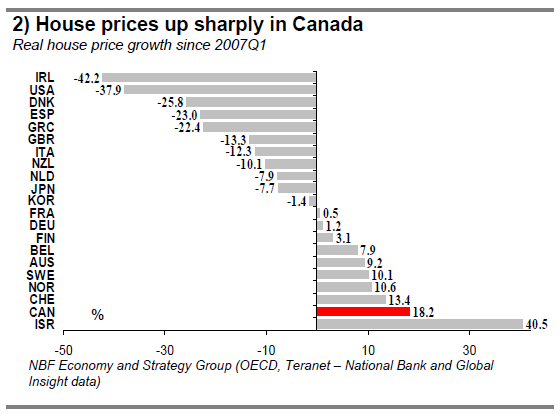

How does Canada stack up against the other advanced countries in terms of how house prices have fared? Well, its performance becomes all the more amazing when we discover that, of the 21 countries where the OECD monitors house prices in real terms, Canada is second only to Israel in this regardi (Chart 2).

Favourable factors supporting housing market

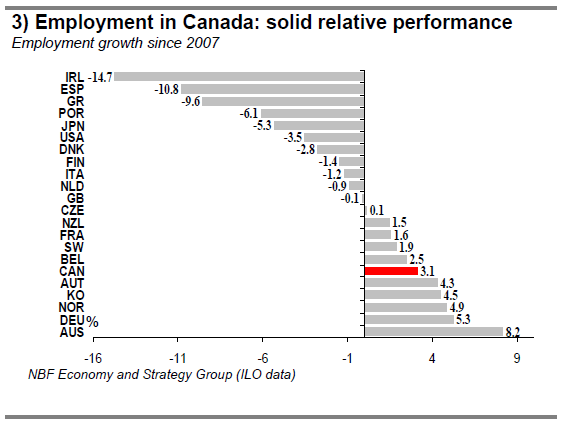

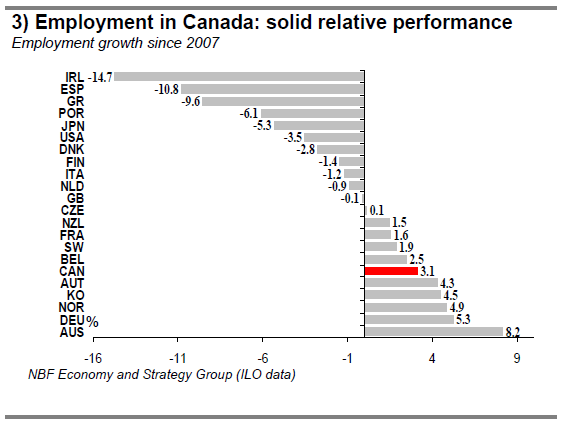

This spectacular progression in house prices at a time when various countries are going through a tough economic period has led some analysts to express scepticism about the sustainability of recent price increases in Canada. However, we are of a mind that the resilience of the labour market in Canada explains in large part this exceptional performance in relative terms. Indeed, despite the weakness displayed recently, employment in Canada has turned in one of the best showings among the advance countries since 2007.

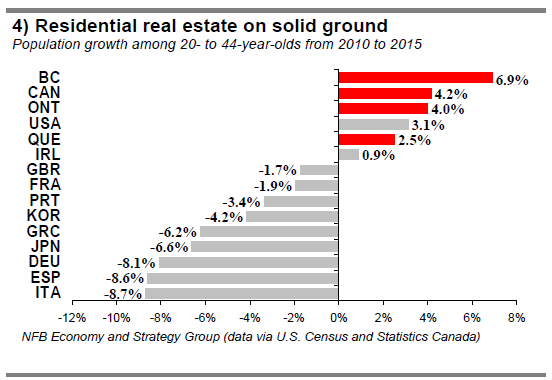

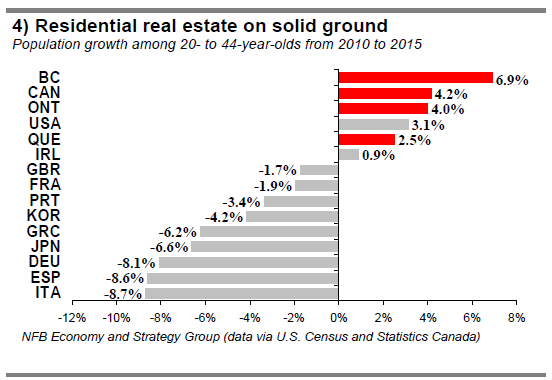

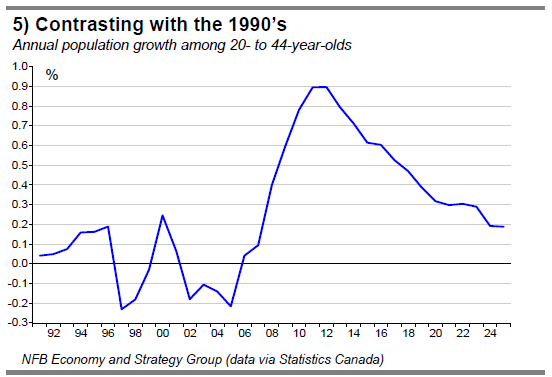

What’s more, it need be said that demographics, too, play a role in explaining the resilience of the housing market in Canada. Indeed, unlike in other countries, the cohort of first-time homebuyers is presently growing at a strong pace and this is contributing to buoy demand (Chart 4 and 5).

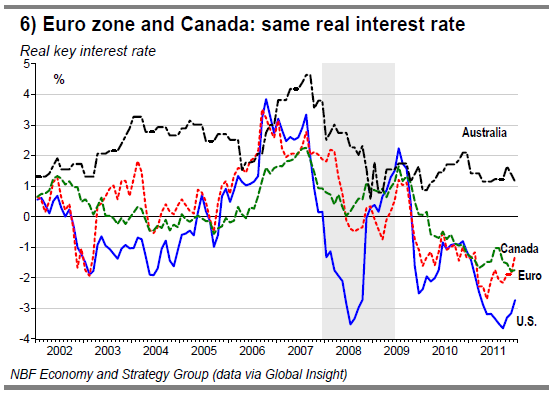

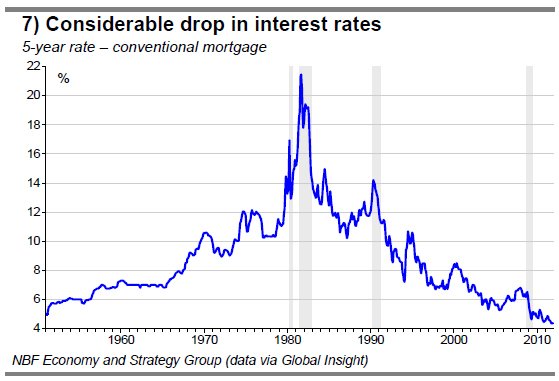

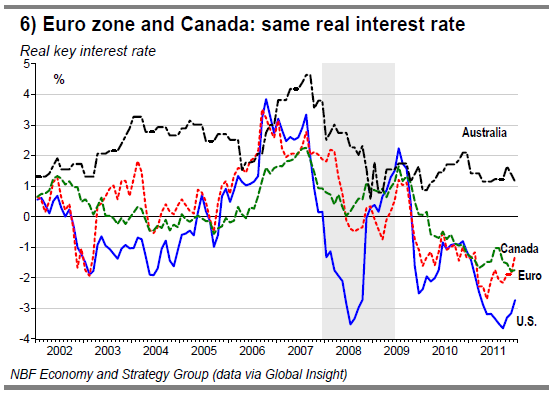

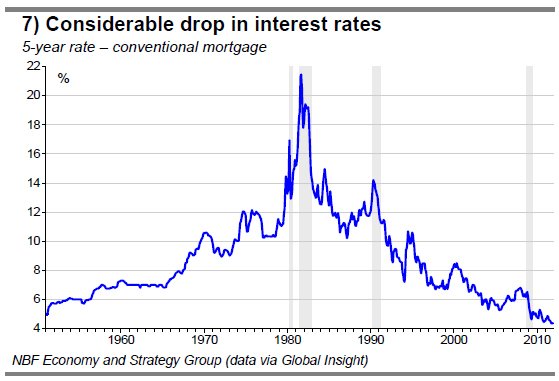

With demand holding up thanks to a vigorous labour market and supportive demographics, it is clear that the highly stimulative interest rate environment has sent house prices in Canada off on a sharp rise. Real interest rates have been in negative territory for more than two years and their present levels are close to those observed in Europe where the economy has likely slipped into recession again (Chart 6). As a result, mortgage rates today are at levels never before seen since the CMHC began keeping records in this regard (Chart 7).

Ratios do not tell entire story

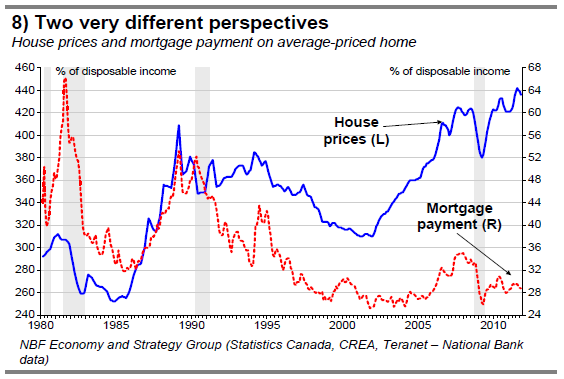

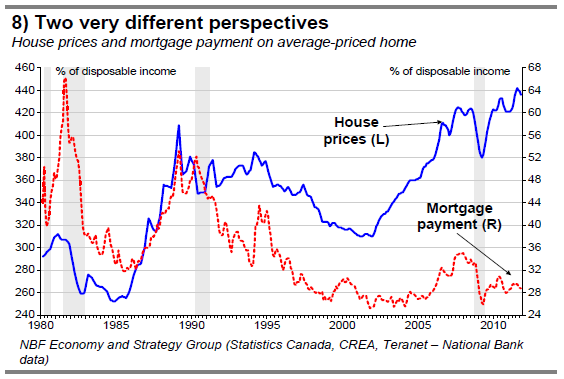

Analysts with pessimistic scenarios for the Canadian housing market, including those from The Economist and Demographia, have rested their arguments on ratios of house prices to income or rent that are currently at new and, in their view, alarming heights (Chart 8). If housing was a good like any other, that is, if households bought homes with their income, this way of seeing things would make sense. However, in the vast majority of cases, households must finance this major purchase. At the average level of current house prices and at an interest rate of 5%, 43% of household expenditures for this purchase would serve to cover interest charges over a 25- year amortization period. Hence, not taking today’s recordlow interest rate levels into account constitutes a fault in the analysis given that rates will not return to their historical average. This is why in gauging whether present house price levels are compromising housing affordability we prefer to calculate the proportion of average household income absorbed by the monthly mortgage payment on an average-priced homeii.

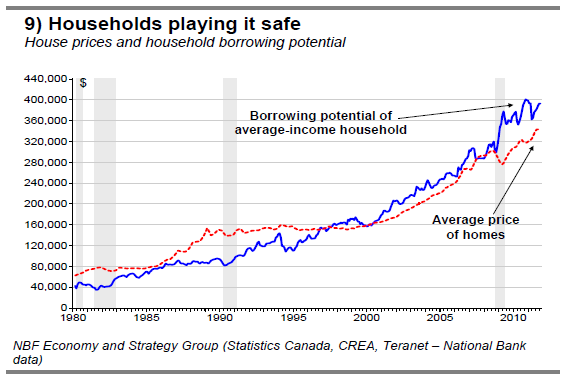

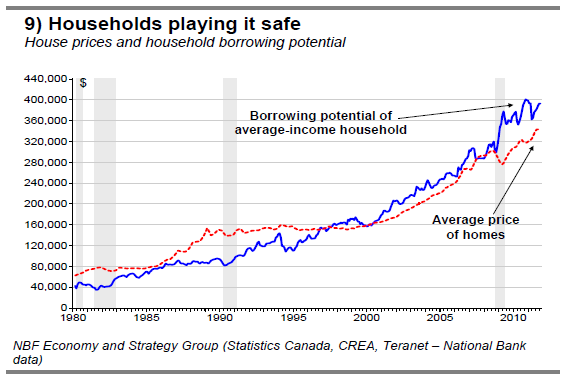

Our calculations show that this presently represents 28.7% of disposable income, which is shy of the average since 1997iii (28.9%) and well below the 35.1% mark reached in 2007. There is no denying, then, that the increase in house prices seems due solely to an accrued capacity to pay owing to lower interest rates. In Chart 9, the blue curve represents household borrowing potential if no more than 30% of disposable income can be allocated to the monthly mortgage payment, which depends also on the mortgage interest rate and the maximum amortization period allowed by law. Despite the recent reduction of the maximum amortization period (from 40 years in 2008 to 30 in 2011), maximum borrowing potential is essentially at a new record high at present. What’s more, the current gap between borrowing potential and house prices could even lead us to believe that households are actually playing it safe. This is maybe a sign that households expect higher rates down the road.

Situation at regional level

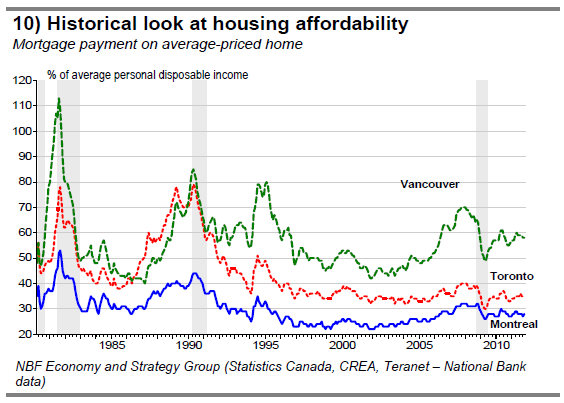

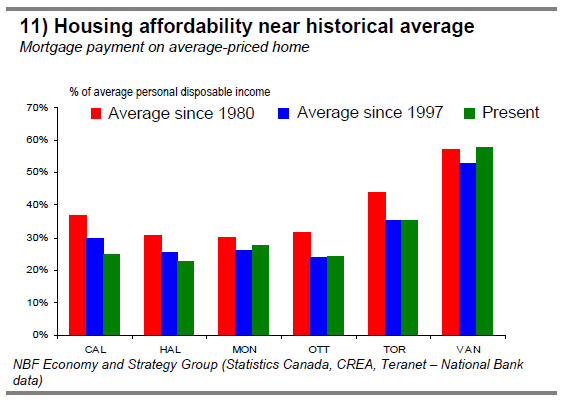

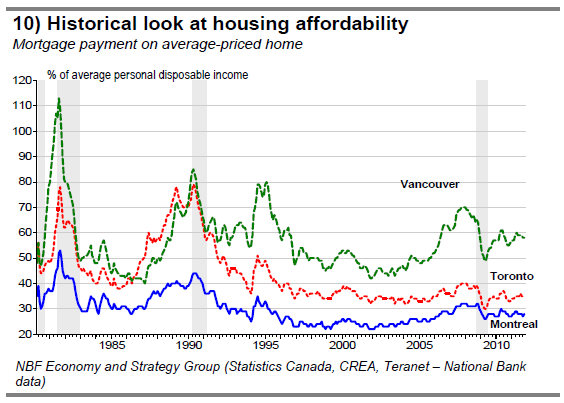

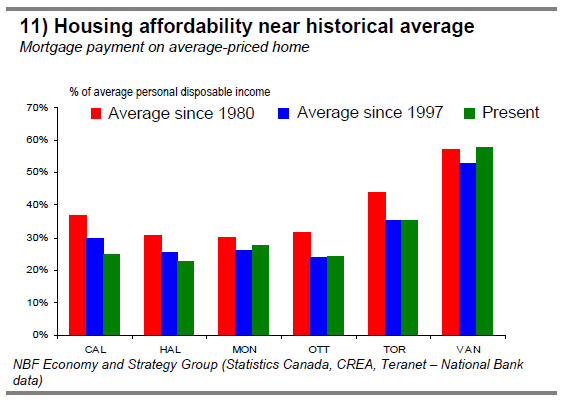

At the aggregate level, the above data does not seem to point to an affordability problem that could trigger a price correction. But what of the major Canadian cities taken individually? Regarding the country’s three largest cities, mortgage payments relative to income are well below where they were at in 2008 (Chart 10). In Toronto, our indicator is in line with its average since 1997. As for Montreal and Vancouver, monthly payments are just above their historical average.

Interest rate hikes to come

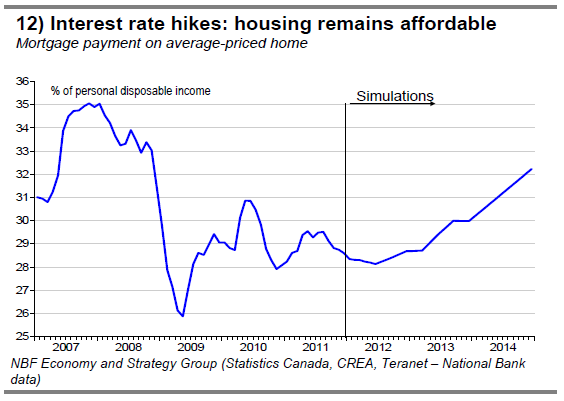

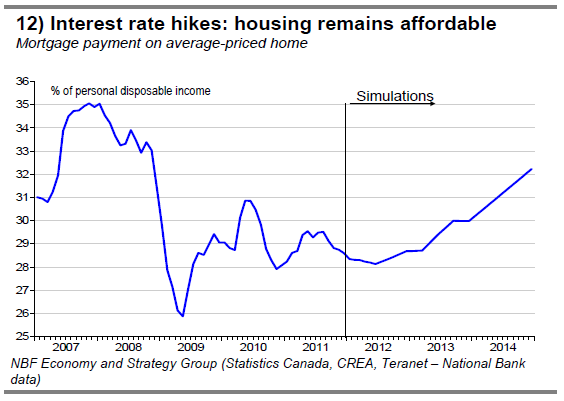

Even if house prices remain affordable for Canadian households in the present interest rate environment, various analysts fear the moment when the Bank of Canada will need to normalize its monetary policy. First, it has to be understood that the central bank is tracking the situation closely as evidenced by its concerns regarding household debt. This is why it is hardly likely that interest rates will in the present cycle reach the levels witnessed in the previous one. Based on our forecast for the federal government 5-year bond yield by the end of 2014, we projected the 5-year mortgage rate over this same time horizon by maintaining the current rate spread fixed. In our opinion, such a scenario appears extremely conservative given that the measure or spread is presently very high and that at the end of the horizon the mortgage interest rate is even higher than where it was at its peak in 2008 (see Chart 7). If income grows at its historical trend rate and house prices hold at their present level our calculations demonstrate that, in the end, housing will still be more affordable than it was in 2008 (Chart 12).

Conclusion

For several months now, various analysts have expressed fears regarding the residential real estate sector in Canada based on ratios of house prices to income or rent. In our opinion, these analyses do not paint a correct picture of the situation in that interest rate levels were not taken into account.

To our eyes, the recent advance in house prices in Canada is due to record-low interest rates at a time when the labour market has registered one of the best performances among the advanced countries since 2007. What’s more, Canada’s demographic profile is playing in favour of the housing sector given that the cohort of firsttime homebuyers is presently growing at one of the fastest rates among the advanced countries. Based on our calculations, in order to purchase an average-priced property today in Canada, the average household must spend 28.7% of its disposable income, a level shy of the average since 1997 (28.9%) and well below the 35.1% mark reached in 2007. As for the three largest Canadian cities, the monthly mortgage payment relative to income is also well below what it was at in 2008.

In sum, the growth of house prices in Canada in recent years seems to reflect the country’s economic fundamentals. Consequently, provided that Canadian economic expansion is not undermined by a global credit crisis, an imminent house price correction is rather unlikely. However, given that real estate has fared quite well as an asset class over the past few years, any price acceleration in future could be the sign of undesirable speculative activity. Over the past decade, Canadian households have benefited from a substantial wealth effect from real estate but conditions are less conducive to gains over the next ten years given that interest rates are expected to rise and demographics should take a less favourable turn (Chart 5).

ECONOMIC INDICATORS REVIEW

Canada – In January, the year-on-year inflation rate sprang to 2.5%. On a month-over-month basis, the CPI rose 0.5% in seasonally adjusted terms. The movement was driven mostly by the transportation component (+1.3%). Six of the eight broad CPI categories saw monthly advances. Health/personal care and recreation/education were flat on a seasonally adjusted basis. The Bank of Canada core CPI, which shocked with its softness in December, bounced back 0.2% (0.3% seasonally adjusted). This nudged the year-on-year rate two ticks higher to 2.1%. Still, over the past three months, core inflation has remained subdued, progressing only 1.0% annualized.

In December, Canadian factory shipments jumped 0.6%, well short of the 2% gain expected by consensus. Twelve of the 21 industries rolled forward. The main thrust was

provided by transportation equipment (+3.7%), with autos the main contributor. These increases more than offset decreases in petroleum and coal products and machinery.

In volume terms, shipments grew 1.2%.

Elsewhere, Canadian securities transactions data for December revealed that foreigners added C$7.4 billion in Canadian assets to their portfolios. These included a mix of bonds (+C$2.1 billion), money market instruments (+C$3.5 billion) and stocks (+C$1.7 billion).

United States – In January, the consumer price index rose 0.2% over the prior month. Both energy and food prices were up 0.2%. The annual inflation rate dropped a tick to 2.9%. Excluding food and energy, prices climbed a consensus-matching 0.2% on impulse from higher medical care, tobacco and apparel prices, among others. These increases more than offset declines in other segments, including vehicles where prices pursued their downward slant for a fifth month running. The year-on-year core CPI ticked up to 2.3%. On a three-month annualized basis, core CPI stood at 2.2%, a five-month high.

Still in January, retail sales swelled 0.4%, half as much as expected by consensus. The prior month was revised down one tick to flat. The downside surprise to the headline results was due to autos. It should be noted that while unit auto sales were actually very strong in the month, dollar revenues slipped 1.1% on the back of discounts at auto dealerships and of rental car purchases, which are accounted for under business fixed investment. Excluding autos, sales were much stronger, rising 0.7% after sinking a downwardly revised 0.5% in December. The ex-autos increase was fuelled by a rebound in gasoline (+1.4%), sporting goods (+1.1%) and food/beverages (+1.3%) sales. These more than offset declines elsewhere, including in health/personal care (-0.3%). Discretionary spending (i.e., retail sales excluding gasoline, groceries, and health/personal care) notched up 0.1% after rising 0.5% the month before. With January’s gains, real retail spending has now risen at more than 7% annualized since consumer confidence struck bottom back in August. This is the greatest five-month increase in retail sales since December 2010. After expanding at an annualized rate of 8.7% in 2011Q4, real retail spending growth is presently tracking at 1.9% annualized in 2012Q1, which is consistent with moderating yet still healthy GDP growth on the quarter.

Again in January, U.S. industrial production held level instead of climbing 0.7% as per consensus expectations. However, the prior month was revised up six ticks to +1.0%. Capacity utilization fell one tick to 78.5% (from an upwardly revised 78.6%). Manufacturing production expanded 0.7% after swelling an upwardly revised 1.5% in December, thanks primarily to auto production, which ramped up 6.8%. Mining output sank 1.8% after posting robust gains in the prior three months. After showing unexpected weakness in December, utilities contracted sharply once again (-2.5%), probably due to unseasonably warmer winter temperatures.

In February, the Philadelphia Fed index of manufacturing activity rose to a four-month high of 10.2. The new-orders component reached 11.7, its highest point since last April. The shipments index soared to 15, also a high mark since April. The New York Fed’s Empire Index of manufacturing activity flew to 19.53 in the month, its highest level since June 2010. The two activity indices point to increased factory activity in February consistent with Q1 GDP growth of about 2% annualized.

Back in January, U.S. housing starts bounced back sharply to 699K, topping consensus expectations for 675K units. Single starts fell after three straight months of solid growth, while multi-unit starts rebounded slightly after a disappointing December. Building permits rose to 676K (from a downwardly revised 671K), roughly in line with consensus expectations. Single and multi-unit permits were up 0.9% and 0.4%, respectively. Hence, the January drop in single starts is not likely the start of a downtrend.

Euro area – The eurozone economy shrank less than expected in Q4. According to the Eurostat flash estimate, GDP fell 0.3% (non-annualized) after gaining 0.3% the previous quarter. France saw its economy grow 0.2%, providing some offset to the weakness in other member countries, including Germany (-0.2%), Italy (-0.7%) and the Netherlands (-0.7%). Of the countries that have reported GDP estimates, Portugal recorded the weakest economic activity (-1.3%). In comparison, the economy of the United States grew 0.7% in Q42011, while those of Japan and the United Kingdom contracted 0.6% and 0.2%, respectively.

• For several months now, various analysts have expressed fears regarding the residential real estate sector in Canada based on ratios of house prices to income or rent. In our opinion, these analyses do not paint a correct picture of the situation in that interest rate levels were not taken into account.

• The recent advance in house prices in Canada is due to recordlow interest rates at a time when the labour market has registered one of the best performances among the advanced countries since 2007. What’s more, Canada’s demographic profile is playing in favour of the housing sector given that the cohort of first-time homebuyers is presently growing at one of the fastest rates among the advanced countries.

• Based on our calculations, in order to purchase an averagepriced property today in Canada, the average household must spend 28.7% of its disposable income, a level shy of the average since 1997 (28.9%) and well below the 35.1% mark reached in 2007. As for the three largest Canadian cities, the monthly mortgage payment relative to income is also well below what it was at in 2008.

• In sum, the growth of house prices in Canada in recent years seems to reflect the country’s economic fundamentals. Consequently, provided that Canadian economic expansion is not undermined by a global credit crisis, an imminent house price correction is rather unlikely.

• However, given that real estate has fared quite well as an asset class over the past few years, any price acceleration in future could be the sign of undesirable speculative activity. Over the past decade, Canadian households have benefited from a substantial wealth effect from real estate but conditions are less conducive to gains over the next ten years given that interest rates are expected to rise and demographics should take a less favourable turn as far as housing is concerned.

Residential real estate raising fears Residential real estate in Canada has performed amazingly well in the difficult global economic context that has persisted since 2008. Indeed, house prices have declined drastically in various advanced countries and activity in the construction sector remains at anemic levels

in many cases. In Canada, the drop in activity in the construction sector and in the home resale market lasted but a few months before bouncing back essentially to prerecession levels. House prices, for their part, presently stand 13.1% above their pre-recession peak, an extraordinary performance among the advanced countries. In such a context, numerous analysts have expressed reservations regarding the sustainability of these price increases. Back in March 2011, The Wall Street Journal asserted in an article titled “Housing Booms North of the Border” that some economists considered the market ripe for a correction. Then, last November, in an article titled “House of Horrors”, The Economist took it a step further by saying that houses in Canada were overpriced by more than 25%. More recently, in an international comparison, Demographia reported that Montreal, Toronto and Vancouver were cities where housing was severely unaffordable. In this issue of the Weekly Economic Letter, we will take stock of the situation regarding house prices in Canada.

Extraordinary performance

As mentioned, the resilience of house prices in Canada during the latest recession has surprised many people. All in all, the drop in house prices that began in September 2008 proved modest at 8.7% (Chart 1). What’s more, it took no more than 14 months for house prices to regain the lost ground. As prices have continued to rise, they presently stand 13.1% above their pre-recession level. Such a performance is all the more spectacular in that it contrasts with that in the United States, where house prices remain 33.5% below where they were at before the crisis.

How does Canada stack up against the other advanced countries in terms of how house prices have fared? Well, its performance becomes all the more amazing when we discover that, of the 21 countries where the OECD monitors house prices in real terms, Canada is second only to Israel in this regardi (Chart 2).

Favourable factors supporting housing market

This spectacular progression in house prices at a time when various countries are going through a tough economic period has led some analysts to express scepticism about the sustainability of recent price increases in Canada. However, we are of a mind that the resilience of the labour market in Canada explains in large part this exceptional performance in relative terms. Indeed, despite the weakness displayed recently, employment in Canada has turned in one of the best showings among the advance countries since 2007.

What’s more, it need be said that demographics, too, play a role in explaining the resilience of the housing market in Canada. Indeed, unlike in other countries, the cohort of first-time homebuyers is presently growing at a strong pace and this is contributing to buoy demand (Chart 4 and 5).

With demand holding up thanks to a vigorous labour market and supportive demographics, it is clear that the highly stimulative interest rate environment has sent house prices in Canada off on a sharp rise. Real interest rates have been in negative territory for more than two years and their present levels are close to those observed in Europe where the economy has likely slipped into recession again (Chart 6). As a result, mortgage rates today are at levels never before seen since the CMHC began keeping records in this regard (Chart 7).

Ratios do not tell entire story

Analysts with pessimistic scenarios for the Canadian housing market, including those from The Economist and Demographia, have rested their arguments on ratios of house prices to income or rent that are currently at new and, in their view, alarming heights (Chart 8). If housing was a good like any other, that is, if households bought homes with their income, this way of seeing things would make sense. However, in the vast majority of cases, households must finance this major purchase. At the average level of current house prices and at an interest rate of 5%, 43% of household expenditures for this purchase would serve to cover interest charges over a 25- year amortization period. Hence, not taking today’s recordlow interest rate levels into account constitutes a fault in the analysis given that rates will not return to their historical average. This is why in gauging whether present house price levels are compromising housing affordability we prefer to calculate the proportion of average household income absorbed by the monthly mortgage payment on an average-priced homeii.

Our calculations show that this presently represents 28.7% of disposable income, which is shy of the average since 1997iii (28.9%) and well below the 35.1% mark reached in 2007. There is no denying, then, that the increase in house prices seems due solely to an accrued capacity to pay owing to lower interest rates. In Chart 9, the blue curve represents household borrowing potential if no more than 30% of disposable income can be allocated to the monthly mortgage payment, which depends also on the mortgage interest rate and the maximum amortization period allowed by law. Despite the recent reduction of the maximum amortization period (from 40 years in 2008 to 30 in 2011), maximum borrowing potential is essentially at a new record high at present. What’s more, the current gap between borrowing potential and house prices could even lead us to believe that households are actually playing it safe. This is maybe a sign that households expect higher rates down the road.

Situation at regional level

At the aggregate level, the above data does not seem to point to an affordability problem that could trigger a price correction. But what of the major Canadian cities taken individually? Regarding the country’s three largest cities, mortgage payments relative to income are well below where they were at in 2008 (Chart 10). In Toronto, our indicator is in line with its average since 1997. As for Montreal and Vancouver, monthly payments are just above their historical average.

Interest rate hikes to come

Even if house prices remain affordable for Canadian households in the present interest rate environment, various analysts fear the moment when the Bank of Canada will need to normalize its monetary policy. First, it has to be understood that the central bank is tracking the situation closely as evidenced by its concerns regarding household debt. This is why it is hardly likely that interest rates will in the present cycle reach the levels witnessed in the previous one. Based on our forecast for the federal government 5-year bond yield by the end of 2014, we projected the 5-year mortgage rate over this same time horizon by maintaining the current rate spread fixed. In our opinion, such a scenario appears extremely conservative given that the measure or spread is presently very high and that at the end of the horizon the mortgage interest rate is even higher than where it was at its peak in 2008 (see Chart 7). If income grows at its historical trend rate and house prices hold at their present level our calculations demonstrate that, in the end, housing will still be more affordable than it was in 2008 (Chart 12).

Conclusion

For several months now, various analysts have expressed fears regarding the residential real estate sector in Canada based on ratios of house prices to income or rent. In our opinion, these analyses do not paint a correct picture of the situation in that interest rate levels were not taken into account.

To our eyes, the recent advance in house prices in Canada is due to record-low interest rates at a time when the labour market has registered one of the best performances among the advanced countries since 2007. What’s more, Canada’s demographic profile is playing in favour of the housing sector given that the cohort of firsttime homebuyers is presently growing at one of the fastest rates among the advanced countries. Based on our calculations, in order to purchase an average-priced property today in Canada, the average household must spend 28.7% of its disposable income, a level shy of the average since 1997 (28.9%) and well below the 35.1% mark reached in 2007. As for the three largest Canadian cities, the monthly mortgage payment relative to income is also well below what it was at in 2008.

In sum, the growth of house prices in Canada in recent years seems to reflect the country’s economic fundamentals. Consequently, provided that Canadian economic expansion is not undermined by a global credit crisis, an imminent house price correction is rather unlikely. However, given that real estate has fared quite well as an asset class over the past few years, any price acceleration in future could be the sign of undesirable speculative activity. Over the past decade, Canadian households have benefited from a substantial wealth effect from real estate but conditions are less conducive to gains over the next ten years given that interest rates are expected to rise and demographics should take a less favourable turn (Chart 5).

ECONOMIC INDICATORS REVIEW

Canada – In January, the year-on-year inflation rate sprang to 2.5%. On a month-over-month basis, the CPI rose 0.5% in seasonally adjusted terms. The movement was driven mostly by the transportation component (+1.3%). Six of the eight broad CPI categories saw monthly advances. Health/personal care and recreation/education were flat on a seasonally adjusted basis. The Bank of Canada core CPI, which shocked with its softness in December, bounced back 0.2% (0.3% seasonally adjusted). This nudged the year-on-year rate two ticks higher to 2.1%. Still, over the past three months, core inflation has remained subdued, progressing only 1.0% annualized.

In December, Canadian factory shipments jumped 0.6%, well short of the 2% gain expected by consensus. Twelve of the 21 industries rolled forward. The main thrust was

provided by transportation equipment (+3.7%), with autos the main contributor. These increases more than offset decreases in petroleum and coal products and machinery.

In volume terms, shipments grew 1.2%.

Elsewhere, Canadian securities transactions data for December revealed that foreigners added C$7.4 billion in Canadian assets to their portfolios. These included a mix of bonds (+C$2.1 billion), money market instruments (+C$3.5 billion) and stocks (+C$1.7 billion).

United States – In January, the consumer price index rose 0.2% over the prior month. Both energy and food prices were up 0.2%. The annual inflation rate dropped a tick to 2.9%. Excluding food and energy, prices climbed a consensus-matching 0.2% on impulse from higher medical care, tobacco and apparel prices, among others. These increases more than offset declines in other segments, including vehicles where prices pursued their downward slant for a fifth month running. The year-on-year core CPI ticked up to 2.3%. On a three-month annualized basis, core CPI stood at 2.2%, a five-month high.

Still in January, retail sales swelled 0.4%, half as much as expected by consensus. The prior month was revised down one tick to flat. The downside surprise to the headline results was due to autos. It should be noted that while unit auto sales were actually very strong in the month, dollar revenues slipped 1.1% on the back of discounts at auto dealerships and of rental car purchases, which are accounted for under business fixed investment. Excluding autos, sales were much stronger, rising 0.7% after sinking a downwardly revised 0.5% in December. The ex-autos increase was fuelled by a rebound in gasoline (+1.4%), sporting goods (+1.1%) and food/beverages (+1.3%) sales. These more than offset declines elsewhere, including in health/personal care (-0.3%). Discretionary spending (i.e., retail sales excluding gasoline, groceries, and health/personal care) notched up 0.1% after rising 0.5% the month before. With January’s gains, real retail spending has now risen at more than 7% annualized since consumer confidence struck bottom back in August. This is the greatest five-month increase in retail sales since December 2010. After expanding at an annualized rate of 8.7% in 2011Q4, real retail spending growth is presently tracking at 1.9% annualized in 2012Q1, which is consistent with moderating yet still healthy GDP growth on the quarter.

Again in January, U.S. industrial production held level instead of climbing 0.7% as per consensus expectations. However, the prior month was revised up six ticks to +1.0%. Capacity utilization fell one tick to 78.5% (from an upwardly revised 78.6%). Manufacturing production expanded 0.7% after swelling an upwardly revised 1.5% in December, thanks primarily to auto production, which ramped up 6.8%. Mining output sank 1.8% after posting robust gains in the prior three months. After showing unexpected weakness in December, utilities contracted sharply once again (-2.5%), probably due to unseasonably warmer winter temperatures.

In February, the Philadelphia Fed index of manufacturing activity rose to a four-month high of 10.2. The new-orders component reached 11.7, its highest point since last April. The shipments index soared to 15, also a high mark since April. The New York Fed’s Empire Index of manufacturing activity flew to 19.53 in the month, its highest level since June 2010. The two activity indices point to increased factory activity in February consistent with Q1 GDP growth of about 2% annualized.

Back in January, U.S. housing starts bounced back sharply to 699K, topping consensus expectations for 675K units. Single starts fell after three straight months of solid growth, while multi-unit starts rebounded slightly after a disappointing December. Building permits rose to 676K (from a downwardly revised 671K), roughly in line with consensus expectations. Single and multi-unit permits were up 0.9% and 0.4%, respectively. Hence, the January drop in single starts is not likely the start of a downtrend.

Euro area – The eurozone economy shrank less than expected in Q4. According to the Eurostat flash estimate, GDP fell 0.3% (non-annualized) after gaining 0.3% the previous quarter. France saw its economy grow 0.2%, providing some offset to the weakness in other member countries, including Germany (-0.2%), Italy (-0.7%) and the Netherlands (-0.7%). Of the countries that have reported GDP estimates, Portugal recorded the weakest economic activity (-1.3%). In comparison, the economy of the United States grew 0.7% in Q42011, while those of Japan and the United Kingdom contracted 0.6% and 0.2%, respectively.