If there was ever a contest for the most unloved sector in the global economy, European banks would certainly vie for the top spot.

Pummeled by years of negative rates, sclerotic growth in the region and a highly fragmented legal framework that left many players woefully undercapitalized to compete on the global stage, European banks have been in a bear market since 2009.

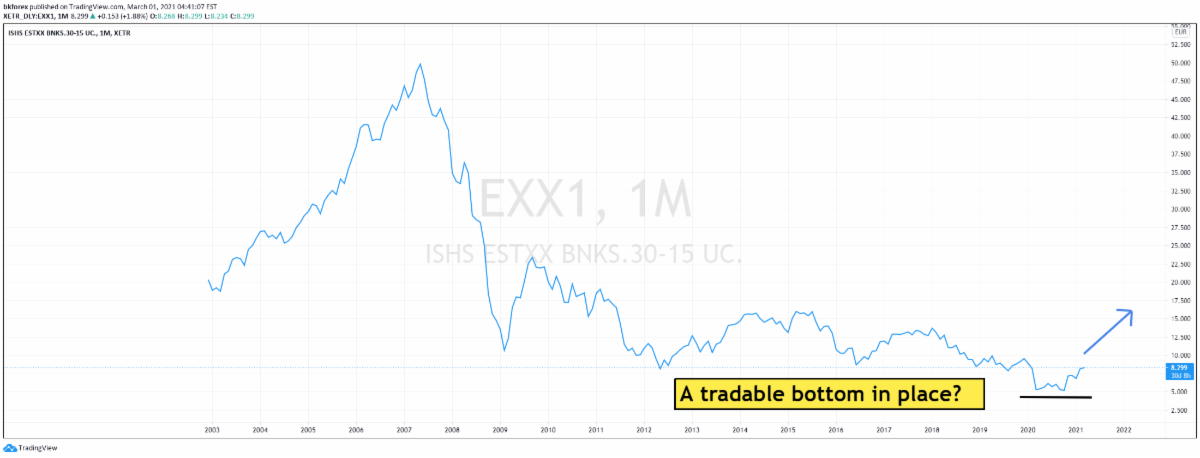

But, for the first time in more than a decade, there may be reason to believe that the sector has made a tradable bottom and could be one of the better value plays in the year ahead. A panoply of factors are coming together to make the bet on European banks a compelling proposition.

EU yields have bottomed

First and foremost long term yields in the region may have bottomed out. In Germany, the benchmark 10-year is up 30 basis points from the COVID-19 lows and the yield curve has started to steepen as investors are beginning to warm up to the notion of pick up in demand.

Although many European rates remain negative across the yield spectrum, they are finally starting to inexorably move towards the zero line and in financial markets it is always the direction rather than the absolute values that matter.

Europe has lagged behind the US and the rest of the world on all fronts—vaccinations, post-COVID-19 recovery, and reflationary impulse in the financial markets. But that is precisely the reason why European banks may be such a timely trade. The markets have only started to price in the prospect of recovery.

EU: on the cusp of a rebound

Although the Europeans have been the slowest to rebound from COVID-19, a variety of forces are now aligned to make sure that economic conditions in the region improve. Most importantly, as vaccination makers continue to increase production, the European Union will finally start to make significant progress in vaccinating the population, which in turn will open up the region’s massive tourism sector that has been moribund for more than a year.

The slow rebound in the private sector will be aided by the €750 billion fiscal infusion from the Pandemic Emergency Purchase Program (PEPP) that will finally start to make its way to member states. Finally, on the other side of the Atlantic as the US economy returns to full capacity, the pick up in demand will help the EU’s export sector especially now that political relations under President Joseph Biden's administration have improved markedly.

A simple way to trade the banks

One of the better ways to trade the rebound in European banks is through the iShares EURO STOXX Banks 30-15 UCITS ETF (DE) (BS:EXX1d) and holds positions in all the major European banks Including BNP Paribas SA (PA:BNPP), Banco Santander (MC:SAN) and Deutsche Bank (DE:DBKGn). The ETF sports a 2.15% dividend yield and because of years of problems in the sectors trades at a much cheaper valuation than its US counterpart the Financial Select Sector SPDR® Fund ETF (NYSE:XLF).

Technically, the EXX1 ETF has made a clear double bottom at the €5 level and has been slowly inching towards the €10 mark. It is displaying all the signs of a value play trade and a move through the €10 level would confirm that the EU banking sector may be back from the brink of extinction.

Catching the turn early

As Peter Lynch often said, investors do not need for business to do well in order to make money. Conditions simply need to go from horrible to not-so-bad for stocks of those businesses to perform well. The EU banking sector may be the classic case of the value rebound and EXX1 is the simplest way to participate in that theme.