What are the commonly listed headwinds to economic growth in the USA?

- baby boomers not spending but saving for retirement;

- European recession;

- Divided government with no direction.

One might ask why the government is important in a consumer driven economy? Well timed INVESTMENT spending by the government can be used to offset consumer spending contractions. Investing in the future (education of citizens, infrastructure, health care, research and development, etc.) not only adds to the economy at the time of the spending, but it provides dividends in the future).

Of course, no economy can ever be completely planned or controlled – there are always actions to be taken to unforeseen events. But when a government has a master-plan for the future, more options are available. For instance, during the downturn of the Great Recession – Singapore was able to accelerate the time tables on its preplanned infrastructure programs. Did they search for shovel ready projects?

The government master-planning headwind will not be going away soon. Even IF master planning was in the cards, a view of inflation adjusted per capita government spending (federal plus state plus local) will tell you that the USA appears to have started what could be a long-term down trend – austerity or no austerity.

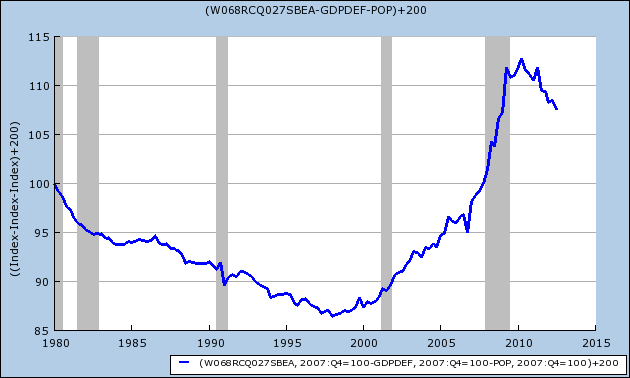

Indexed and Inflation Adjusted Total Government Per Capita Spending

But a decline in per capita government spending is exactly what is prescribed after government overspending due to a recession. But note the spending spree began in the late 1990′s – and peaked with the Great Recession’s stimulus. The USA economy is not geared to government spending at this elevated rate in good times as well as bad.

The European recession headwinds have started. Likely, they will grow worse with some projections showing a Eurozone GDP decline approaching 1%. The impact will be felt by USA exports – as the first impact of recessions are to imports in the recessing country. Exports add to GDP, imports are subtracted.

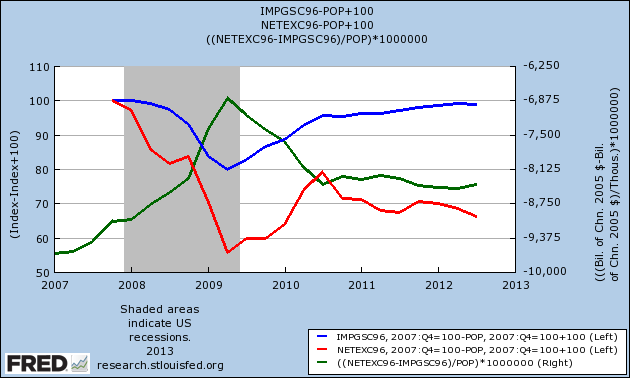

Indexed and Inflation Adjusted per Capita Exports (blue line) and Imports (red line) – The Green Line is the Trade Balance per Capita (right axis)

Exports (the blue line in the above graph) has not recovered from the Great Recession – AND now is declining. The opposite is true with imports until mid 2012. The trade balance (exports minus imports – the green line, right axis in the above graphic) has been relatively constant per capita – and now we need to add the potential impact of the European Recession. This headwind should grow in 2013, but it will be a relatively small impact to the economy as the trade balance is not a large element in GDP.

The boomers were one of the major factors in the perfect storm which caused the Great Recession. The demographic shift as boomers continue to retire will disturb historic comparisons.

Trends are trends until they no longer are trends. I see little to affect the new trends coming into play right now.

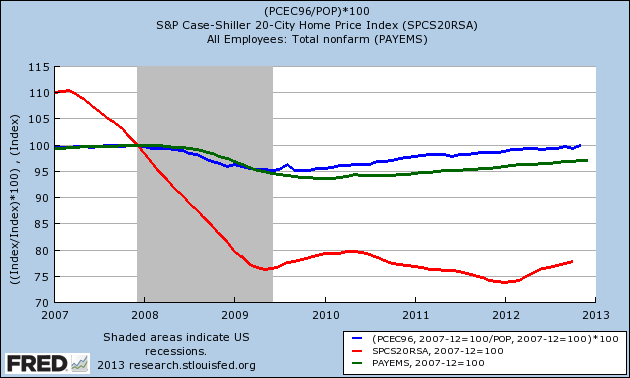

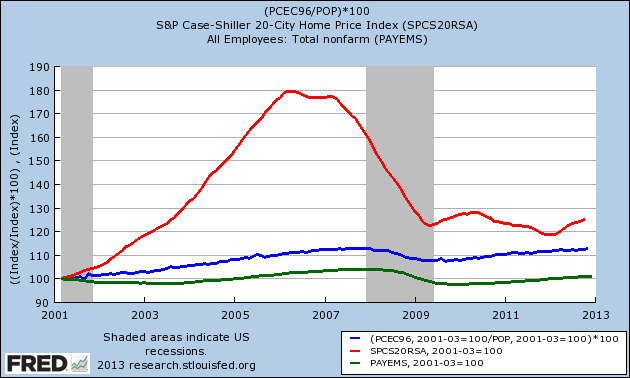

Indexed and Inflation Adjusted per Capita Spending (blue line), Home Prices (red line), and Non-Farm Employment (green line)

It has taken three and a half years for consumer spending to recover. Employment is only half recovered, while home prices still suck. However, what they all have in common is improving trend lines. The current trend lines have approximately the same slopes as the pre-recession trends.

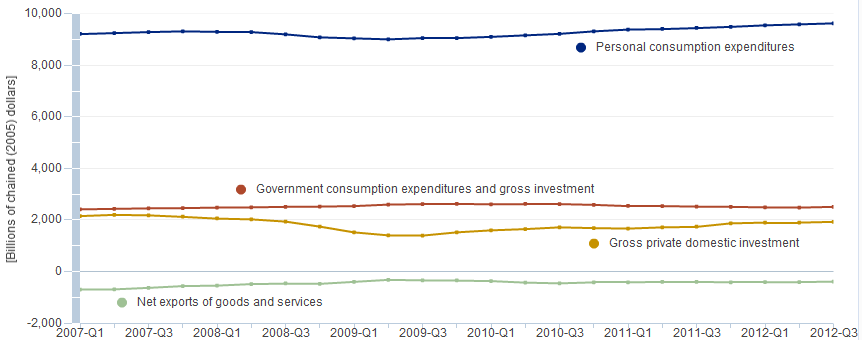

The USA economy is dominated by the consumer and that is the elephant in GDP. The bottom line is that a European recession or lower government spending are not major headwinds when USA consumption is growing.

Inflation Adjusted Contribution to GDP of Consumer Consumption, Government Spending, Investment and Trade

The boomers have cut back on consumption, the economy has reset, and now the economy is growing. The rate of growth is far from excellent – but growth is growth.

Other Economic News this Week:

The Econintersect economic forecast for January 2012 shows weak growth. The underlying dynamics have a whiff of improvement – as underlying trends seemed to have stabilized with some marginally improving. Most of the recession markers have evaporated, and one of our alternate methods to validate our forecast remains recessionary (but now only slightly so). All in all, still not a great forecast – but at least there is hope that conditions will be improving in the months to come.

ECRI now believes a recession began in July 2012. ECRI first stated in September 2011 a recession was coming . The size and depth is unknown. The ECRI WLI growth index value has been weakly in positive territory for over three months. The index is indicating the economy six month from today will be slightly better than it is today.

Current ECRI WLI Growth Index

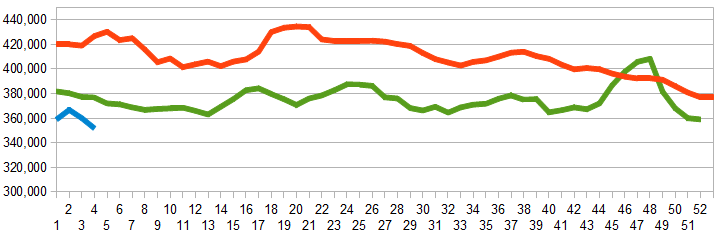

Initial unemployment claims fell from 371,000 (reported last week) to 335,000 this week. Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate (background here and here).

The real gauge – the 4 week moving average – fell marginally from 365,750 (reported last week) to 359,250. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks releases), the 4-week average remains the reliable gauge.

Weekly Initial Unemployment Claims – 4 Week Average – Seasonally Adjusted – 2010 (blue line), 2011 (red line), 2012 (green line)

Bankruptcies this Week: Education Holdings 1, fka The Princeton Review, Atari

Data released this week which contained economically intuitive components (forward looking) were:

- Rail movements (where the economic intuitive components indicate a moderately expanding economy).

Weekly Economic Release Scorecard:

Click here to view the scorecard table below with active hyperlinks.