While many are aware of the rising price of Bitcoin and the cryptos, few have noticed or mentioned an incredible development that has contributed to the move. Specifically, that while part of the price movement is due to the value of the cryptos, the skyrocketing prices are also a reflection of the accelerating decay of the U.S. dollar.

Certainly growing awareness and adoption of crypto currencies and alt tokens has brought a lot of money into crypto space. Which is likely to continue. However, especially as the crypto price rise accelerated toward the end of 2017, it has become more difficult to ignore what’s simultaneously happening to the dollar.

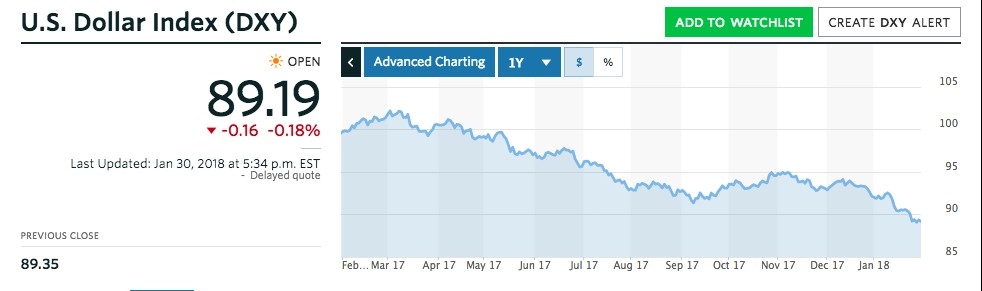

One common measurement is the dollar index, which measures the dollar against a basket of other paper currencies. Included in that basket are the Euro and the Japanese Yen, which make up about 70% of the basket. Keep in mind that the Eurozone is printing enough money to generate negative interest rates, while Japan’s Shinzo Abe was essentially elected based on his promise to print any amount of money necessary to fuel a Japanese stock bubble. Which he has done.

So it’s not exactly like the dollar index is comparing the dollar to the rock of Gibraltar. Yet it’s still declined over 10% in the last year, and dropped from a level of 93 to as low as 89 in just the past month. Which may not be a big move for a biotech or cryptocurrency, but is a stunning decline for the world’s reserve currency.

(chart courtesy of marketwatch.com)

So if the dollar is getting clobbered when compared to other currencies that are also being devalued, what’s its real value as compared to a currency where the supply is limited?

We’re witnessing the answer in the crypto market.

Keep in mind that that most are looking at cryptos as priced in dollars. Which is just a simple fraction with 2 parts. So the price can change if the value of the cryptos change, or if the value of the dollar changes. Rising crypto prices and a falling dollar are not unrelated events.

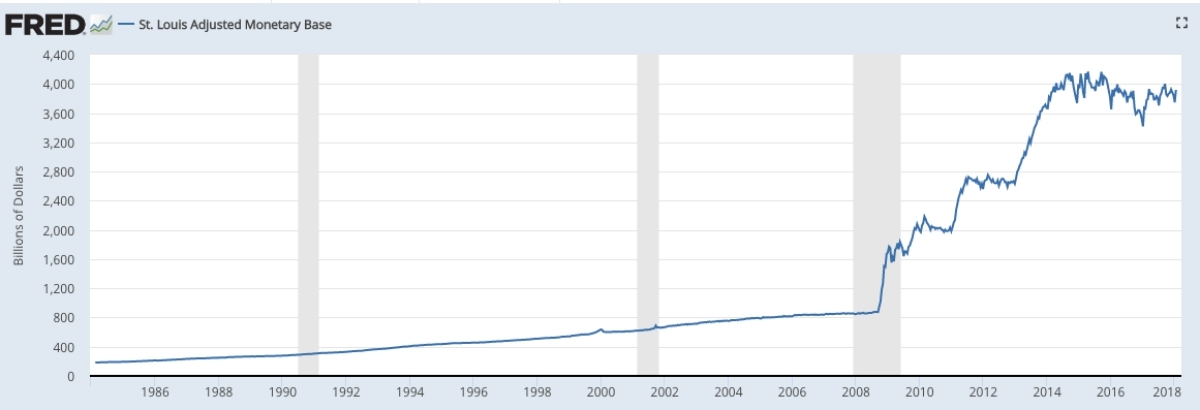

Further, when you look at the price of cryptos as well as the money supply, a truly fascinating picture emerges. Consider the following two charts.

(chart courtesy of the St. Louis Federal Reserve branch)

(chart courtesy of the coindesk.com)

Notice any similarities?

While many are quick to label the cryptos a bubble, the stunning price rise looks incredibly similar to the increase in the money supply. Given that the cryptos are priced in dollars and the supply of dollars are increasing, the move in cryptos makes a lot of sense when seen in this context.

When also factoring in the current geopolitical climate, which includes the introduction of the PetroYuan, rumors of China leaving the U.S. debt market, and continued chaos in Washington, the move out of the dollar into an asset that can’t be printed at will is actually pretty logical. While there is indeed speculation and volatility in the crypto market, there are underlying factors that explain what’s going on.

Many have forecast the dollar’s demise for years or even decades, but more and more it appears as if the event has finally begun. Which is not to say that it will all happen overnight. But rather that when thinking about what’s happening in the crypto market, it’s worthwhile to keep an eye on what’s happening with the currency the cryptos are being priced in.