The US dollar has been given a boost by Jerome Powell’s hawkish hints during his first testimony yesterday. Stopping short of confirming four hikes, his optimistic view of the economy and talk of economic ‘headwinds’ becoming ‘tailwinds’ may have caught some by surprise, as consensus had been for him to play down economic strength where possible. With that in mind, we see the potential for the dollar to extend gains from recent lows whilst wondering if 2017’s pain trade could see EUR/USD reverse more than some are prepared for.

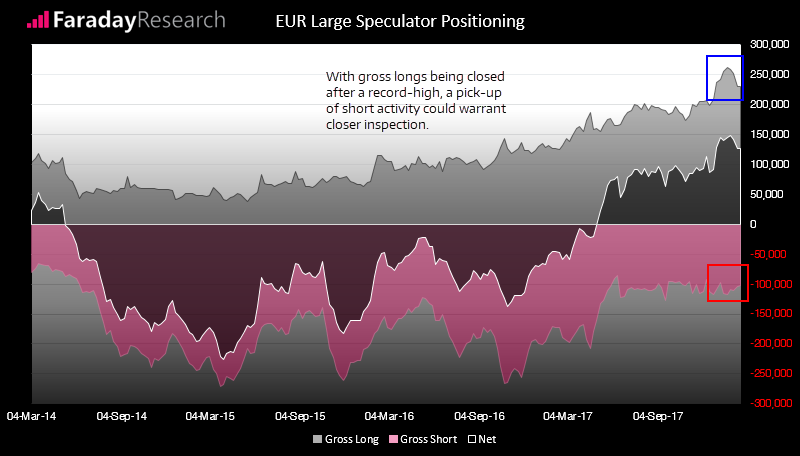

There’s no denying that the Euro is within a strong bullish trend which is clearly visible on the weekly chart. But it’s also possible too many have become accustomed to long Euro positions, which could make it a crowded trade. If we are to see a deep correction or reversal, such moves tend to be preceded by a sentiment extreme, signs of which were apparent on Euro Futures just a few weeks ago.

As we tweeted earlier this week, we’re keeping a close eye on the relationship between gross long and short bets in particular. Since mid-2015, gross long bets began a steady uptrend which pushed exposure to net long and eventually dragged EUR/USD higher (against consensus). Now, after hitting record highs, long bets have been reduced for four straight weeks and the rally in the Euro has stalled. So if we are to see gross shorts rise over the coming weeks it adds credence to the bear case an inflection point has been seen.

On the fundamental side, one of the key pillars of support which led euro to dizzy heights (growth expectations) is also coming under pressure. The ESI (European Sentiment Indicator) represents the overall health of the eurozone and includes surveys on consumer, industrial, retail etc. for all member states. As the ESI is a leading indicator for Eurozone growth and has declined for two-months from multi-year highs, talk of eurozone "peak growth" is beginning to surface. As investors speculate on growth projections, we could see a change of heart if leading indicators continue to soften. Mix that with the potential for Fed to hike four times and the fiscal stimulus from the White House in the form of tax cuts, then we see potential for a divergent theme to form and weigh on EUR/USD.

However, it is still early in the year and data can exceed or miss targets. We have a host of European inflation data shortly which could tarnish the bears plan if CPI surprises to the upside. The Fed still haven’t achieved 2% inflation and there’s no certainty US companies will use tax savings to reinvest, expand and employ. So, whether we have seen a significant inflection point on euro remains to be seen, but the threat of further downside is beginning to shake the bull camp’s tree.