One of the most commonly cited facts about the U.S. economy is that consumers represent two-thirds or more of GDP growth. Put another way, if Americans are spending, the economy expands. If we rein in our consumption, however, the economy expands at a slower pace and/or contracts.

GDP Driven

On Thursday (1/30), newswires trumpeted that GDP expanded at a pace of 3.7% between the beginning of July and the end of December. Not only did the economy accelerate in the second half of 2013 — the first-half growth came in at an anemic 1.8% — but 3.7% marked the strongest second-half growth in ten years. With a government shutdown? With higher interest rates? Surely this demonstrates the remarkable resilience and durability of the American consumer.

On the other hand, there are plenty of conflicting data points regarding consumption. Pending home sales are at their lowest level in more than two years. Meanwhile, annualized wage growth averaged somewhere in the neighborhood of 1.75%-2.0% in 2013, well below the “norm” for personal income growth that is closer to 3.25%. Undoubtedly, many Americans have been feeling wealthier because of rising home prices and/or rising 401k values. Nevertheless, the absence of genuine income growth may eventually exact a heavy toll.

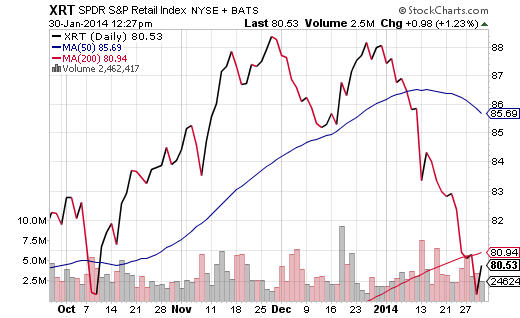

Now comes the biggest question of them all: Does any of this matter to the stock market or its key component sectors? Probably. For example, retailers have put forward some of the weakest earnings reports, revenue numbers and forward guidance of any sub-segment. It follows that SPDR S&P Retail (XRT) has been one of the ugliest year-to-date investments with regard to its percentage losses as well as its dip below a long-term 200-day trendline.

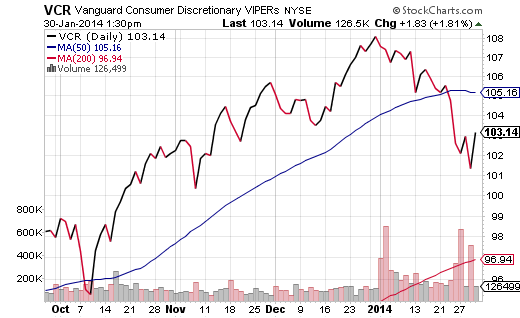

Today (1/30), popular consumer investments like SPDR Sector Select Consumer Discretionary (XLY) and Vanguard Consumer Discretionary (VCR) may appear like “buy-the-dip” winners. Still, one has to wonder if we may be witnessing a last hurrah for stocks tied to household consumption.

| How Troubling Is The Undeperformance Of Consumer-Oriented ETFs? | ||||||

| YTD Through 1/29 | ||||||

| SPDR Sector Select Consumer Staples (XLP) | -4.9% | |||||

| SPDR Sector Select Consumer Discret (XLY) | -6.2% | |||||

| Vanguard Consumer Discretionary (VCR) | -6.2% | |||||

| Rydex Equal Weight Consumer Disc (RCD) | -6.8% | |||||

| SPDR S&P Retail (XRT) | -9.7% | |||||

| S&P 500 SPDR Trust (SPY) | -4.0% | |||||

The long and the short of the current environment may be that U.S. companies, particularly consumer-oriented corporations, may not be able to increase their profit margins by charging more for products. That leaves cost-cutting and share buybacks as the primary ticket for “goosing” results until employment gains translate into wage gains.

Bearish prognostications notwithstanding, the easiest way to deal with the uncertainty is to monitor a popular consumer barometer like VCR. If VCR falls below and stays below its long-term 200-day moving average — if highly correlated funds like SPDR S&P Retail (XRT) and SPDR Sector Select Consumer Staples (XLP) struggle in the same fashion — broader market trouble may be afoot. In contrast, if ETFs in this arena can recapture their shorter-term 50-day trendlines, “buy-the-dip” fans will have beaten the bears yet again.