Check out the price action on the following monthly charts of the Commodity ETF (DBC) and the Agriculture ETF (DBA).

During intraday trading today, they are both hovering over their major support levels...25.00 for DBC and 20.00 for DBA.

With Crude Oil prices on the rise, once again, I anticipate that we'll see these major support levels hold, and prices on these two ETFs rise, as well.

If they hold, the first upside target price for DBC is 30.00, or higher, and for DBA is 24.00, followed by 30.00.

Watch for an increasing ATR on both of these to depict increased buying volatility [I've shown it in histogram format and the input value as one period (one month) to amplify that activity and confirm the long position].

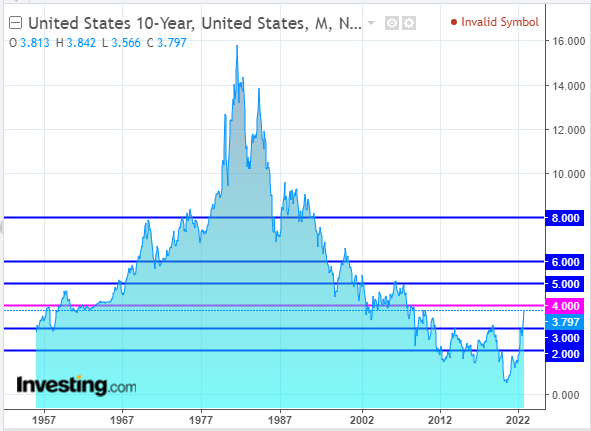

Furthermore, rising commodity and agriculture prices may go hand-in-hand with rising US 10-year Yields, so keep an eye on the next major resistance level of 4.00%, as shown on the following monthly chart of US 10-year Treasury.

A break and hold above 4.00% may, eventually, push it higher to 5.00%, or beyond...depending on how aggressive the U.S. Fed raises interest rates in the coming months.