Arconic Inc. (NYSE:ARNC) entered into a multi-year cooperative research deal with Airbus to advance metal 3D printing for aircraft manufacturing. The deal combines Arconic’s expertise in metal additive production and metallurgy with Airbus’s qualification and design capabilities.

Per the deal, both companies will build customized parameters and processes to make and qualify large, structural 3D printed components like rib structures and pylon spars up to roughly 1 meter in length.

Arconic will use electron beam high deposition rate technology to 3D print parts, which is suitable for producing larger aerospace components as it prints up to one hundred times faster than technologies used for smaller and more intricate parts. Moreover, the company will also exhibit the benefits of its proprietary Ampliforge process, which combines additive and traditional manufacturing. Arconic will utilize its additive and advanced manufacturing facilities in Cleveland, OH and at the Arconic Technology Center outside Pittsburgh, PA.

Arconic’s comprehensive capabilities and supply chain management experience are helping the company to grow its partnership with Airbus. Airbus achieved a breakthrough in 3D printing last September which involves a 3D printed titanium bracket installed on the A350 XWB series of Airbus commercial aircraft. Arconic is making these titanium brackets utilizing laser powder bed technologies at its additive manufacturing facility in Austin, TX.

In 2016, Arconic declared three deals with Airbus under which it had agreed to 3D print titanium and nickel airframe components, including fuselage and engine pylon components. The agreements established Arconic as an innovation partner of Airbus in the rapidly growing metal 3D printing space.

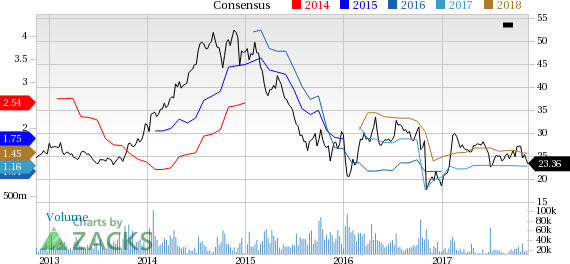

Arconic’s shares have declined 3.7% in the past three months underperforming the industry’s 3.4% growth.

Arconic logged profit, as reported, of $119 million or 22 cents per share for the third quarter of 2017, down from $166 million or 33 cents a year ago. The results in the reported quarter include special items including restructuring charges. Barring one-time items, earnings came in at 25 cents per share for the quarter. Results lagged the Zacks Consensus Estimate of 27 cents.

The company reported revenues of $3,236 million, up around 3% year over year. Sales topped the Zacks Consensus Estimate of $3,129 million. Revenues were driven by improved volumes across all segments and higher aluminum prices.

Arconic reaffirmed its full-year adjusted earnings guidance of $1.15-$1.20 per share. However, the company updated its revenue and capital expenditure outlook for 2017.

The company now sees revenues for 2017 in the range of $12.6-$12.8 billion (up from $12.3-$12.7 billion expected earlier). Arconic now expects capital expenditure to be roughly $600 million, compared with its prior view of up to $650 million.

Zacks Rank & Stocks to Consider

Arconic currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are ArcelorMittal (NYSE:MT) , Westlake Chemical Corporation (NYSE:WLK) and Kronos Worldwide Inc. (NYSE:KRO) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

ArcelorMittal has an expected long-term earnings growth rate of 11.3%. Its shares have moved up 27.5% year to date.

Westlake Chemical has an expected long-term earnings growth rate of 8.4%. Its shares have rallied 61.8% year to date.

Kronos Worldwide has an expected long-term earnings growth rate of 5%. Its shares have surged a whopping 122.4% year to date.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Westlake Chemical Corporation (WLK): Free Stock Analysis Report

Arconic Inc. (ARNC): Free Stock Analysis Report

ArcelorMittal (MT): Free Stock Analysis Report

Original post

Zacks Investment Research