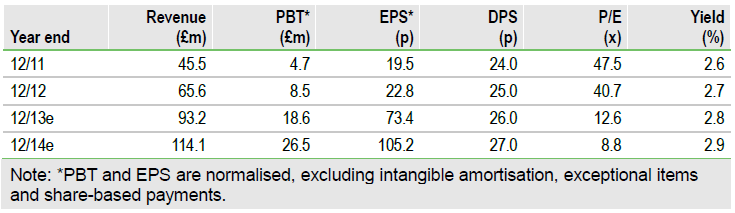

Arbuthnot Banking Group (ARBB.L) is growing both organically and by acquisition, bringing diversification of credit risk, distribution and improved operational capabilities. Total loan growth in retail banking was 92% with customer numbers up to 232k from 145k. Organic growth at the private bank was 21% in loans, 18% in deposits and 20% in discretionary funds. Both banks continue to be strongly funded and capitalised, and well positioned to exploit opportunities as major banks continue to re-structure. ABG’s market capitalisation continues to be below the market value of its 70.7% stake in Secure Trust Bank (STB).

Core growth including pay-back on investments

The private bank delivered organic lending growth of 21% and deposit growth of 18% (year-end loans to deposit ratio 59%). Profits grew 5%, held back by investment in new staff (total £0.9m) and deposit margin pressure expected to ease in 2014. The structured-product unit Gillat Financial Services saw profits treble to £0.6m. In STB, organic growth in loan was 44% and deposits 47% (loan-to-deposit ratio 75%).

New investments

STB acquired Everyday Loans (EDL consideration £1 with a conditional performance payment of £1.7m, 8 June 2012, fair value gain £9.8m), V12 Group (consideration £3.5m, 3 January 2013, at NAV) and Debt Managers (consideration £0.8m, 15 January 2013, at NAV). These deals will in aggregate add c £100m to the loan book, bringing diversification of credit risk, distribution and improved operational capabilities. EDL added £1.8m to profit since acquisition.

Net-positive accounting distortions to 2012 results

The EDL acquisition introduced a number of items to the statutory accounts, with a net positive of £5.3m in 2012. 2013/14 profits will be depressed below what may be regarded as a normalised rate by the unwind of the loan fair value adjustment, intangible amortisation and fees on new business being spread over the life of the loan. Other acquisition costs were £0.5m and profits on disposals were £0.9m.

Valuation: Upside from STB stake

ABG trades well below the value of its 70.7% stake in STB (£210m) and below the rating of other high growth financials. Our sum-of-the-parts indicates upside to over £11.01. While our Gordon’s growth model indicates a fair value of c £7.94, our long term assumptions are well below the near term delivery by the company and give no credit for potential acquisitions.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Arbuthnot Banking Group: Upside From STB Stake

Published 03/29/2013, 06:16 AM

Updated 07/09/2023, 06:31 AM

Arbuthnot Banking Group: Upside From STB Stake

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.