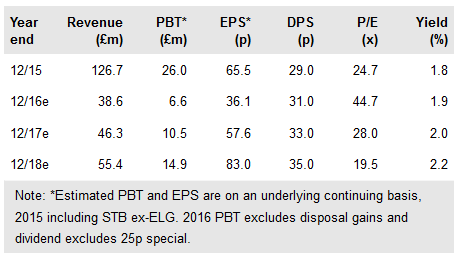

Arbuthnot Banking Group Plc (LON:ARBB) is in a period of transition following the sale of the Everyday Loans Group (ELG) and shares in Secure Trust (STB). The gains crystallised by these disposals resulted in a first half post-tax profit of £225m and an NAV of 1,852p. Prospectively, balance sheet strength is likely to be used for growth in the Arbuthnot Latham loan book and opportunistic M&A. The current below-book valuation appears cautious in view of the bank’s history of NAV growth and the conservative, long-term approach taken by management.

2016 first half results

Stripping out the gains of over £200m on ELG and STB, the underlying pre-tax profit for ARBB increased from £1.4m to £2.0m. Private bank Arbuthnot Latham recorded growth of over 12% in its loan book and more than 13% in assets under management (to £657m and £739m, respectively). Bolstered by the disposal gains, net assets have grown more than sixfold in the period since 2011. The interim dividend was increased by a penny to 13p and the bank has paid a special dividend of 25p reflecting the gain on the ELG disposal.

To read the entire report Please click on the pdf File Below