Investing.com’s stocks of the week

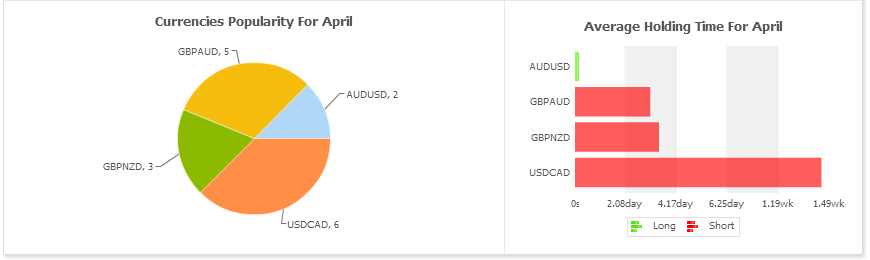

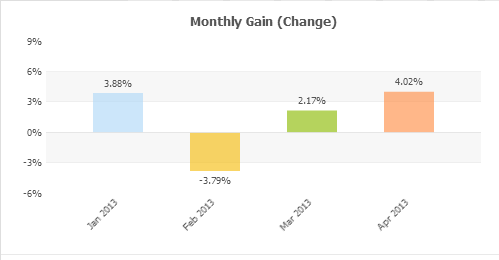

Overall April was a great month for me in all regards: I'm very pleased with a 4% profit, and I thought I traded well. One mistake I made was not being at the computer to capture an opportunity that would have brought me an additional 0.75% in profits. I also refined my approach so that if I am above 0.5% risk, it must be across multiple currencies that are not directly correlated (i.e. USD/CAD and GBP/NZD). Moreover, to be at 1%, I must also get pullbacks that fill entry orders. Given these pre-requisites, I'm rarely at full 1% risk. Being between 0.25% and 0.75% is more likely. But with 3:1 reward/risk, this can help me achieve the returns I'm looking for.

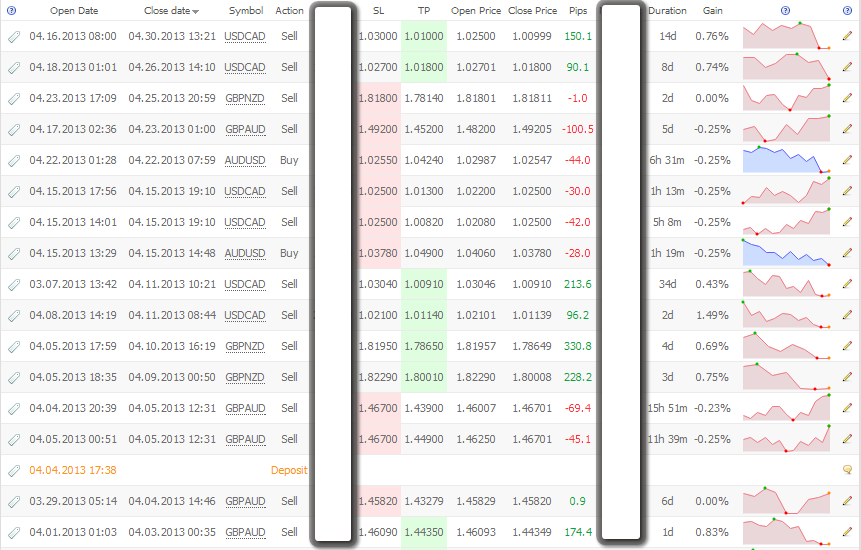

The table below illustrates the trades I placed for the month. Overall I placed 16 trades; 6 were losers, 2 were breakeven, and the remaining 8 were winners. A win rate of 50% is the highest I've had this year, which I think is a reflection of two factors: (1) luck and (2) more discipline in trading only off the 4 hour chart and in accordance with the aforementioned risk parameters regarding trading non-correlated currencies and placing a greater demand on entry orders.

The table below illustrates which currencies I traded and my average duration per trade.

Here is a recap of my monthly performance YTD.

Original post