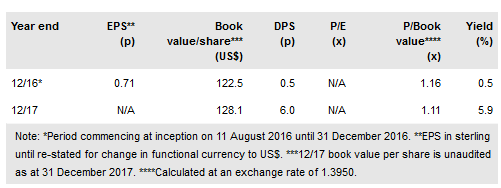

Following shareholder approval at the December EGM, APQ Global Ltd (LON:APQ) has issued an additional £10.3m in 3.5% convertible unsecured loan stocks (CULS) at a 3% premium to par value. The CULS provide long-term structural gearing at a fixed cost, the proceeds of which will be deployed in line with the company’s business and investment strategy. APQ has also changed its reporting currency from sterling to US dollars so as to more closely match its investments. Separately, it has reported an unaudited 31 December net book value per share of US$128.1 and declared a fourth quarterly DPS of 1.5p. Total DPS of 6.0p declared in respect of 2017 matches the target set at IPO and takes the annual US$ NAV total return to 9.9%.

CULS provide long-term structural gearing…

APQ first issued CULS in September 2017, raising £20.1m, and these have subsequently traded on the International Securities Market of the LSE at a premium to the issue price and par value. Encouraged by this success, the board decided to increase the size of the issue as a means of increasing gearing, which it believes will enhance total return over the longer term. The CULS may be converted from 31 March 2018 at an initial conversion price of 105.358p, equivalent to a 10% premium to the unaudited book value per share at 31 July 2017. Outstanding CULS are repayable at par in 2024. Old Mutual, a 23.1% holder of the ordinary shares, participated in the issue.

To read the entire report Please click on the pdf File Below: