Since listing in August 2016 with the issue of £78m in equity, APQ Global Ltd (LON:APQ) has moved quickly but cautiously to deploy the funds. It has initially assembled a highly diversified liquid markets portfolio of predominantly bonds and equities in global emerging markets, including a number of strategic positions, while working on the sourcing of direct investments. APQ is managed by an experienced and incentivised team aiming to deliver a sustainable, progressive dividend with the potential for capital growth from investments in emerging markets.

Targeting income and long-term growth

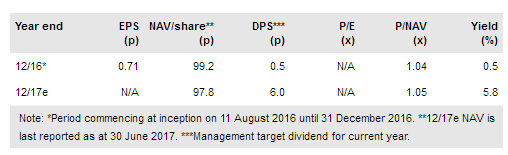

APQ is a listed company with the stated objective of building a growing business in emerging markets globally as well as earning revenue from direct investments in income generating operating activities. Against the backdrop of secular growth opportunities in emerging markets, the company’s goal is to steadily grow earnings and deliver a sustainable and growing dividend to shareholders with added potential for capital growth. APQ has initially assembled a highly diversified, liquid, tradeable portfolio of positions in a range of listed emerging markets bonds, equities, and currencies. Management indicates that the economic income potential of this portfolio leaves the targeted 6% return on the 100p issue price in respect of FY17 well covered (3p per share paid/declared in H117).