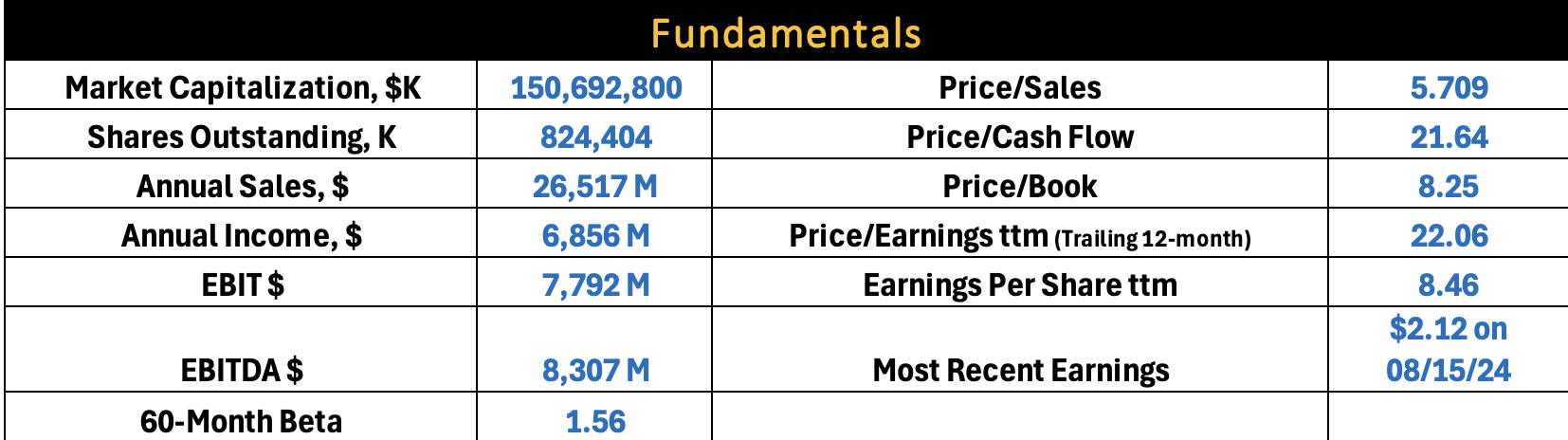

Applied Materials (NASDAQ:AMAT) provides manufacturing equipment, services and software for the semiconductor, display, and related industries. It operates through the following segments: Semiconductor Systems, Applied Global Services, and Display & Adjacent Markets.

The Semiconductor Systems segment includes semiconductor capital equipment for etch, rapid thermal processing, deposition, chemical mechanical planarization, metrology and inspection, wafer packaging, and ion implantation. The Applied Global Services segment provides solutions to optimize equipment, performance, and productivity.

The Display & Adjacent Markets segment offers products for manufacturing liquid crystal displays, organic light-emitting diodes, equipment upgrades, and other display technologies for TVs, monitors, laptops, personal computers, smart phones, and other consumer-oriented devices.

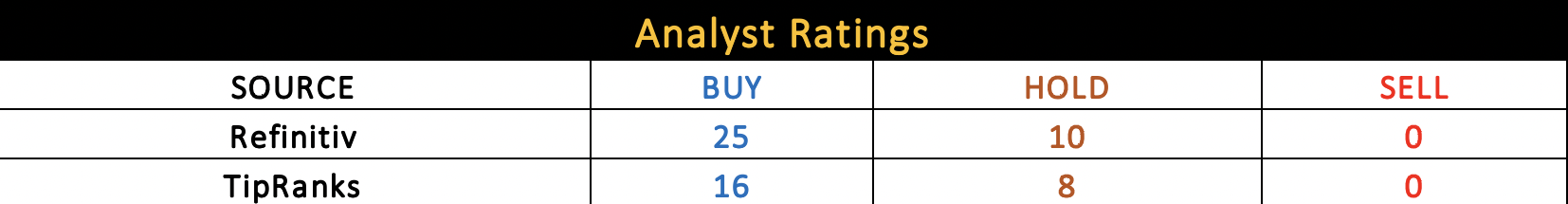

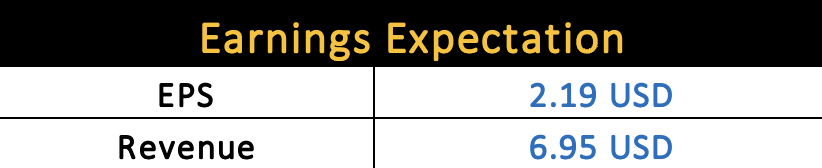

Key Highlights:

- Applied Materials is benefiting from strength in the Applied Global Services segment.

- The company dominates in the semiconductor equipment sales territory.

- AMAT semiconductor business continues to grow with significant design wins. And market dynamics are improving.

- A key concern is the weakening moment across Taiwan and Europe.

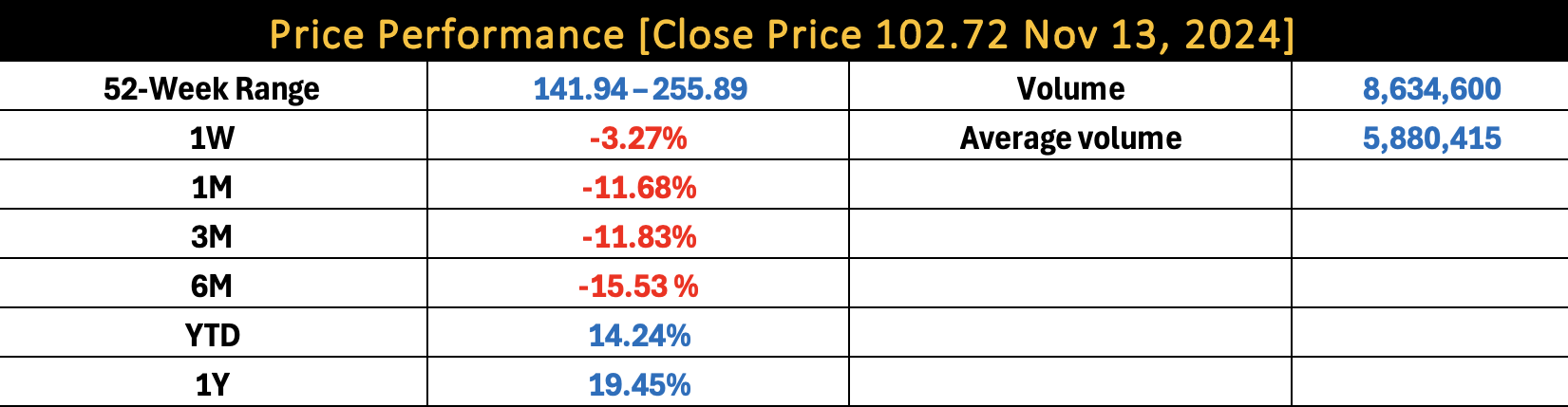

Technical Analysis Perspective:

- AMAT moves higher at an accelerated pace in a rising channel pattern since late 2022 on weekly and monthly charts.

- The following chart shows Channel 1 from November 2012 to March 2015 followed by 75% correction of the rally.

- Channel 2 from January 2016 to November 2017 chased by 60% drop from the channel peak.

- Channel 3 from April 2020 to January 2022 followed by about 60% drop from the recent peak before getting into Channel 4 from October 2022 until July 2024.

- Prices have penetrated and closed below channel 4 since September 2024.

- Chartists believe that history repeats itself if so then a minimum 60% decline of Oct 2022 (price level 71) to September 2024 (price level 255.89) rally is on the way. The target is 145 to 142.

- A sustained move and close above 223/25 would negate the downside move.

AMAT Monthly Chart

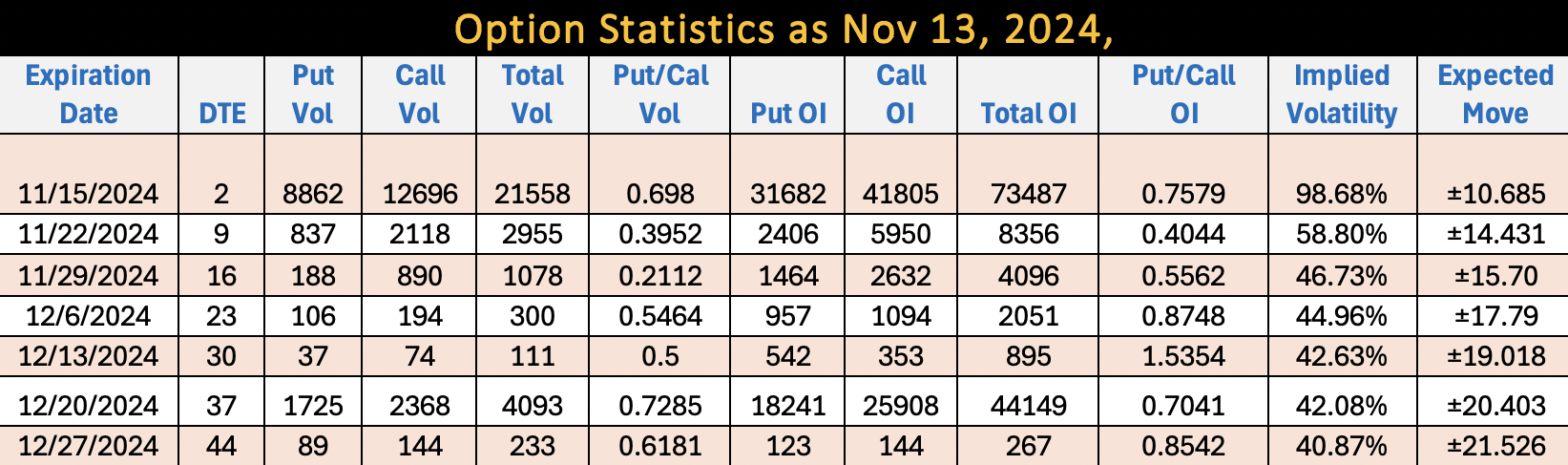

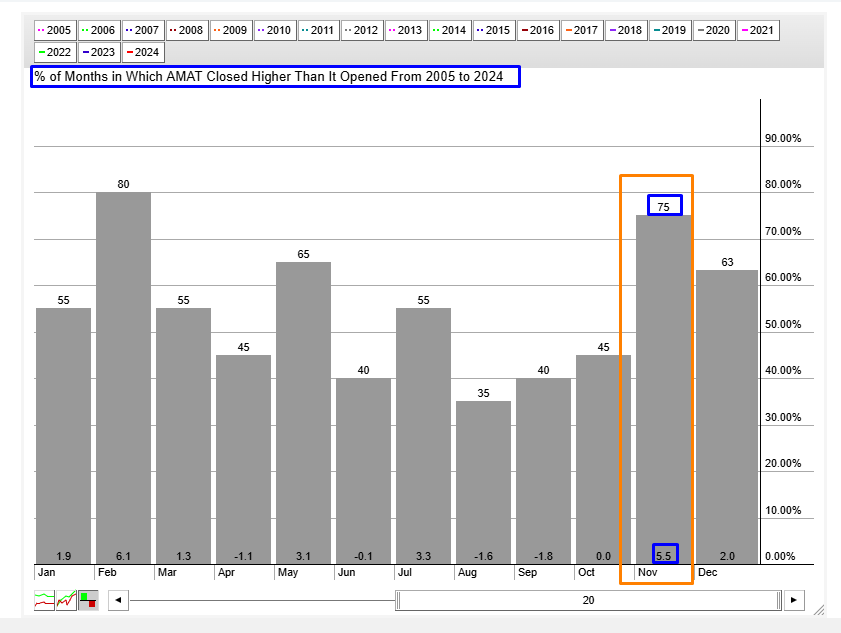

AMAT Seasonality Chart

- AMAT 18 years seasonality suggests that it closes 5.5% higher in November 75% of the time.

Conclusion

There seems to be a disconnect between technical charts vs historical seasonality patterns. If AMAT breaks 170 post earnings then a lower move is on the cards, otherwise, a range trade between 215 to 170 is the name of the game.

***

Ali Merchant is a seasoned financial market professional with expertise in Technical Analysis, Treasury & Capital Markets, Trading, Sales, Research, Training, Fund & Relationship Management, Fintech, and Digitalization. He is a CMT charter holder and an active member of CMT Association, USA, American Association of Professional Technical Analysts, and CMT Association of Canada. He has worked on various roles and organizations in North America and the GCC, such as ABN Amro bank, Thomson Reuters (NYSE:TRI), Refinitiv, MAK Allen & Day Capital Partners (WA:CPAP), and Bridge Information Systems.

He is the founder of TwT Learnings, provides financial market training. Follow us on “X” formerly Twitter “@twtlearning.”