Applied Materials’ (NASDAQ:AMAT) price target was recently increased by more than 14% to $55 from $48 by RBC Capital’s analyst Amit Daryanani. The analyst also raised its rating from Sector Perform to Outperform.

Following the news, Applied Materials’ shares inched up 1.93% in response, eventually closing at $48.05. Additionally, the share price hit a new 52-week high of $48.53 on Sep 18, eventually closing at $48.05.

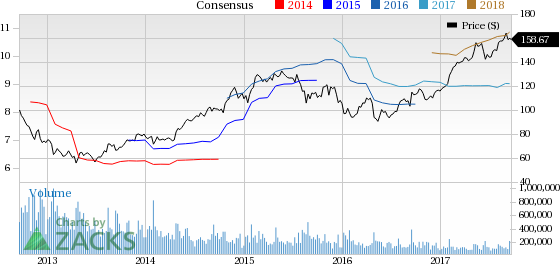

Also, shares of Applied Materials have been steadily treading higher on a year-to-date basis. The stock returned 48.9% compared with the industry’s gain of 46.6%.

Why the Hike?

Analysts at RBC Capital remain optimistic about Applied Materials’ market dominance in the semiconductor space.

There have been significant developments in emerging technologies such as the Internet of Things (IoT), virtual reality, augmented reality, big data, artificial intelligence and self-driving cars. These areas have the potential to significantly increase semiconductor spending and drive the advances in silicon technology in the future.These new technologies will be key sources of growth for Applied going ahead.

Given this material shift in capital intensity due to increasing demand in these areas, the analyst believes that capital equipment spending has become less cyclical and the current wafer fab equipment (WFE) growth will continue in the near future, benefiting Applied Materials.

Notably, the company has tasted considerable success in expanding beyond semiconductors, particularly in display. New display technologies like OLED and large format TVs are opening new market opportunities for Applied Materials. With about 34% of revenue coming from display and services, Daryanani expects Applied Materials to remain in a better position to deal with WFE cyclicality compared with its peers.

Also, Daryanani expects the company earnings per share to increase to more than $4.00 per share by fiscal year 2020. He believes that modest WFE growth, margin expansion, display tailwinds, expansion in China and buybacks, among others, will drive earnings in the years to come.

With its sustained focus on growth areas, sound fundamentals, margin expansion and strength within the semiconductor space, Daryanani remain positive about the company’s overall success in the future.To add to it, the analyst expects Applied Materials’ Analyst Day, which is to be held on Sep 27, to be a positive event.

Conclusion

Applied Materials is one of the world’s largest suppliers of fabrication equipment to semiconductor, LCD and solar PV cell manufacturers. Strength in mobility platforms and TV capacity builds, better utilization of resources and increased WFE spending are the major positives for the company.

The company has an impressive record of returning cash to shareholders through share buybacks and regular dividend payouts. In the third quarter, the company returned $482 million through stock repurchases and cash dividends to shareholders.

Moreover, the company has well-differentiated products and high market share. Also, the company has witnessed strong top-line growth and an expanding bottom line in the last few quarters. The Zacks Rank #1 (Strong Buy) company’s solid market position in China, expansion in display, continued innovation and strong long-term growth potential position it well.

Other Stocks to Consider

A few better-ranked stocks in the same space are Lam Research Corporation (NASDAQ:LRCX) and Stamps.com Inc. (NASDAQ:STMP) , both carrying a Zacks Rank #1 (Strong Buy), while Advanced Energy Industries, Inc. (NASDAQ:AEIS) , carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Lam Research delivered a positive earnings surprise of 4.44%, on average, in the trailing four quarters.

Stamps.com Inc. delivered a positive earnings surprise of 30.64%, on average, in the last four quarters.

Advanced Energy Industries delivered a positive earnings surprise of 13.69%, on average, in the trailing four quarters.

4 Promising Stock Picks to Keep an Eye On

With news stories about computer hacking and identity theft becoming increasingly commonplace, the cybersecurity industry looks like a promising investment opportunity. But which stocks should you buy? Zacks just released Cybersecurity: An Investor’s Guide to Locking Down Profits to help answer this question.

This new Special Report gives you the information you need to make well-informed investment choices in this space. More importantly, it also highlights 4 cybersecurity picks with strong profit potential.

Get the new Investing Guide now>>

Stamps.com Inc. (STMP): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Advanced Energy Industries, Inc. (AEIS): Free Stock Analysis Report

Original post