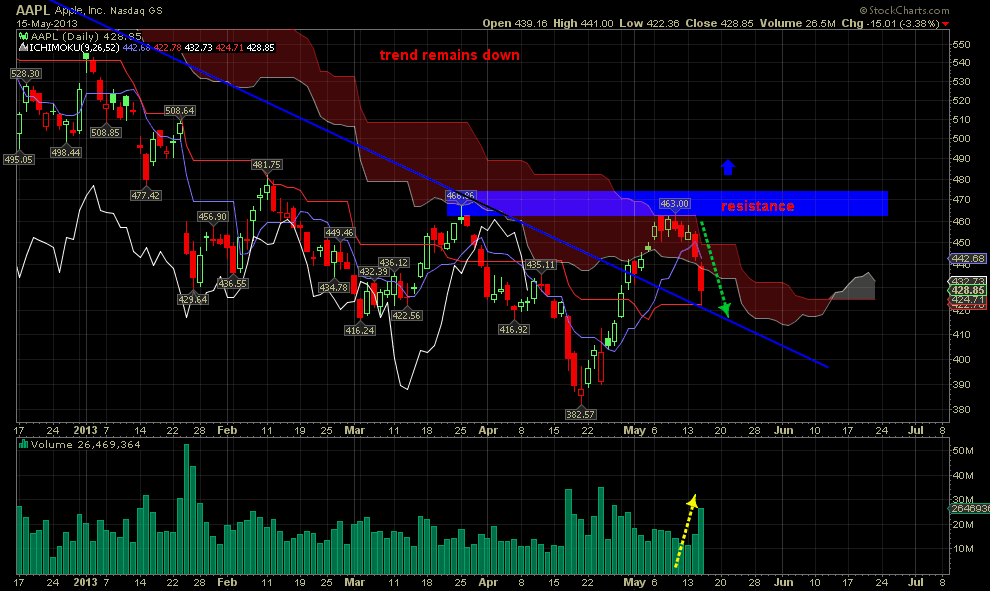

Apple (AAPL) after having managed to stage a big upward move from $382 to $463, it now returns downwards with increased volume. Prices managed from late April to break short term resistance levels and reach the previous important high near $470. The longer term downward sloping trend line has been broken upwards as shown in the chart below.

This rise that took an entire month to complete at 463$ has hit the important resistance level at 460-470$ area. One worrying signal regarding the upward move is the declining volume. On the other hand, during the decline from 463$ to 428$ the volume has been rising. This is not usual if we take as granted that the rise was an impulsive wave and the pull back the correction.

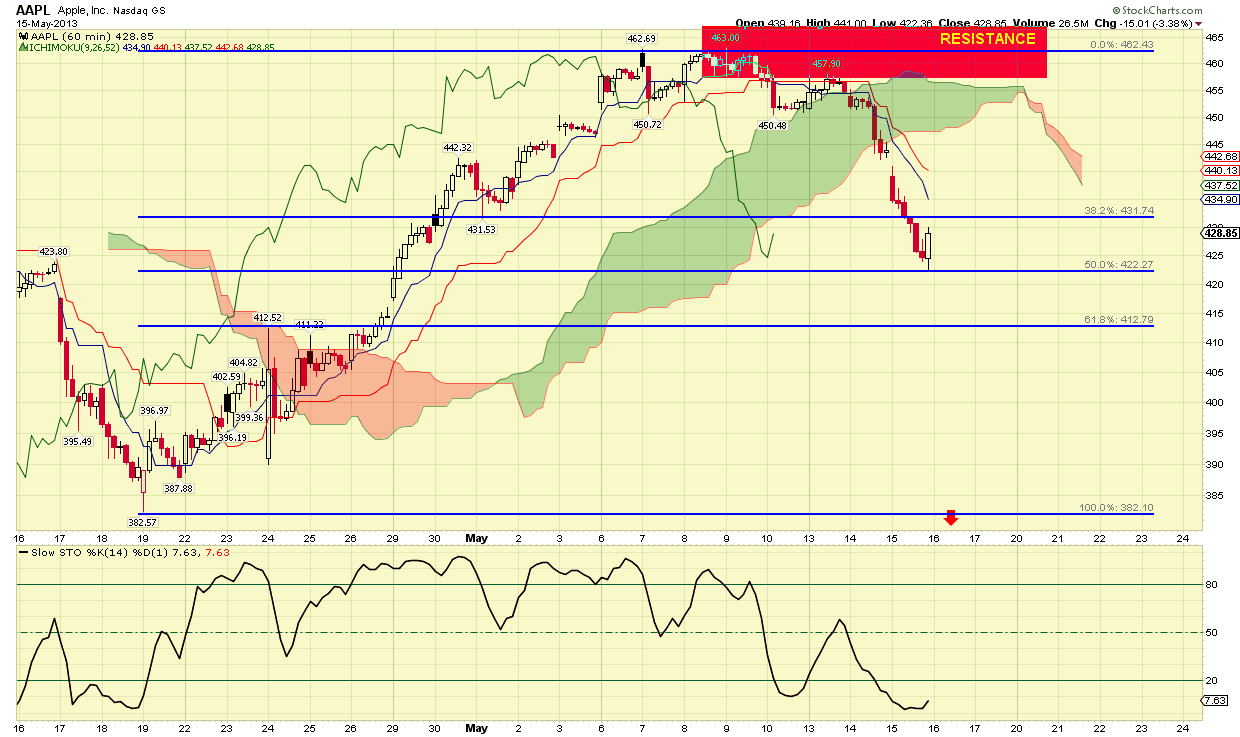

The bullish scenario implies that an upward thrust completed at $463 and is now back testing the broken blue trend line that was intact during the entire decline. As shown in the chart below we see that the decline from $463 has reached the 50% Fibonacci retracement level.

This is a good level for a bottom if the downward move is a correction. Our view is that a small bounce could be expected but it is more probable to see lower price levels as low as the 61.8% Fibo retracement. Moreover we would like to see increasing volume as prices rise. Additionally we should not that if you feel bullish your stop should be $382 lows. For the time being the downward move from 463$ is in 3 waves thus corrective. If it unfolds and completes 5 waves down, that would be another bad sign for the bullish scenario. The bulls will get more confident if prices start to grind higher from these levels and the important resistance at 460-470$ area is broken upwards.

As always, thank you for taking the time to catch up on my thinking. Don’t forget that you can try our services for free for 1 week. Last trade we made in Apple was a sell at $450 and a buy close at $434.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Apple: Buy The Pull Back, Or New Lows Ahead?

Published 05/16/2013, 07:35 AM

Updated 07/09/2023, 06:31 AM

Apple: Buy The Pull Back, Or New Lows Ahead?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.