- Apple is due to report earnings today after the closing bell.

- The stock has fallen sharply in recent days and is therefore nicely poised to react to a positive surprise.

- What are the consensus forecasts, and what are the fundamental factors investors should be on the lookout for?

- Navigate this earnings season at a glance with ProTips - now on sale for up to 50% off!

Tech giant Apple (NASDAQ:AAPL) is preparing to announce its first-quarter fiscal 2024 earnings after the market closes today.

Unlike some of its peers that reached all-time highs ahead of their earnings reports, Apple enters its release with a more subdued stance. The stock marked its sixth consecutive losing session on Wednesday, trading roughly 8% below its December 14 record of $199.62.

This decline in the stock is undeniably associated with concerns about potential disappointment in Thursday's release, prompting investors to approach it cautiously. However, it also positions the stock favorably to respond positively to any positive surprises, unlike others that might merely avoid a correction of recent gains with good results.

Let's take a look at Apple's fundamentals to better understand where the iPhone-maker stands going into earnings.

To better investigate the company's fundamentals, we will use our flagship tool: ProTips.

Available exclusively for InvestingPro users, ProTips distills extensive financial data into a list of strengths and weaknesses for each stock in the market, offering a quick qualitative overview to complement the platform's quantitative tools like fair value and financial health score.

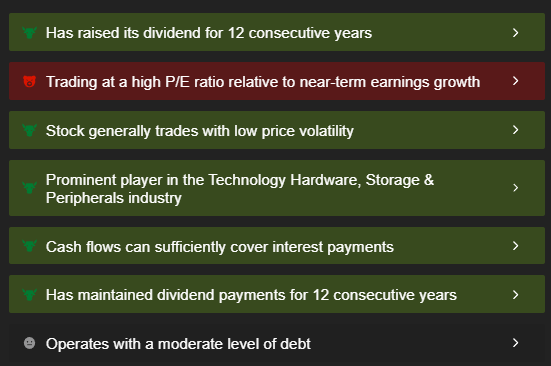

Apple's strengths and weaknesses according to ProTips

See below for the full list of InvestingPro ProTips for Apple shares:

Source: InvestingPro

Source: InvestingPro

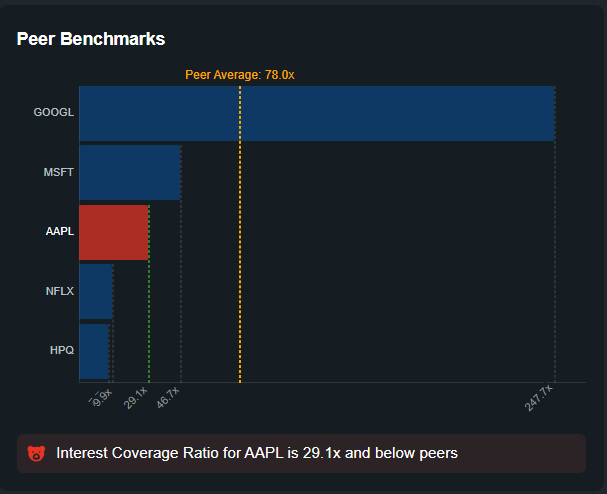

The ProTips note several key positives for Apple, including the fact that cash flow more than covers interest expense, although the company underperforms its peers on this score.

Source: InvestingPro

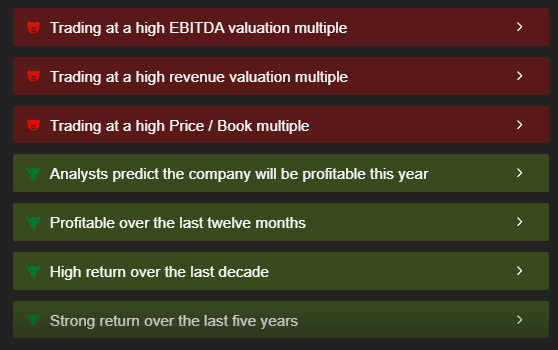

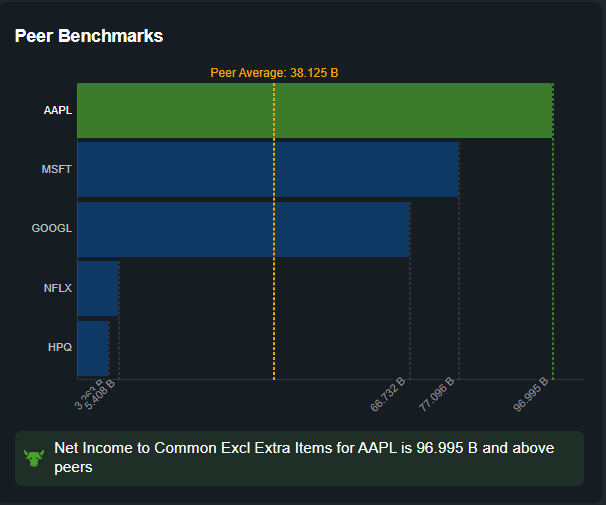

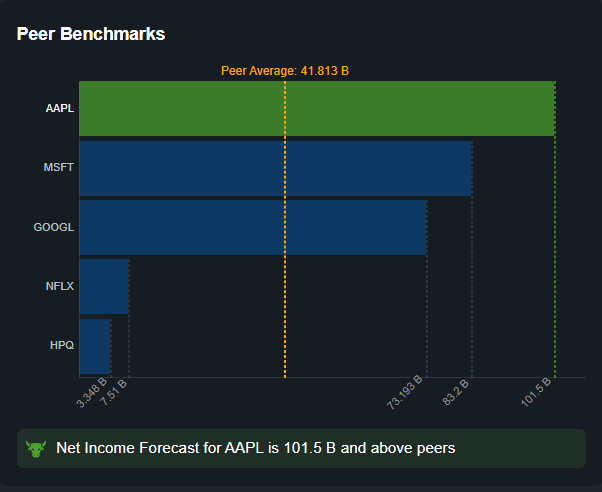

The ProTips also point out that the stock has proved more profitable than its peers over the past 12 months.

Source: InvestingPro

Moreover, analysts expect the company to remain largely profitable this year.

Source: InvestingPro

On the negative side, the ProTips tell us that the stock is trading on high multiples in terms of Ebitda, revenues and price/book value.

What are Apple's earnings forecasts?

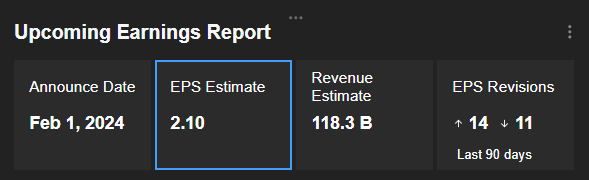

For the results expected on Thursday, the analyst consensus forecasts EPS of $2.10, 48.3% higher than in the previous quarter, and up 11.7% year-on-year.

Source: InvestingPro

Revenues are expected to reach $118.3 billion, 32% higher than in the previous quarter, but up by less than 1% in the same quarter of the previous year.

It's also worth noting that InvestingPro data shows that Apple has exceeded earnings expectations for the last 8 consecutive quarters. A further positive surprise on Thursday is therefore not out of the question.

Key points to watch closely beyond the main metrics

Of particular concern is the risk of sluggish iPhone sales, given the weak economy in China, a key market for Apple.

The iPhone has long been one of Apple's main revenue drivers. Sales of iPhones far exceed those of iPads, Apple Watches, and even the company's Mac product range.

Following the launch of the latest iteration, the iPhone 15 series, in September, investors will be keeping a close eye on the impact of this new range on sales.

iPhone sales are expected to reach $68.4 billion, the second-highest quarterly level in the company's history, up around 4% year-on-year.

However, some analysts have warned that iPhone sales may not be able to maintain this momentum until 2024, while studies show a preference for keeping phones longer without upgrading to the latest models.

We'll also be waiting for potential updates about the consequences of the company's legal troubles, including the ban on sales in the US of certain Apple Watches using blood oxygen sensors while the company appeals a patent infringement case.

The U.S. Department of Justice could also be on the verge of launching a wide-ranging antitrust proceeding against Apple for alleged anti-competitive practices concerning the iPhone.

The performance of Apple's services portfolio, which has been a major source of growth in recent years and is the group's most profitable business, will also need to be closely monitored.

Analyst forecasts and valuation model conclusions for Apple shares

Finally, neither analysts' forecasts nor valuation models give cause for optimism regarding the outlook for Apple's share price.

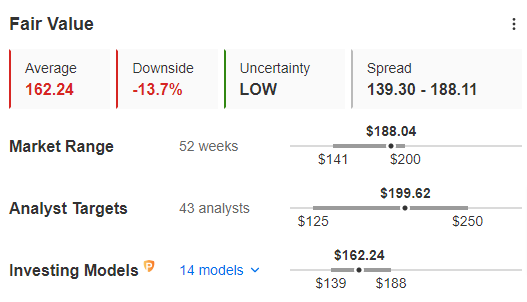

Indeed, the 43 analysts surveyed by InvestingPro who follow Apple's share price have an average target of $199.62, just over 5% above Tuesday's closing price.

Source: InvestingPro

In addition, InvestingPro's Fair Value, which is an average of 14 recognized financial valuation models, stands at $162.24, almost 14% below the current price.

Bottom Line

Apple is undoubtedly the stock of the Magnificent 7 for which the market seems least optimistic, with a recent drop in share price, and modest forecasts from analysts.

China's slowdown and other concerns are weighing on sentiment. And while that's not engaging, it also means that the stock could present solid immediate upside potential if results exceed expectations.

***

Take advantage of our InvestingPro stock market strategy and fundamental analysis platform at a reduced rate for a few more days, with a discount of up to -50% to celebrate the New Year!

Unlock the potential to outperform the market and enhance your investments by utilizing a range of exclusive tools with InvestingPro:

- ProPicks: Experience AI-managed stock portfolios with a proven track record of performance.

- ProTips: Access digestible information condensing complex financial data into a few concise words.

- Advanced stock screener: Identify top-performing stocks based on your criteria, considering numerous financial metrics.

- Historical financial data for thousands of stocks: Empower fundamental analysis professionals to delve into comprehensive details.

- Plus, stay tuned for additional services we have in the pipeline!

*Don't forget your free gift! Use coupon code OAPRO1 at checkout to claim an extra 10% off on the Pro+yearly plan, and OAPRO2 for an extra 10% discount on the by-yearly plan.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple perspectives and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.