Apple (NASDAQ:AAPL)'s stock, ticker symbol AAPL has gone up to almost its former high. The question is will this stock make another new high?

AAPL investors definitely hope that this stock will continue to give them profits. Let's take a look at this stock from a short term, mid term and long term perspective.

Let's take a look at the daily chart of AAPL first. We need to establish whether the stock is in an uptrend.

Currently AAPL is above its rising 20 MA, rising 50 MA and rising 200 MA. I put the emphasis on rising.

That's because when the moving averages are rising, the stock is definitely in a strong uptrend.

AAPL is also now in a stage 2 of the stock market stage. You can read more about the 4 stages of the stock market in my article.

One of the reasons why traders and investors lose money is they do the wrong things at each stage. Reading the article will help you to be on the right side of the market.

Coming back to the daily chart, AAPL is indeed in a state of strong power uptrend. The rising 200 MA gives us confidence that the odds of it moving higher in the long run is very good.

To double confirm if the long-term trend is good or not, we will next take a look at the weekly chart of AAPL. There are a few things you need to take note here.

First of all, AAPL has broken above a long-term downtrend line. The top of the trend line will be a new support area.

The stock has also broken out of a weekly flag. A target can be made from the base to the flag and projected upwards. This is also a measured move and a possible target is shown above.

The rising weekly 200 MA also points to the long-term health of AAPL.

The 200 MA is a very important moving average that you can use to help you analyze stocks. Read my article on Using The 200 MA As Support to learn more about the 200 MA.

Now that we have established the mid-term and long-term strength of the stock, we need to be a complete trader and look at the short-term trend.

That's because entry is very important for a trader. You do not want to enter when the stock is about to make a short-term correction.

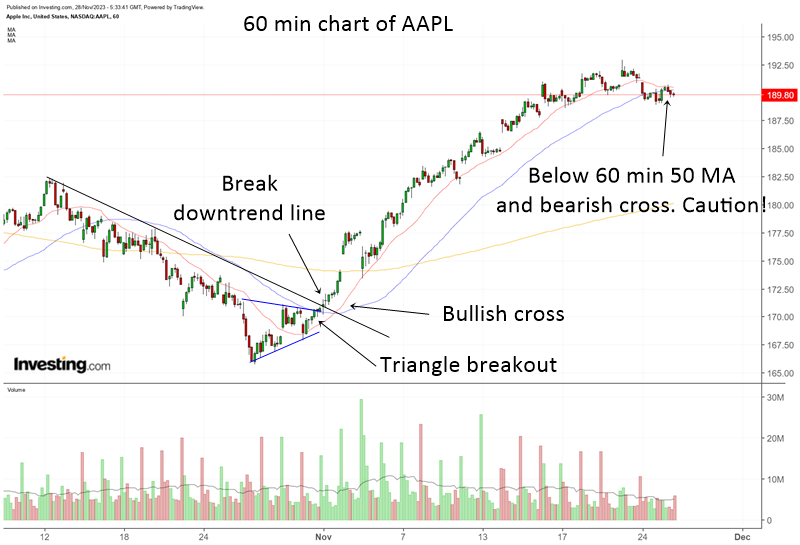

The chart above shows the 60 min chart of AAPL. Previously it broke above a 60 min downtrend line. This is also where it had a bottoming triangle breakout. This itself is a buy setup.

The stock also had a bullish 20 MA cross above 50 MA and this set up a strong uptrend in the 60 min chart. When this happens I like to stay bullish on the stock short term till the stock breaks below the 50 MA.

From what we can observe right now, the stock has already broken below the 60 min 50 MA and there is also a bearish cross.

So while the mid term and long term is good, the short term picture is CAUTION. We should wait for the correction to finish its course before any entry.

Correction can happen through sideways trading or a short term downtrend. It is still too early to tell what type of correction it will be but definitely you should be careful before entering this stock at the moment.

Wait for a short term breakout or buy the dip.