Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Apple Inc. (NASDAQ:AAPL) headlines a busy week of earnings season, with the iPhone maker set to unveil its fiscal second-quarter results after the close on April 30. Ahead of the event, AAPL stock has been relatively quiet on the charts, per its 30-day historical volatility of 12.3%, which registers in the 8th annual percentile, but the options market is pricing in a big swing for Wednesday's trading.

At last check, Trade-Alert had Apple stock's implied earnings deviation at 7.1% -- well above the 4.5% next-day move the shares have averaged over the last two years. Five of those eight earnings reactions have been positive, though not one of them was large enough to match or exceed what the options market is anticipating. The closest was a 6.8% post-earnings pop in January, followed by a 6.6% one-day loss in November.

Options traders appear to be bracing for another upside move. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), AAPL's 10-day call/put volume ratio of 2.04 ranks in the 81st annual percentile. In other words, calls have been bought to open over puts at a quicker-than-usual clip.

Meanwhile, Apple's 30-day at-the-money (ATM) implied volatility (IV) of 28.1% ranks in the 67th annual percentile, meaning short-term options premiums are relatively rich at the moment -- not too surprising ahead of a scheduled event. The stock's 30-day IV skew of 9.9% registers in the 38th percentile of its 12-month range, indicating calls are pricing in slightly higher volatility expectations than their put counterparts.

Elsewhere on Wall Street, Baird is upbeat on Apple ahead of earnings. Earlier today, the brokerage firm raised its AAPL price target to $225 from $200, saying Apple will be "driven by its strong eco-system," and that its "growing services contribution can help drive its valuation multiple higher." Overall, 14 analysts maintain a "buy" or better rating on the equity, compared to 12 "holds," and zero "sells," while the average 12-month price target sits at $202.77.

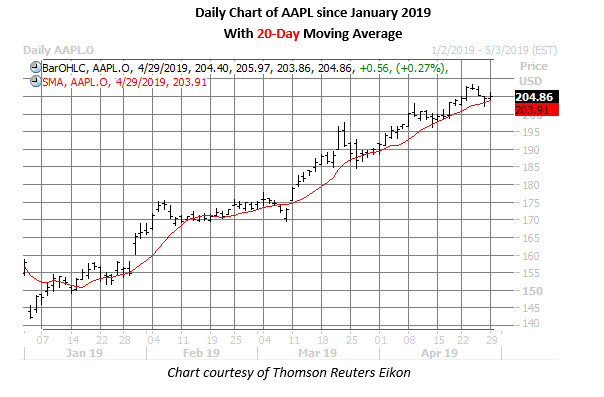

Looking closer at the charts, the FAANG stock has charted a steady path higher since its Jan. 3 low at $142, up 44.2%. Today, AAPL shares are up 0.3% at $204.86, earlier finding a foothold atop their 10-day moving average -- a rising trendline that's served as support for most of the past two months.